A Reston advisory group studying how to raise $2.6 billion for road improvements over the next 40 years is set to hold a pubic meeting tonight.

A Reston advisory group studying how to raise $2.6 billion for road improvements over the next 40 years is set to hold a pubic meeting tonight.

Members of the Reston Network Analysis Advisory Group are scheduled to gather in the lecture hall at South Lakes High School (11400 South Lakes Drive) at 7 p.m., according to an announcement.

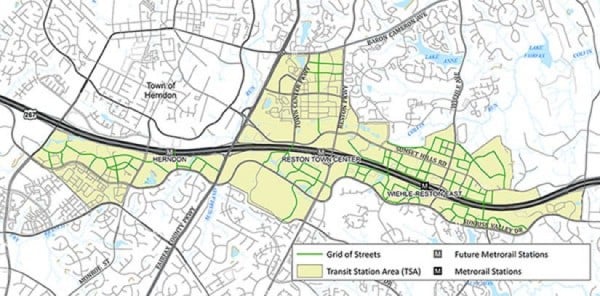

RNAG, created by Fairfax County’s Hunter Mill District supervisor, is a group of locals who seek feedback from people who are the most affected by local development and changes to the transportation system. Through the Reston Network Analysis, the county seeks to evaluate the effectiveness of pedestrian friendly streets and paths around the Wiehle-Reston East Metro station, as well as the future Reston Town Center and Herndon stops.

The advisory group works with the county and the Virginia Department of Transportation to come up with ways to secure funding for Reston’s network and maintaining local roadways. This fall, RNAG expressed strong opposition to creating a special tax district, in which residents who live near the Metro stations would get taxed to help with road improvements.

This is an op-ed by Reston resident Terry Maynard. It does not reflect the opinion of Reston Now.

This is an op-ed by Reston resident Terry Maynard. It does not reflect the opinion of Reston Now.

On Monday, the Fairfax County Department of Transportation (FCDOT) and Reston Network Analysis Group (RNAG) once again offered several proposals that would create a transportation tax service district (TSD) for the Reston Metro transit station areas (TSAs) along the Dulles Corridor that would add to the tax bills of Restonians living there.

At the meeting, FCDOT detailed three TSD tax rate options: $0.017/$100 assessed valuation, $0.20/$100 assessed valuation, and $0.27/$100 assessed valuation to be paid for 40 years largely based on mindless comparisons with Tysons.

Ostensibly, these funds would close a $350 million “gap” in funding new and improved streets and intersections throughout the TSAs to accommodate the traffic added there by new high-density development.

The Fairfax County Board of Transportation is looking at a variety of funding sources to pay for more than $2 billion in Reston road improvements over the next 40 years.

FCDOT officials outlined some of their ideas at a community meeting in Reston on Monday. They stressed all proposals are in the idea stage and still being discussed with the Reston Network and Funding Advocacy Group (RNAG). They are also seeking public feedback on ideas, but hope to have a solid plan to go before the Fairfax County Board of Supervisors by the end of 2016.

Here is what you need to know:

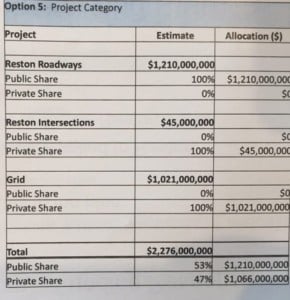

The $2.27 billion cost would be split between public and private funds over three categories.

- Reston Roadways: $1.2 billion – 100 percent paid for by public share

- Reston Intersections: $45 million – 100 percent paid for by private share

- Urban Street grid near Metro Stations: $1.021 billion – 100 percent paid for by private share.

That works out to 53 percent paid for by public funds; 47 percent paid for by private funds. However, even using those estimates and in-kind contributions, FCDOT estimates a $355 million shortfall.

That works out to 53 percent paid for by public funds; 47 percent paid for by private funds. However, even using those estimates and in-kind contributions, FCDOT estimates a $355 million shortfall.

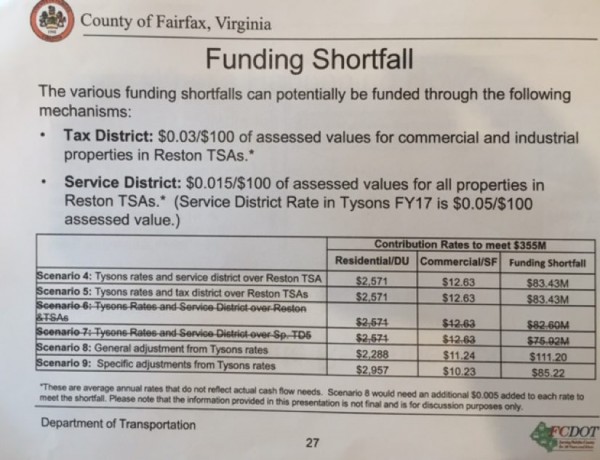

That’s why they are considering a tax district for commercial properties or a special service district for all properties located in the Reston Transit Service Areas (TSAs). TSAs are the new construction within about a quarter-mile of Reston’s eventual three Metro stations.

