This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

In a recent social media post, I indicated that the annual General Assembly session would be underway very soon. AutoCorrect changed the text to be “underwater very soon.” My son alerted me to the change, and I made what I thought was a correction. As the General Assembly session has gotten underway I am starting to wonder if AutoCorrect knew something that I am now coming to realize: the General Assembly may well be underwater!

The session is scheduled to go until Feb. 22. Meeting five days a week means 38 actual days for work on more than 2,000 bills and resolutions. While I have highlighted big issues like redistricting reform, preventing gun violence and ERA ratification, there are many more issues large and small that make up the agenda for the session.

Virginia has always conformed its income tax policies to the federal system. With the massive changes that have been made in federal tax law, the General Assembly will wrestle with what we will do in Virginia. There will be an effort to resolve the issue early in the session to accommodate taxpayers who want to file their returns early. Part of the tax policy debate will be making the Earned Income Tax Credit (EITC) refundable as promoted by the governor in a bill that I have introduced. The purpose would be to allow persons of low income to keep more of the money they earn and be more self-supporting.

As a Dillon Rule State — meaning local governments have only the powers granted to them by the state — dozens of bills called “local bills” are introduced to extend powers some of which are very minor to a particular locality. Another group of bills is called “housekeeping” to make corrections or clarifications to legislation that passed in previous sessions. All these bills are important but add to the workload of a session.

Challenging environmental issues will be coming before the legislature many of which relate to energy. There are proposals to increase the required uses of alternative and renewable fuels. Cleaning up from the past use of fossils fuels and the resulting growth in coal ash ponds will be taken up. There is a strong need to deal with the degradation of water quality in the Chesapeake Bay area. The Tidewater area is subject to recurrent flooding coming about with climate change that needs addressing now rather than later.

There are many bills dealing with criminal justice reform including bills intended to reduce the school to prison pipeline. The governor has announced his support of decriminalizing possession of small quantities of marijuana. A bill that has been introduced would allow casino and sports gambling.

There will be a number of dog and cat bills that include high levels of emotion from interested parties. Being able to limit dogs running across the properties of landowners is a big concern in rural areas.

You can review all the bills on the agenda of the General Assembly.

If you have not done so already, let me know your positions on issues by going to my website and click on Legislative Session Survey.

File photo

A flash flood watch is in effect — The watch will remain in effect through tonight. Multiple rounds of rainfall will be possible throughout the day. Saturated soil from previous rains may result in flash flooding. [National Weather Service]

Fair and carnival kicks off today — The 70th Annual 4-H Fair and Carnival kicks off today at Frying Pan Farm Park today through August 5. The event features four days of fresh air, farm fun and good times for friends, family and neighbors. Activities include fair food, 4-H exhibits, carnival rides, games and live entertainment. [Fairfax County Government]

If you’d rather not pay taxes — From Friday through Sunday, a sales tax holiday means you won’t have to pay taxes on things like school supplies, emergency supplies and energy star items. [Fairfax County Government]

Register for Reston Community Center programs — Registration is now open for Reston residents and employees to take part in RCC programs, classes and trips. [Reston Community Center]

The official version of events — A press release discusses the recent approval of the 4.1 million square foot Reston Crescent development, which will include Reston’s first Wegmans. [Fairfax County Government]

Flickr pool photo by vantagehill

Construction on office tower in Reston Station to begin — Comstock will begin building a new $95 million office tower this spring. The tower is the third office building that is part of its Reston Station development. [The Washington Business Journal]

A tax(ing) season — Need some tax relief? The county is hosting two tax relief workshops for older adults and people with disabilities in Reston next month. [The Connection]

Police seek suspects in a string of Northern Virginia robberies — “Police are searching for the suspects they believe are responsible for more than a dozen robberies in Northern Virginia over the last few months. Two men have been involved in five commercial robberies in Fairfax and Loudoun counties since Monday.” [WTOP]

Reston Station thinks big — Comstock wants to make its massive redevelopment project more robust. A new hotel and taller buildings could be added to its development plan. [Reston Planning and Zoning Committee]

Local dance company goes to Atlas — Gin Dance Company will perform at the Atlas Festival this year. We hope they’ll break a leg! [The Connection]

Photo by Fatimah Waseem

By Suzette Blackwell, Global Law PLLC

The next time you’re out dining at your favorite RTC restaurant, don’t be surprised if you find the conversation gravitate toward SALT — but it won’t be the seasoning. Many Reston-area residents just lost a major tax break, as the new tax law passed by Congress caps state and local tax (SALT) deduction at $10,000 on individual tax returns. Here’s a brief summary of how you may be affected by this change in the tax code.

