Fairfax County is missing out on about $2 million in payments from residents who try and skip out on paying annual car taxes.

That’s why the county is calling attention to its “Target Program” for residents to alert county officials to possible evaders, mostly residents who move here from other states and fail to register their cars locally.

“This program provides Fairfax County residents a way to communicate with the tax office in reporting vehicles that may be evading personal property taxes,” says Juan Rengel of the Fairfax County Department of Tax Administration. “This is an effective way to participate in ensuring everyone living in Fairfax County pays their fair share.”

Fairfax County recently mailed more than 900,000 car tax bills to residents. Payments are due Oct. 5.

Officials say that more than 1,800 previously unregistered vehicles were added to car tax records, which will yield more than $2 million in tax revenue to support the county budget. The state with the most cars added to the Virginia rolls: Maryland, with 742. Florida was second (161), followed by DC (123).

However, just because a car does not have Virginia plates, it does not mean it is in violation. Fairfax County’s location near Washington, D.C., military bases, universities and corporate world headquarters draws people from all over the world who are in Fairfax County on a temporary or permanent basis.

Some vehicle owners with non-Virginia plates may not be required to register. Among them:

- Military personnel temporarily living in Fairfax County due to military order and their permanent residence is elsewhere

- Full-time college students

- People visiting family members

- Diplomats

- Vehicles with government license plates

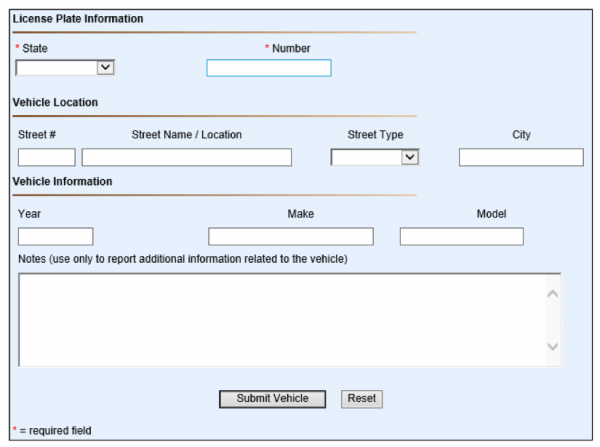

But if you think someone is in violation, visit the Tax Evaders link on the county website. You will be asked to fill out an (anonymous) form. County staff will then investigate. If a vehicle should be registered in the county, then the owner will receive a tax bill, which will also include penalties, interest and the “No Plate Tax.“