Search Results for "budget"

With over $110 million in unallocated funds to work with, the Fairfax County Board of Supervisors moved yesterday (Tuesday) to address employee compensation, tax relief and other priorities.

As approved by the board 9-1, nearly all of that available money will go toward reducing the real estate tax rate by 1.5 cents and fully funding salary market rate adjustments for county employees — items totaling $47 million and $54.9 million, respectively.

Other revisions to the county’s advertised budget for fiscal year 2024 include support for bamboo removal on park land, additional staffing for the 24-hour domestic violence hotline, and the creation of a self-help legal center in the Fairfax County Courthouse.

“The adjustments I’ve outlined here show a true balance between tax relief, investing in county employees, standing up and fighting for our school system, and also making sure that the core services that have made this county…are supported in this budget,” Board of Supervisors Chairman Jeff McKay said when introducing the mark-up package.

The budget proposal that County Executive Bryan Hill presented in February kept the county’s real estate tax rate flat at $1.11 per $100 of assessed value, but with the average residential bill calculated to increase by about $520, board members indicated that they would look for ways to cut the rate.

With yesterday’s vote, the board agreed to adopt a rate of $1.095 per $100 of value, which will lower the average increase to $412.

Herrity proposes cuts to schools budget

Several supervisors expressed disappointment at not being able to make a bigger cut. Mason District Supervisor Penny Gross stated she had hoped for a 3-cent reduction, and Springfield District Supervisor Pat Herrity proposed an “alternative” budget that he said would take five cents off.

The reduction would’ve been achieved by cutting $100 million from the county’s funding for Fairfax County Public Schools and putting $31 million for affordable housing on hold, among other cuts, according to a plan Herrity shared at a pre-mark-up session on Friday (April 28).

After FCPS told the board in a memo that Herrity’s proposal would “most definitely” prevent the school system from fully covering worker salary increases, he revised the proposal yesterday to suggest cutting $31 million from schools, taking one additional cent off the tax rate.

“I’m all for giving schools all the resources they need to address the challenges of the pandemic and challenges of our kids, but the spending needs to be done in a responsible way,” Herrity said.

Other supervisors blasted Herrity’s proposal as “budgeting by ambush” and “completely out-of-touch.” McKay noted that any reduction in salary increases for teachers would mean losing state money contingent on average raises of at least 2.5% for instructional positions in FY 2024, which begins July 1.

“The Herrity budget proposal doesn’t cut waste,” Braddock District Supervisor James Walkinshaw said. “I think you were trying to find waste. Instead of waste, you found teacher salaries and textbooks. It’s not cutting fat from the FCPS budget, it’s cutting into the bone.”

Support for FCPS constitutes 52% of Hill’s proposed $5.1 billion budget, which includes a $144 million increase for the school system compared to last year.

County workers get boosts in pay

Aside from Herrity, who voted against the mark-up package, the supervisors argued that the 1.5-cent reduction struck a good balance between providing tax relief — which also includes assessing 90% of personal property taxes for this year — and funding county workers and services.

After Hill initially proposed only covering a 2% market scale adjustment for all county employees, the package passed yesterday will fund the full 5.44% recommended by staff. Leaders of SEIU Virginia 512 and the Fairfax Workers Coalition, which both represent county workers, praised the change, while calling for a more stable approach to pay.

“We need to provide a consistent, sustainable and equitable process of compensation that eliminates the annual anxiety that all workers feel when wondering if the County is going to fulfill its commitment to employees,” the FWC said in a statement. “We’re hopeful this helps stem the loss of quality workers to other employers. We look forward to building a fair system together.”

Next year’s budget is expected to be the county’s first in 46 years where pay for many employees will be determined by a contract. According to McKay, the board could approve collective bargaining agreements this December, though general county government employees have yet to hold elections.

Fire department employees became the first to elect a bargaining unit last fall. In January, workers in the Fairfax County Police Department elected the Southern States Police Benevolent Association to represent them in the bargaining process, which is now underway, SSPBA Executive Director Sean McGowan confirmed.

“We know lasting change and true pay fairness will only come with a contract. That is our goal and we won’t stop until we get it,” SEIU Virginia 512 Fairfax County President Tammie Wondong said.