Previously, these state and local taxes were fully deductible on 1040, Schedule A:

- State and local real and foreign property taxes

- State and local personal property taxes

- State, local and foreign income (or sales) taxes

Under the new law, state and local tax deductions will be limited to certain situations. These changes will be in effect temporarily from January 1, 2018 until January 1, 2026 unless Congress makes them permanent:

- State, local and foreign property taxes and state and local sales taxes are fully deductible only when paid in connection with a trade or business. These taxes may be claimed as a business expense on Schedule C (for example real estate and sales taxes to generate business income), rental property expense on Schedule E (for example, real estate taxes on rental property that qualifies as a business asset) or farm expense on Schedule F.

- Itemized personal deduction of up to $10,000 for combined: 1) state and local property taxes not paid in connection with trade or business; and 2) state and local income (or sales) taxes. Note that foreign real property taxes may no longer be claimed under this deduction.

Roughly 60 percent of Reston residents are listed as homeowners according to the U.S. Census Bureau. These people would be allowed to claim the itemized personal deduction on Schedule A. In Reston, your home would have to be worth $1 million or more for your property taxes to be above $10,000.

Roughly 60 percent of Reston residents are listed as homeowners according to the U.S. Census Bureau. These people would be allowed to claim the itemized personal deduction on Schedule A. In Reston, your home would have to be worth $1 million or more for your property taxes to be above $10,000.

Your property tax assessment can be found by entering your street address here on the Fairfax County government website to obtain the tax district number (be sure to leave off the street suffix – i.e, Road, Street, etc.) You can also find more information about the tax rates applicable to your property’s tax district here.

For some homeowners, the doubling of the standard deduction will offset the lower SALT deduction. For those with higher income, however, the standard deduction may be lower than the previous SALT deduction.

Global Law PLLC represents taxpayers locally, nationally and internationally. If you need assistance with a tax law issue, please visit www.mygloballaw.com, contact our office at (703) 712-8000 or email Suzette at [email protected], or to schedule a consultation.

This is an op-ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op-ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

By this time, most Restonians are aware of the County transportation department’s (FCDOT’s) efforts to add an additional property tax on Metro station area residents to pay an estimated $350 million for improvements in their streets to accommodate developer growth. The entire 16-month-long process to get Restonians, particularly the Restonians selected by Supervisor Cathy Hudgins to serve on the so-called Reston Network Analysis Group (RNAG), to nod “yes” to yet another Reston tax has been filled with lies and deception well worthy of our new President’s world of “alternative facts.”

We have already detailed a key Reston road tax assumption that is obviously false (p. 5): That the County cannot divert tax revenues from existing or future uses to improve Reston’s urban intersections. The County won’t even address the fact that the diversion of less than $9 million of the more than $4 billion in annual General Fund tax revenues will pay for all the roads it proposes to improve under its cost assumptions. That’s just two-tenths of one percent from current tax revenues, well less than its mid-year budget adjustment. Instead, FCDOT simply refuses to acknowledge this reality.

But there are so many other intentional, incessantly repeated mis-statements, failures to recognize certain obvious truths, and just plain poor County analysis that comprise the entire “big lie” of the need for a Reston road tax. An obvious place to start is the other side of the road improvement cost equation: The grotesquely huge profits of developers and massively increased property tax revenues of the County because of the major development that will occur in Reston’s station areas over the next four decades. Not once has FCDOT acknowledged that reality, much less used it in any analysis of how street improvements could be paid for.

Based on Boston Properties per square foot 2015 profits from continuing operations nationwide, we estimate that filling out the Reston Master Plan over the next 40 years will generate more than $45 billion in profits in 2016 dollars for Reston’s station area developers. That’s more than one billion dollars per year on average — about double that with modest inflation — most of it from the operation of existing office and residential structures. Why can’t $9 million of that more than one billion per year — less than 1 percent — be devoted to improving Reston’s urban area streets?

