This is an op-ed by Reston resident Terry Maynard. It does not necessarily reflect the opinion of Reston Now.

Contrary to RA President Ellen Graves’ op-ed on Friday, the planned RA purchase of the Tetra property is neither a good value now nor a good investment in the long term. Only Reston voters now can stop this ill-conceived, secretly planned purchase by voting “NO” in the ongoing RA referendum.

The price RA has committed to paying, subject to the referendum vote, is $2.65 million. The $2.65 million price is two and one-half its current market value of the Tetra property as measured by both Fairfax County in its annual real estate assessment and the RA-funded appraisal and property condition report.

The County puts the value of the Tetra property at $1.20 million as of Jan. 1, 2015. That is down about $44,000 from last year. And, as you probably know, the County is obligated under state law to assess real estate at its fair market value.

The property appraisal prepared for RA by The Robert Paul Jones Company, LLC, (RPJ) walks through the property’s “as is” valuation in two ways: comparable sales and income approach. After putting the comparable sales valuation at $1.45 million and the income approach valuation at $1.1 million, it arrives at an “as is” fair market value of $1.3 million. (See p. 22 of the RPJ appraisal.)

The RPJ valuations assume that the building is in good repair. Yet, as RPJ notes in its income valuation of the property, “The subject’s historic maintenance and repair expenses for all expenses, including pest control and some expenses which are considered to be atypical, has averaged $1.74 per square foot on average for 2012 through 2014, ranging from approximately $0.34 per square foot in 2012 to $2.95 per square foot in 2014. We have stabilized this amount at $1.25 per square foot of GBA, or $3,910 annually.” (Page 20 of the appraisal.)

At its three-year average, annual maintenance and repair costs over the last three years actually reach more $5,440 –some 39 percent higher than the value “stabilized” by RPJ. Why we should expect future maintenance and repair costs to be lower than recent ones remains a mystery.

Yet, the Tetra building is not in good repair as RA directed the appraiser to assume (“deferred maintenance has been corrected”, p. 2). The property condition report from Criterium Engineers attests puts the needed repairs at about one-quarter million dollars; specifically, $257,410 over the next decade including $144,364 that needs to be done right away (see p. 4).

So, the true “as is” value of the Tetra property in good condition is the fair market value of $1.2-$1.4 million less the needed repairs of $257,410 to put it in good condition. That’s a net fair market price of the Tetra property in good condition of $943,000 to $1.143 million, call it $1 million dollars, nowhere near the $2.65 million that RA is committed to pay if this referendum is approved (although RA may get the priced reduced by the cost of immediate repairs–$144,000 — to roughly $2.5 million).

The only reasons that the price has been fixed at $2.65 million are that the President of Tetra Properties is insisting on receiving that price and the fact that the appraisal assumes, by RA direction, that a 6,930-square-foot restaurant can be added to the property, an extremely unlikely prospect given the restrictions on the property reflected in Tetra’s inability to sell the property to any restaurants for years. Otherwise, paying more than $1 million for the property is a grand waste of Restonians’ assessment fees.

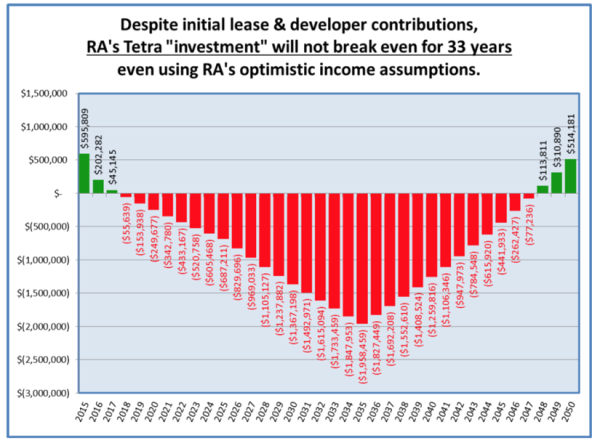

Moreover, if RA is allowed by Reston voters to proceed with this “investment,” it will lose money for more than three decades, doubling the life of the current building. Using RA’s assumptions about the revenues and expenses of purchasing and operating the property in the RA “Fact Sheet” with some further assumptions about the longer term, we anticipate that cumulative losses will peak at $2.0 million 20 years from now, the last year in which RA has to make mortgage payments.

These calculations are shown in a Reston 2020 post. Extending this analysis out to 2050 (and adding only $10,000 annually for capital repairs and replacements after 2035) shows that the cumulative loss begins to shrink after the mortgage is paid, but does not reach break even or better until 2048 — 33 years from now.

The Tetra building will be 66 years old in 2048 and probably need to be torn down if it hasn’t been torn down already. And it cannot be re-built. The County’s Chesapeake Bay Preservation Ordinance calls for the return to a natural state of all Resource Protection Areas (RPAs), such as this one, at the end of the natural life of existing structures. RA may never realize cumulative revenue on its purchase of the Tetra property.

Assuming the building is still standing and usable in 2050, RA’s cumulative annual return on investment will be 0.5 percent over the next 35 years. And, in real terms, assuming a 3-percent inflation rate as RA does, it will still be a losing investment, providing Restonians a negative 2.5 percent return annually for the next 3 1/2 decades. We would do better as an investment by putting Restonians’ $2.65 million in a money market account.

In sum, RA is willing to pay more than 2 1/2 times the current value of the Tetra property and we can expect that RA’s investment will lose money for the rest of the building’s useful life. It is a horrible purchase value and even more atrocious long-term RA investment. Vote “NO” on the Tetra property purchase to save Restonians’ money, sustain RA’s good financial reputation, and prevent unneeded spending.

Something on your mind? Send a letter to [email protected]. Reston Now reserved the right to edit letters for style, spelling and clarity.