A venture capital fund that invested millions of dollars in a startup later hit with a federal fraud investigation and bankruptcy is suing the Herndon-based business accelerator Center for Innovative Technology.

According to the lawsuit, which was filed with the Fairfax County Circuit Court on May 10, Savano Capital Partners III — a fund tied to a Baltimore-based investment firm — paid CIT nearly $4.5 million in 2020 to invest in a fraud prevention technology company called NS8.

“On paper, it appeared to be earning millions in customer revenue and to have tens of millions of dollars of assets on hand,” the civil complaint said, adding that “the fraud described above occurred under Innovative’s ownership of NS8.”

Savano Capital entered into its financial agreement with CIT on March 20, 2020. At the same time, the Securities and Exchange Commission was investigating NS8 for fraud, issuing subpoenas to the company and its CEO in November 2019 and March 2020.

The SEC charged former NS8 CEO Adam Rogas with defrauding investors on Sept. 17, 2020, alleging that he had raised approximately $123 million from investors — at least $17.5 million of which he pocketed himself — by falsely claiming millions in revenue in 2019 and 2020.

NS8 filed for Chapter 11 bankruptcy in October before being acquired by the software company Avolin this past February. Criminal and civil cases against Rogas are still going through federal court, with the civil case halted while the criminal case unfolds.

Prosecutors allege Rogas’ actions “led to the illusion that NS8 had over $62 million in [revenue] when, in fact, it had just over $28,000” by June 2020.

In its legal complaint, Savano says it made the deal with CIT without knowing NS8 “was virtually worthless and was in the midst of a massive accounting fraud and SEC investigation.”

According to the complaint, the investment fund valued its NS8 stake at over $4.4 million as part of a tech companies portfolio with CIT. The plaintiff is seeking to rescind the contract, arguing that the business accelerator benefited from the windfall of worthless stock, attorney Jason Ohana said at a hearing on Friday (July 23).

CIT, which facilitated funding for NS8 and previously cited it as a success story, called the lawsuit meritless and asked for a dismissal with prejudice to avoid a trial. Fairfax County Circuit Court Judge Thomas Mann denied the request.

During the hearing, Jack McCann, an attorney for CIT, argued that Savano’s investment purchase was a “unilateral mistake” by the plaintiff, because the nonprofit never detailed the underlying value of the companies.

He compared the situation to an “as is” used car sale in which a buyer could inspect the vehicle and review maintenance reports but would be responsible if they realized the next day that they had purchased a hunk of junk.

“I don’t mean this disrespectfully, but the used-car analogy was not well done,” Mann said during the virtual hearing. “It’s a completely different set of circumstances than an ‘as is’ sale.”

He also cited a 1993 Supreme Court of Virginia decision on the right to a jury trial.

Founded in 2016, NS8 was once located in Arlington, but its headquarters were moved to Las Vegas. Rogas resigned on Sept. 1, 2020, according to a legal filing.

In its lawsuit, the SEC said Rogas at one point provided false bank statements to an investors’ consultant who found line items that didn’t correctly add up. The executive allegedly re-doctored information after being questioned.

The SEC also alleged Rogas sent falsified monthly bank statements to NS8’s finance department. In January and February 2020, NS8 claimed $38 million and $42 million in revenue, respectively, on financial statements when in reality, it brought in around $39,000 and $45,000, according to the SEC complaint.

An attorney for Rogas declined to comment. Filings on his behalf refer to the charges as allegations.

Amid the SEC investigation, Virginia sold CIT’s Herndon office complex to a private real estate developer and capital investment firm. Gov. Ralph Northam said proceeds from the $47 million sale would go to the Virginia Innovation Partnership Authority, which the General Assembly created last year.

The neighborhood immediately around the Innovation Center Metro Station in Herndon could look drastically different once the Silver Line extension begins running.

Origami Capital Partners LLC and Timberline Real Estate Partners have a major redevelopment plan in the works for the Center for Innovative Technology campus, a 26-acre property in Herndon.

The companies bought the campus — which was once under consideration for Amazon’s second headquarters — for $47 million. Gov. Ralph Northam made the announcement earlier this month.

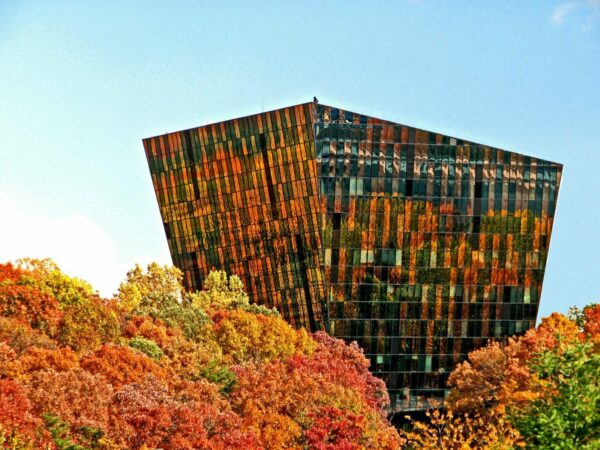

Currently, the property, which is near the Innovation Center Metro Station, includes a seven-story tower and three-story building, including the CIT, a publicly-funded corporation.

Origami is planning an “Innovation Station” that would include five residential buildings, a hotel, an entertainment facility and retail, in addition to existing office space.

Renderings submitted to the state describe the new district as a “mixed-use hub” with “bucolic urbanism” and a “connected lifestyle,” according to an application received by Reston Now.

Plans also include a central green park, a technology hub, a retail village, and a grand food hall.

Virginia has sold off the Center for Innovative Technology office building in Herndon, Gov. Ralph Northam announced today.

The 149,000-square-foot office building that’s located on a 26-acre parcel near the Washington Dulles International Airport and the future Innovation Center Metro Station was sold for $47.4 million to Origami Capital Partners and Timberline Real Estate Partners.

The sale will help fund the Virginia Innovation Partnership Authority, a new entity for “innovation ad new technology-based economic development,” according to a release. Funds will be allocated directly to the Virginia Research Investment Fund.

The building housed the nonprofit Center for Innovative Technology, Northern Virginia Technology Council and other private technology firms.

Here’s more from the release:

“This event represents a significant milestone toward the goal of delivering to Northern Virginia a development that will entice and excite major corporate tenants,” said Jeff Young, Managing Partner of Origami. “We know companies will embrace the project and resolve to focus on delivering a development to the residents of Northern Virginia they will celebrate. We look forward to our ongoing partnership with the commonwealth, Loudoun and Fairfax counties.”

The General Assembly declared the property surplus in 2016 and directed DGS, which manages Virginia’s real estate portfolio, to dispose of it. DGS and its contracted real estate broker, Divaris Real Estate, marketed the property and received 13 proposals from 12 offerors in its initial solicitation. In October 2019, a Call for Best and Final Offers resulted in 12 proposals from 10 potential purchasers. DGS began discussions with the chosen purchaser in November.

“The sale of this property in an area of Virginia where property development continues at a robust pace provided the Commonwealth an opportunity to receive the most favorable outcome from an open competitive sale process,” said DGS Director Joe Damico. “DGS worked collaboratively with many stakeholders, including the localities where the property resides, the Office of the Attorney General, building tenants, and the new owners to complete the successful surplus property sale that will further the Commonwealth’s economic development goals.”

Photo via Facebook/CIT