At the same time, the value of property in the station areas will increase at least ten-fold from $6 billion to $60 billion, and possibly as much as $90 billion, with the growth in square footage and appreciation over the next four decades if the Reston Master Plan is fulfilled. That property value will generate over $11 billion in property taxes for the County without increasing the property tax rate or adding a new Reston road tax. Certainly the County can divert three percent of that massive Reston tax revenue flow to the improvement of Reston’s streets, but you haven’t heard a word about that possibility from the County. Not once.

The County clearly does not want to tie any of this huge increase in Reston tax revenues to expenditures in Reston. Reston is just a County tax “cash cow” — as it has been for decades — to be milked for County expenditures elsewhere.

In fact, FCDOT has gone so far as to create a roadway “funding gap” out of whole cloth that it values at $350 million. The gap is merely a foil based on faulty assumptions about the availability of road funds to generate a reason for an added Reston road tax. It has no basis in the reality of available of County, regional, state, or federal tax revenues for road improvement purposes. But if you don’t have a “gap,” no matter how phony, you can’t justify a new tax. So the County made one up.

Worse is the planned use of the Reston road tax funds. About 12 percent of it ($45 million) will be used to actually improve intersections on Reston’s through streets, the streets that are already clogged with rush hour traffic.

The other 87 percent ($305 million) or so will be used to flesh out the “grid of streets.” The purpose of the “grid of streets” is to create street fronts for commercial development. They have no purpose in improving traffic flow; in fact, to the contrary, the development that will accompany them will actually add to the traffic flow burden on nearby through streets such as Reston Parkway and Wiehle Avenue, Sunrise Valley Drive and Sunset Hills Drive, used to access the rest of Reston, the Dulles Toll Road, and beyond.

Worse, almost all the streets that Reston’s road tax will be used to build are streets that would not be built in the absence of a Reston corporate welfare tax because of a lack of commercial demand. The streets financed by Restonians’ taxes will be at the extreme west and east ends of the station areas, near Centerville Road in Herndon and in the vicinity of the Reston Post office to the east. These locations are too far from any Metro station to be walkable and would not be developed at all unless paid for by the public, specifically Restonians’ tax dollars. In contrast, Tysons’ developers are paying for the entirety of the “grid of streets” there, even those well beyond walking distance to a Metro station. In short, developers will use Restonians’ corporate welfare to increase their profits with no traffic or other benefit to the community.

The entire County assertion of a need for a special Reston road tax, a so-called Tax Service District (TSD), on residents in Reston station areas is nothing more than a massive con built on fraudulent assumptions, half-baked analysis, ignored realities, and the gullibility of Restonians serving on RNAG (none of whom live in the areas to be taxed except an employee of Boston Properties), and even the Reston Association Board of Directors. In fact, the RA Board will be considering a resolution at its meeting this week to support the imposition of the Reston road tax on non-member areas of Reston so long as the rate remains constant at $.021/$100 valuation and the tax has a 40-year sundown provision. The Board of Supervisors will eliminate those proposed constraints with a dismissive wave of its hand if not at the outset, at the first sign that it might crimp its tax collection from Reston’s station areas.

It is time for Restonians, and the RA Board in particular, to quit being the sucker for County taxes imposed on Reston. We already pay an extra $.047/$100 valuation for the Reston Community Center (RCC) which is stealthily moving forward with a plan to build a large regional performing arts center in Town Center North, a mile from the nearest Metro station, and raising our RCC (STD#5) tax rate to pay for its construction and ensuing perpetual operating losses.

It is time for Reston to say not just “No,” but “Hell No” to more property taxes that go to subsidize commercial for profit ventures and county-wide spending initiatives. If a developer can’t pay a few extra dollars per year to cover the cost of the road in front of his property, they simply should not be in the development business in the highly lucrative Reston market. And if the County’s leaders can’t figure out how to do that, then they should be replaced by representatives who can. We, the people of Reston, should not be putting our money in developers’ pockets through added County taxes so they can make even more billions of dollars with no benefits for our community.

Terry Maynard, Co-Chair

Reston 20/20 Committee

The average Fairfax County homeowner will see a rise of about $300 in his or her annual tax bill next year.

The average Fairfax County homeowner will see a rise of about $300 in his or her annual tax bill next year.

The Fairfax County Board of Supervisors on Tuesday approved its $4.01 billion Fiscal Year 2017 budget. The motion passed 7-3, with Supervisors Herrity (Springfield), Linda Smyth (Providence) and John Cook (Braddock) voting against it.