Here’s some of the models they are considering for that:

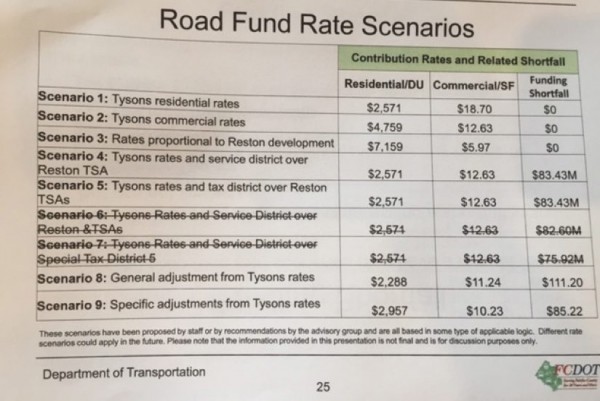

And here are some of the models for a Road Fund comprised of developer contributions:

In several of the Road Fund scenarios, there would still be a shortfall.

Read more about the process and provide feedback on FCDOT’s web page.

The Fairfax County Department of Transportation is still considering a special tax or special service district to fund $2.6 billion in transportation improvements in the Reston area in coming years.

The Fairfax County Department of Transportation is still considering a special tax or special service district to fund $2.6 billion in transportation improvements in the Reston area in coming years.

Two ideas mentioned in a briefing to the Reston Network Analysis & Funding Plan (RNAG) Advisory Group this week include a tax district: $0.03/$100 of assessed values for commercial and industrial properties in Reston transit station areas or a service district of $0.015/$100 of assessed values for all properties in Reston transit station areas.

The suggestions will be further discussed at a community meeting Monday, 7-9 p.m., at the North County Government Center, 1801 Cameron Glen Drive, Reston.

The presentation uses the example of a .015 cent tax to show how it would affect homeowners. A service district homeowner with a $400,000 home would see a rise of about $60 in annual taxes. An owner with a $900,000 home would be taxed about $135 more. Read More

In looking for ways to fund about $2.6 billion in transportation improvements in Reston, there has been talk among officials of creating a special tax district to cover some of the costs.

In looking for ways to fund about $2.6 billion in transportation improvements in Reston, there has been talk among officials of creating a special tax district to cover some of the costs.

At a community meeting Wednesday, Fairfax County Department of Transportation officials said that idea is still on the table — but only for residents and businesses in developments within the Reston’s transit area. Transit areas are considered within one-quarter of a mile or less from Metro Stations at Wiehle-Reston East and (in 2o2o) Reston Town Center.

The Reston Network Analysis Group (RNAG) and FCDOT mentioned in February the possibility of taxing all of Reston or all of Special Tax District 5 (the Reston area that is already paying annually to fund the Reston Community Center). That idea has been discarded, FCDOT says.

The transit areas are expected to see the greatest level of development — and will need the most street grid, lane additions and traffic signals, among other improvements — as Reston grows over the next three decades.

FCDOT’s Janet Nguyen says $1.34 billion in transportation projects will likely come from shared public and private contributions. That money would go for road widening, intersection improvements, the Soapstone overpass, and an Dulles Toll Road underpass near Reston Town Center, among other projects. Read More

The Reston community can get an update on the planned urban-style street grid — and the potential of a special tax to help pay for it — at a community meeting Wednesday.

Join Hunter Mill Supervisor Cathy Hudgins and the Fairfax County Department of Transportation (FCDOT) for another in a series of discussions on the Reston Network Analysis from 7 to 9 p.m. at South Lakes High School.

Residents will be able to learn more about the analysis, which is evaluating the concept of urban-style grids of streets in the areas surrounding the Reston Metrorail Stations, also known as the Reston Transit Station Areas. County staff will give a presentation on the status of the Network Analysis and potential recommendations for the transportation network. Staff will also answer questions.

The Reston Network Analysis Advisory Group has most recently discussed Tier 2 mitigation (see presentation below). The group is looking at ways to reduce congestion and waiting times at traffic lights. The presentation points out some of the worst trouble spots in the Reston area. The goal is adding traffic lights and turning lanes, but patience is needed as the plan covers mitigation over the next several decades. Read More