Other compensation adjustments focus on public safety workers, including over $10.2 million to give uniformed police officers a 5% raise and increase police starting salaries by 5%. On average, current officers will see pay increases of 12.8% — in line with what Herrity had proposed — as the county hopes to address recruitment and retention challenges.

The FY 2024 budget will be formally adopted next Tuesday (May 9).

Live Fairfax is a bi-weekly column exploring Fairfax County. This recurring column is sponsored and written by Sharmane Medaris of McEnearney Associates. Questions? Reach Sharmane at 813-504-4479.

Looking for fun and affordable date ideas in Fairfax County? Check out our top 5 date nights (or day dates)!

1. Head to The Boro for scrumptious shrimp ceviche and grilled fish tacos at Fish Taco. Save room for Plant Burger’s irresistible dairy-free shakes, like the Campfire S’mores flavor. Cap off the night with a trip down memory lane at Whole Foods’ arcade featuring an impressive selection of 80s and 90s video games.

2. The vibrant Mosaic District is a perfect date spot with something for everyone. Experience the delectable Cuban food at the lively Colada Shop or indulge in the mouth-watering Mexican cuisine at Urbano. Take a leisurely walk after dinner and find yourself in the lush green space where you can relax, connect and savor the moment with your special someone.

3. and 4. Looking for an active and delicious date idea? Look no further than hitting the W& OD trail for a cycling or running adventure! Not only will you enjoy the beautiful outdoors and get some exercise in, but you’ll also have plenty of yummy options to fuel up along the way. Stop by Sushi Yoshi for fresh and flavorful sushi, grab a refreshing smoothie and South Block or indulge in some savory tacos at Taco Bamba, all located right off the trail in Vienna. This is the perfect way to combine fitness and food while making lasting memories with your special someone.

5. Why not try Aim Point airsoft shooting inside Fair Oaks mall? It’s a thrilling and exciting way to bond with your special someone while getting your adrenaline pumping. And once you’ve worked up an appetite, head over to Coastal Flats for some delicious cuisine. Indulge in their mouth-watering seafood dishes or treat yourself to a juicy steak. This date night is sure to be a memorable one that you’ll be talking about for years to come!

Make your date nights unforgettable, even on a budget!

Whether you’re exploring new places, trying new activities, or simply enjoying each other’s company, remember to savor every moment and create lasting memories.

Explore Fairfax with Sharmane Medaris of McEnearney.

Sharmane Medaris | Live Fairfax | www.soldbysharmane.com | [email protected] | @soldbysharmane | 813-504-4479 | 374 Maple Avenue Suite 202, Vienna, VA 22180

The preceding sponsored post was also published on FFXnow.com

A 12.5% salary increase for police officers will be under discussion later this week for inclusion in Fairfax County’s upcoming budget.

Other items under consideration in the mark-up package include more money for ArtsFairfax, funding for girls’ softball facilities, and establishing a self-help resource center in the Fairfax Courthouse library.

In many years, shifting revenue, expense, and administrative cost estimates enable adjustments to the advertised budget presented in February, opening up funding for some initially unaddressed items.

County Executive Bryan Hill left about $90.2 million in unallocated funds in the fiscal year 2024 advertised budget, but with adjustments, that has now risen to $110.4 million.

As a result, supervisors are able to submit items to be considered at a pre-markup discussion by the Board of Supervisors’ budget policy committee on Friday (April 28) and a mark-up session with the full board on May 2.

Seven items were submitted for the mark-up package, totaling about $26.5 million.

The biggest ask, by far, is a 12.5% salary increase for police officers at rank of second lieutenant and below from Springfield District Supervisor Pat Herrity. The raises would cost $26.2 million and come in addition to the 2% market rate adjustment increase already in the budget.

“Budgets should be about priorities and public safety is a priority. We are short about 200 officers; we have had to disband many of our specialty units to staff patrol, and changed shifts which have had a negative impact on our current officers,” Herrity told FFXnow. “It is past time to address a staffing shortage we have seen coming for many years. We can address the public staffing crisis without increasing the tax burden on our residents.”

He added that he’s “very optimistic” the board will approve at least some level of salary increase, if not the full 12.5%.

Last year, the county gave raises to certain public safety workers as part of the mark-up package, but it was a step increase and cost the county $6.1 million.