The supervisors’ vote approves a tax increase of 4 cents per $100 of home value, to $1.13. This will provide an additional $93 million to the county annually.

At a budget mark-up session last week, the supervisors said they would provide an additional $33.6 million to Fairfax County Public Schools. This was done by allocating an entire penny of the tax rate and using reallocated funds from Third Quarter Review, said Supervisor Chair Sharon Bulova. Read More

Yes, Tax Day is traditionally April 15. But since that fell on a Friday this year, today is the deadline for filing 2015 taxes.

Yes, Tax Day is traditionally April 15. But since that fell on a Friday this year, today is the deadline for filing 2015 taxes.

A bunch of places are helping you celebrate (or prepare to pay up) your 1040 with discounts and freebies.

Among them:

Pei Wei Asian Diner (Woodland Crossing, Herndon) is offering $5 off $20.

Noodles & Company (Plaza America) will give your “little deductibles” (kids!) a free meal when you purchase a regular entree. For those filing digitally this year, Noodles & Company is also offering an online promotion of $4 off any $10 purchase placed through order.noodles.com using the code TAXDAY at checkout.

Boston Market (North Point Village Center) is offering a Tax Day Special of a Half Chicken Individual Meal with two sides and cornbread, plus a regular fountain drink and a cookie, for $10.40.

World of Beer (Reston Town Center) will give you $5 off your check.

Check out this list on WTOP.com for more Tax Day specials.

The Fairfax County Board of Supervisors on Tuesday voted to advertise a tax rate of $1.13, an increase of 4 cents from the current rate of $1.09 per $100 of assessed value.

The Fairfax County Board of Supervisors on Tuesday voted to advertise a tax rate of $1.13, an increase of 4 cents from the current rate of $1.09 per $100 of assessed value.

The board can adopt a tax rate that is lower, but not higher, than is advertised when it marks-up (makes amendments to) the Advertised Budget on April 19.

The additional tax, which is in keeping with the recommendation of County Executive Ed Long, will provide about $23 million more per one-cent rise for Fairfax County’s coffers for Fiscal Year 2017.

But with a 4-cent increase, the county is still likely to give Fairfax County Public Schools only 3 percent more than it did last year. The schools have been seeking a 6.7-percent raise in order to give employee raises and keep elementary class sizes small.

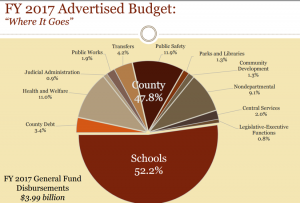

The schools annually receive about 52 percent of the county’s $3.99 billion budget. Read More

The average Reston assessed home value rose 1.03 percent in the last year, according to 2016 Fairfax County tax assessments.

The average Reston assessed home value rose 1.03 percent in the last year, according to 2016 Fairfax County tax assessments.

The average Reston home is valued at $428,378 this year, a rise from $424,021 in 2015.

Here’s a look at some nearby areas: Great Falls, +0.72 percent, Oakton + 1.19 percent, Herndon, +.60 percent, and Vienna, +1.85 percent.

County real estate tax assessments were mailed last week. You can also access yours online.

Fairfax County says about 55 percent of residential property in the county increased in value over the past year due to equalization, with an average increase of 1.64 percent. Nonresidential real estate values (such as commercial) increased 2.87 percent on average due to equalization, the county says.

Assessed value is for tax purposes and is not the same as a listing or sales price if you were to put your house on the market.

Here’s what affects your real estate assessment, according to the county:

- Sales in the neighborhood

- Economic factors – It took an average of 55 days to sell a home in 2015, up from an average of 47 days in 2014

- Improvements to the property (remodeling, additions)

- New construction and rezoning

- Property characteristics (such as size, age and amenities)

You can appeal your assessment. Find out how on Fairfax County’s website.

Meanwhile, the county is considering a 4-cent real estate tax hike for Fiscal Year 2017.

Fairfax County Public Schools students still have a month until they return to the classroom, but the time to get ready may be this weekend.

Fairfax County Public Schools students still have a month until they return to the classroom, but the time to get ready may be this weekend.

Virginia will hold its annual back-to-school sales tax holiday Friday, Aug.1 through Sunday, Aug. 3.

During the three-day event, most school and office supplies that cost $20 or less each, as well as clothing items and pairs of shoes priced at $100 or less, will be exempt from Virginia’s 5.3 percent state and local sales tax. You will save even more in Fairfax County, where the sales tax is 6 percent.

