At its meeting Tuesday, the Fairfax County Board of Supervisors approved the $2.27 billion Reston Transportation Funding Plan.

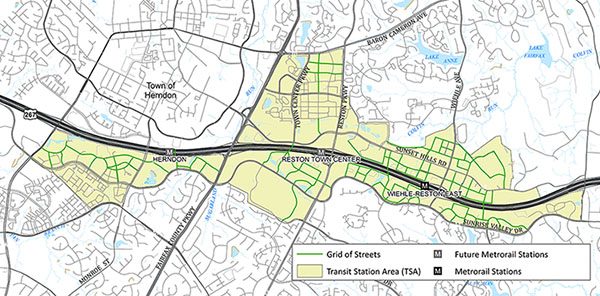

Included in the plan is a 2.1 cent/$100 of assessed value tax assessed to properties in the Reston Transit Station Area (pictured). Under the agreed-upon plan, current homeowners in the TSA will be responsible for up to $44.6 million of the estimated cost. The remainder of the tax funds (totaling $350 million) will be collected from commercial/industrial properties and from residential properties built in the future.

The rest of private funds, about $716 million, is expected to be collected through in-kind contributions to the grid by developers.

The residential tax issue was a concern of several of the speakers during a public hearing before the vote.

“FCDOT implicitly declares that Reston homeowners must be taxed because the County cannot move any current tax revenues in its $4 billion budget to improve Reston’s streets, the County can’t use any future station area property tax revenues to invest in Reston’s streets [and] the County can never raise the rates on any countywide taxes that would help generate billions in future tax revenues,” said Terry Maynard of the Reston 20/20 committee, who has been an outspoken detractor of the tax. “To insist on these assumptions is an outright falsehood, and FCDOT and [the Board of Supervisors] know it.”

Reston resident Tammi Petrine also addressed the board with similar concerns about forcing residents to pay for needed infrastructure. In addition, John McBride, land-use attorney representing Reston Association, addressed the board to share the RA Board of Directors’ stance against the residential tax.

Representing the Reston Network Analysis Advisory Group, chairman Andy Sigle said the “alternative funding sources” beyond the in-kind developer contributions were necessary.

“Following much discussion and additional community input, a majority of the advisory group voted to endorse staff’s recommendation,” Sigle said. “While the vote was not unanimous in regard to the specific road fund and service district contribution rates, the advisory group was in agreement regarding the general structure of the funding plan.”

Maggie Parker of developer Comstock Partners, who was also a part of RNAAG, said the group’s meetings were “informative, inclusive and impactful.”

“This funding plan is burdensome; however, after dozens of meetings, revision of scope and countless financial models, it is what it is,” she said. “Ultimately, it’s an investment in our community and the citizens who live and work here.”

In addition to the grid, private funds are slated to be used for upgrades to intersections. Public funds — from local, state, regional and federal sources — totaling $1.2 billion are to be used for roadway improvements including the construction of a bridge over the Dulles Toll Road at Soapstone Drive and a Town Center Parkway underpass of the Toll Road.

Two supervisors abstained from the vote. Supervisor Pat Herrity (Springfield District) said he continues to have concerns about the overall cost of the project, and Supervisor Linda Smyth (Providence District) said she could not support the plan when she has continually opposed a similar tax in Tysons.

Supervisor Cathy Hudgins (Hunter Mill District) said she understands taxes are unpopular, but she believes the impact is outweighed by the benefits.

“I think the relative point is that the majority of [the plan] is being paid for by public dollars and by developers,” she said. “It is a difficult ask, but we think it is an important ask. As Reston continues to grow, we have congestion — very bad congestion — and these infrastructure improvements need to get started.”