Herrity also is proposing to reduce supervisor office support budgets by $1.1 million, the same amount it was increased by in last year’s budget.

“This is a microcosm for the illogical spending in our County. Last year, no one answered my question about who proposed the $1.1 million increase for Board office budgets,” Herrity said. “We certainly do not need increased staff budgets, certainly not on top of the 38% salary increase. The money would be better spent focusing on improving access and customer service by county agencies as Board staff spend about 75% of their time helping residents with services.”

Also set to be considered is a proposal from Board Chairman Jeff McKay and Braddock District Supervisor James Walkinshaw to provide $300,00 to reduce the “disparity between girls’ fastpitch softball and boys’ baseball facilities.”

In February, the two requested funding after a recent study revealed a widening gap in the quality and quantity of fields in the county available for softball compared to baseball. The supervisors asked for $1.7 million in one-time funding and a recurring cost of $300,000 for consideration in this year’s budget.

Other items that will be considered at the mark-up sessions in the coming weeks include:

- Expanding the Opportunity Neighborhoods initiative into Centreville at a cost of $413,000

- Establishing a self-help resource center within the law library at the Fairfax County Courthouse at a cost of $96,000

- An increase of $200,000 to ArtsFairfax for operating expenses

- Providing $350,000 to nonprofit projects that make home repairs and accessibility modifications so low and moderate-income households who are aging or disabled can stay in their homes

The 2024 fiscal year budget is set to be adopted on May 9.

No property tax rate increases are proposed in the Town of Herndon’s budget proposal for fiscal year 2024.

The $62.5 million budget, submitted by town manager Bill Ashton II, represents a 9% increase over last year’s budget.

Ashton said the town was able to hold the line on its real estate tax rate despite the pressures of inflation and a tight labor market.

“Nevertheless, and through careful fiscal management, the proposed FY 2024 Budget allows for continuation of the programs and services town citizens expect and enjoy, as well as funding for new initiatives, chief among them preparatory work on the town’s Comprehensive Plan,” Ashton said in a news release.

But he cautioned that a mixed level of continued recovery is forecasted in the current economic environment.

“With significant levels of inflation, rising interest rates, and a looming national economic recession, the extent to which these pressures will affect the town’s revenue projections is unknown,” Ashton wrote in a letter with his budget proposal. “While we experienced significant revenue declines during the pandemic, we saw many revenue categories start to recover last year.”

Higher tax bills are expected still for most property owners because of rising real estate values. The real estate tax rate will still remain the same at 26.5 cents per $100 of assessed value.

But increases are proposed for water and sewer rates. The sewer service rate will go from $7.16 to $8.28 per 1,000 gallons of water consumption, and the water service rate will increase from $3.31 to $3.47 per 1,000 gallons of water consumption.

All water consumed during peak periods behind the average in the preceding two winter-quarter billing periods will be charged at a higher rate: $5.91 per 1,000 gallons.

The town also plans to use remaining funding from the American Rescue Plan Act to complete deferred maintenance projects, vehicle purchases and water-sewer infrastructure projects.

The Herndon Town Council will adopt the proposed budget on June 30 following a series of public hearings and work sessions.

The public hearings are slated for Tuesday, April 11 and Tuesday, April 25 at 7 p.m. in the Ingram Council Chambers.

(Updated at 11:10 a.m.) The proposed 2024 budget has real estate taxes once again increasing for many, as home values across Fairfax County continue to rise.

At yesterday’s Board of Supervisors meeting, County Executive Bryan Hill presented his proposed fiscal year 2024 budget. The $5.1 billion budget is up $280 million from last year — an increase of about 6%, largely due to real estate taxes going up.

While the budget calls for the tax rate to stay the same as last year at $1.11 per $100 of assessed value, the average bill is set to increase by about $520 for homeowners, thanks to a nearly 7% rise in real estate assessments.

Hill warned in November that assessments were likely to go up, and Board Chairman Jeff McKay told FFXnow last month that he expected real estate taxes to be a big discussion point during the budget debate. But the extent of the increase nonetheless elicited strong reactions from supervisors.

McKay said that, given last year’s numbers, the tax rate is “far too high,” while Springfield District Supervisor Pat Herrity called the increase “unacceptable.” They signaled strong support for finding a way to provide residential tax relief to residents.

The proposed budget includes $90 million in unallocated funds that can be used at the “Board’s consideration.” A huge chunk of this, if not all, could be used to lower residents’ tax burden in some form, as was the case for the current fiscal year 2023.

The county’s budget continues to rely on real estate taxes, more than three-fourths of which come from residential property owners.

Nonresidential real estate values also increased this year, but by less than residential values. This means that real estate taxes make up more of the tax base than in FY 2023, increasing by about 0.75%.

While seemingly a small tick up, Franconia District Supervisor Rodney Lusk said the trend is going in the wrong direction and that commercial real estate taxes should make up at least 25% of the tax base. It currently only makes up just over 16%.

“Clearly, we are off. It’s not good and very disconcerting,” he said. “We need a plan or a strategy to address these issues.”

Hill’s budget plan proposes a $144 million increase in funds provided to Fairfax County Public Schools, which typically gets over 50% of the overall budget. That represents more than a 6% hike from FY 2023, which began on July 1, 2022.

The FY 2024 Advertised Budget proposal includes a 6.3% or $144.1 million increase for @fcpsnews in addition to support for programs like Head Start, school health, behavioral health services, crossing guards, field maintenance and other costs. pic.twitter.com/8cNyztgNbJ

— Fairfax County Government

(@fairfaxcounty) February 21, 2023

But that number is about $15 million lower than what Superintendent Michelle Reid initially requested.

As expected, the Fairfax County Federation of Teachers doesn’t agree with this proposal, writing in a statement that it “strongly encourages the Board of Supervisors to fully fund the FCPS budget request.”

One of the bigger questions hanging over this year’s school budget is if the state will rectify a calculation error expected to lead to FCPS getting about $18 million less than anticipated. That includes about $13 million missing from the FY 2024 budget.

It remains unclear if the state will reimburse the missing money, or provide any extra, from its $2 billion surplus. When Dranesville District Supervisor John Foust asked when the state will make a decision on its budget, a few chuckles arose from staff about the uncertain situation.

Christina Jackson, Fairfax County’s chief financial officer, said the county is optimistic and is in a “better position” to see much-needed funds headed their way from the state.

As anticipated late last year, this year’s budget process may be one of the “one of the most challenging” in years. This is due to inflation, staff retention challenges, and surging real estate values.

“Balancing the impacts of inflation, the labor market and other economic pressures with the need to fund critical programs and services has made this a difficult budget year,” Hill said in a county press release. “But I am very proud of the work of our budget staff and all our employees in managing through these challenges and moving forward to meet the needs of our residents.”

Hill led off his presentation to the board by emphasizing that the aim of this year’s budget is maintaining and “stabilizing our core,” meaning county staff and existing programs.

“I know that the Board remains concerned about the retention and recruitment issues that our agencies have been facing over the past two years, and I have spent considerable time with my leadership team developing ways in which to tackle these issues,” Hill wrote in his budget message to supervisors.

In the budget is a $134.5 million increase in county disbursement, including a 2% market scale adjustment for most county employees. That’s lower than even what staff had recommended in order to stay competitive in hiring and retention. They had calculated a rate of 5.44%.

“The proposed Fairfax County budget misses the mark when it comes to giving workers the wages we deserve, ” Tammie Wondong, SEIU Virginia 512 Fairfax’s president and a 33-year county employee, said in a statement. “In fact, when the county funds the market rate adjustment (MRA) at only 2% when it should be 5.44%, let’s call it what it is — a pay cut.”

Inflation also adds $18 million to the budget this year, associated with cost increases to cover utility and information technology contracts and lease adjustments.

Supervisors will host a number of public meetings over the next few months to allow residents a chance to provide feedback on the proposed budget.

The Board of Supervisors is scheduled to vote and adopt the FY 2024 budget on May 9.

Photo via Machvee/Flickr

The new Fairfax County Public Schools (FCPS) budget could signal big changes for local schools, including extended availability of school counselors and new middle school athletics programs.

Superintendent Dr. Michelle C. Reid presented the budget for the 2023-2024 school year at a meeting last Thursday (Jan. 12).

The $3.5 billion budget is a $249.6 million (7.6%) increase over the approved budget for fiscal year 2023, which began July 1, 2022 and ends June 30.

Reid is requesting an additional $159.6 million from the Fairfax County Board of Supervisors.

Part of that cost comes from an increase in employee compensation.

According to a release from FCPS, the budget includes:

- $80.9 million to provide a market scale adjustment of 3.0% for all employees.

- $58.2 million to provide a step increase for all eligible employees.

- $19.9 million to provide a 1.0% retention bonus for employees hired in FCPS during FY 2023 and remaining employed with FCPS in FY 2024.

- $4.3 million to provide a step extension for all scales.

Several members of the school board praised the proposed increase for staff compensation.

Another popular item among school board members is funding to provide middle school spring and fall athletic activities.

“You had me at middle school sports,” said Hunter Mill District representative Melanie Meren. “I think about where I grew up and the sports there, and it’s something that’s so missed here…I know this is a significant ask, but we are going to get an incredible investment. I’m eager to work to make this happen.”

Student representative Michele Togbe said the expansion of high school counseling for students into summer break will be a welcome improvement.

“If I could hug a budget, I would hug this budget,” Togbe said. “With the counselors, I think it’s really cool that we’re expanding their contract and their days.”

Other notable investments in the new budget include:

- Increased access to Pre-K: the budget includes $2 million to provide resources for 10 additional Pre-K classrooms.

- Support for students with disabilities: the budget includes $2 million to be allocated to the Special Education Compensatory Services Fund to address learning loss caused by the pandemic

- Changing student enrollment needs: the budget includes a variety of improvements grouped together as “student enrollment needs,” including paying for increased costs in English for Speakers of Other Languages (ESOL) programs and free and reduced-price meals, totaling around $65.2 million for 679.2 positions

The Fairfax County budget will be presented on Feb. 21, followed by a joint meeting of the school board and Board of Supervisors on Feb. 28. Public meetings will be held in April followed by final adoption on May 9 for the county budget and May 25 for the school budget.

Local officials are already preparing for “one of the most challenging” budget talks in years due to inflation, the changing real estate market, and staff retention challenges.

Right before the Thanksgiving holiday, Fairfax County staff offered supervisors and the school board an early look at projected revenues, expenditures, and points of potential discussion as the county and Fairfax County Public Schools (FCPS) prepare to release proposed budgets early next year.

The fiscal year 2024 budget forecast that staff presented on Nov. 22 didn’t paint a particularly rosy picture, however.

Board of Supervisors Chairman Jeff McKay called the forecast “a real mixed bag.” County staff said that generated revenue remained “healthy,” but others weren’t so sunny.

“This is probably going to be one of the most challenging budgets in my 11 years on the [school] board,” Braddock District School Board representative Megan McLaughlin said. “It’s going to be a tough one.”

Springfield District Supervisor Pat Herrity concurred, saying there wasn’t “a lot of good news in here.”

As is the case across the county, the local real estate market has been slowing due to increasing interest rates and rising prices. While it increased from last year, growth is expected to flatten going forward for the rest of 2022 and into 2023.

Non-residential tax revenue is in even worse shape, at least partially due to the change in work-from-home habits resulting from the pandemic. It’s expected to increase by only 0.6% compared to last year when the growth was about 2.3% compared to 2022.

While hotel, retail, and apartment revenues are all expected to increase next year, office revenue is expected to decline between 5% and 6%, raising concerns among some supervisors and school board members.

Braddock District Supervisor James Walkinshaw said he has talked to companies in the county that have no intention of renewing office leases due to decreased need with more employees now teleworking.

He called it a “slow-moving crisis” that could create a “very significant hole” in terms of missing revenue.

“[This] is very troubling,” Walkinshaw said. “It’s a structural challenge now in our economy…I’m not confident we have our arms around what that challenge is going to look like over the next 5 to 10 years.”

New construction and transient occupancy (or lodging) tax revenue are also expected to grow, but at much lower rates than prior to the pandemic.

Real estate taxes are the largest source of revenue for the county, providing more than two-thirds of generated money. Last year, home values soared, while commercial tax revenue dropped, resulting in a 3-cent decrease in the real estate tax rate.

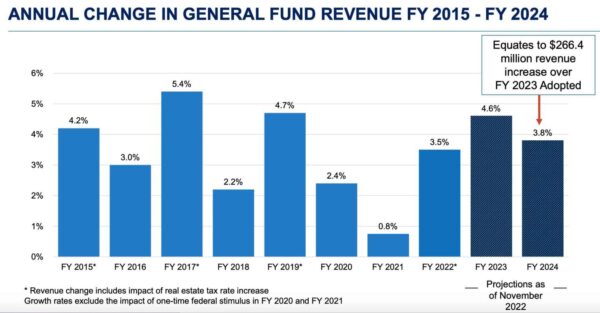

All told, revenue is predicted to rise by about $266 million, a 3.8% increase from last year, per the presented forecast.

However, revenue isn’t keeping pace with expenditures, due mostly to anticipated staff salary increases.

Between recruitment and retention challenges and inflation, an additional $159 million will be needed for salaries and benefits compared to the current budget — plus another $113.5 million for school staff. Adding in other costs, the county and FCPS are looking at a combined shortfall of about $125 million for fiscal year 2024, which begins July 1, 2023, staff said.

Since this is a baseline forecast, a number of county and school priorities were not taken into account, including infrastructure upgrades, increased investments in affordable housing, and an expansion of early childhood education programs.

As county staff and McKay both reiterated, the forecast is only an estimation subject to change.

“As the economic outlook is uncertain, staff is approaching FY 2024 revenue forecasting very conservatively,” the presentation said.

Adoption of the fiscal year 2024 budget remains six months away. Advertised budget plans for the county and schools will be released in February with final votes coming in May 2023.

Fairfax County Public Schools didn’t get all the money it wanted, but its next budget still has room to address some key priorities, including staff compensation and efforts to reduce the system’s carbon footprint.

Adopted by the Fairfax County Board of Supervisors on Tuesday (May 10), the county’s new budget for fiscal year 2023, which starts on July 1, trimmed $10 million from the $112.6 million increase in transfer funds sought by FCPS, officials reported to the school board earlier this week.

The Town of Herndon has held the line on its real estate tax rate as the council approved its $57.3 million budget for fiscal year 2023.

The budget, which represents a nearly 3% increase over last year, includes the first pay raises for the Herndon Town Council in nearly 15 years.

On average, Fairfax County residential property owners will see a bigger hike in their tax bills this year than at any other point in the 21st century.

Based on a real estate tax rate three cents lower than what was originally advertised, the average increase of $465 will come once the Board of Supervisors officially adopts a budget on May 10 for fiscal year 2023, which starts July 1.

Karen Johnson commutes two hours each way to get to work in Fair Oaks, leaving at 5 a.m. from her home in Fredericksburg.

Johnson, a child care center teacher, has tried to live in Fairfax County but can’t afford it, she said on April 12 at a budget hearing with fellow union members. She called on the Board of Supervisors to fund proposed raises to the county’s 11,000-plus merit workers.

When Centreville resident Jim Church received his property assessment, he saw a 14.5% increase, which he calculated would amount to $1,100.

Other residents shared similar concerns yesterday (Tuesday) at the first of three scheduled public hearings on Fairfax County’s proposed budget for fiscal year 2023, which starts July 1.

Several speakers called on the Board of Supervisors to reduce the property tax rate from its advertised rate of $1.14 per $100 of assessed property value. If the board keeps the rate the same, the average tax bill would increase by $666, according to a Fairfax County projection.

Fairfax County’s budget season is in full swing.

The Board of Supervisors will hold public hearings at 3 p.m. today through Thursday (April 12-14), giving residents, community groups, and other stakeholders an opportunity to highlight their concerns and priorities for the spending plan that will take effect on July 1.

About half of the county’s general fund spending goes to Fairfax County Public Schools, which allocates the money based on its own adopted budget. The rest goes to county services, such as the fire and police departments, parks and libraries, public transportation, and more.

A federal budget plan passed by the U.S. House yesterday (Wednesday) would send more than $8.3 million to Fairfax County, Virginia’s senators report.

Designated H.R. 2471, the $1.5 trillion spending package funds the federal government for fiscal year 2022, which began on Oct. 1, 2021, and ends on Sept. 30. It also includes $13.6 billion in aid to support Ukraine during Russia’s invasion and releases funding for the $1 trillion infrastructure bill that President Joe Biden signed into law in November.