Here is what is on the list of tax-exempt items: pens, pencils, loose leaf ruled notebook paper, scissors, binders, backpacks, construction paper, sneakers, hats, shirts, dresses, jeans, bathing suits, lunch boxes, diapers, T-shirts, choir outfits and uniforms. For a more complete list, visit the Virginia Department of Taxation’s website.

There is no requirement that the purchases be made for school purpose. All retailers who sell the exempt items are required to participate. Online purchases of qualifying items are also tax-exempt during the sales tax holiday.

“This is an event that benefits both consumers and businesses in Virginia,” Gov. Terry McAuliffe said in a statement. “Many families will be sending more than one child off to school soon, and this gives them an opportunity to save money on purchases that are necessary to get them ready for class.”

Photo of backpack courtesy of Target

The average Fairfax County homeowner will pay more than $300 more in taxes next year after the Fairfax County Board of Supervisors formally adopted the Fiscal Year 2015 budget on Tuesday.

The average Fairfax County homeowner will pay more than $300 more in taxes next year after the Fairfax County Board of Supervisors formally adopted the Fiscal Year 2015 budget on Tuesday.

The budget includes a real estate tax rate of $1.090 per $100 of assessed value, a half-cent increase from the FY 2014 $1.085 rate.

The $3.72 billion General Fund budget is an increase of 3.62 percent over the FY 2014 Adopted Budget Plan. The total of all appropriated funds is $6.97 billion, which includes the general fund as well as other appropriated funds such as grants, and solid waste and sewer funds, county supervisors said.

The increase in the real estate tax rate was voted on by the supervisors last week. The vote passed 7-3. Supervisors Pat Herrity (Springfield) , Linda Smyth (Providence), and John Cook (Braddock) voted against the rate. Yesterday’s budget vote was also 7-3, with the same supervisors voting no.

County Supervisor Sharon Bulova said the increase was necessary as Fairfax County, like many places in the country, continues to recover from the recession.

The increase will provide an additional $10.9 million for the county and will mean an additional $25 annually in average tax, she said. However, rising assessment values also mean homeowners will pay about $330 more annually as well.

“In total, along with the FY 2015 increased based on equalization, the average annual tax bill for county homeowners increases by approximately $357,” said Bulova.

“Our nation, region, and county continue to struggle during these sluggish post-recession years. The good news this year is that real estate values are beginning to rebound. The bad news is that only residential values are rising; business taxes are flat and commercial assessments are a decrease from Fiscal Year 2014.”

The additional tax revenue ($10.9 million) combined with $6 million in savings achieved on the general county side of the budget will be used to increase the transfer to Fairfax County Public Schools by $17 million (3 percent), the supervisors said.

The school board had requested a 5.7 percent increase (to $98 million) in February. It will get $51 million from the county. Superintendent Karen Garza has said there may be staffing cuts and other cost-cutting measures.

The county will be able to increase compensation for employees and offer step raises to public safety officers without drawing on reserves and creating a further imbalance. However, the budget reduces funding for some public services and the public libraries.

Would you pay more for your dinner if it means more money for county services and schools?

Would you pay more for your dinner if it means more money for county services and schools?

Last week, Fairfax County Supervisor Sharon Bulova established a task force to examine whether a county meals tax could be a reliable source of revenue. A meals tax, at about 4 percent, could provide $88 million annually, Bulova said.

A meals tax would go through without a voter referendum. The county last tried that in 1992. The question failed to advance.

The task force will be led by former Board of Supervisors chairs Tom Davis and Kate Hanley, who will report back to Bulova by June 17. It will be made up of members of two dozen county organizations, including Republican and Democratic parties, the county Chamber of Commerce, the Restaurant Association of Metropolitan Washington, Visit Fairfax, the Fairfax County Taxpayers Alliance and the Fairfax Education Association.

The task force will be asked not only to recommend, or reject, a meals tax referendum, but also to suggest what year the question should be asked and how the resulting revenues should be used.

Photo: PassionFish at Reston Town Center/Credit: File photo

Did you get sticker shock when you opened your 2014 Fairfax County Real Estate Tax Assessment?

Did you get sticker shock when you opened your 2014 Fairfax County Real Estate Tax Assessment?

Many county residents did. Fairfax County said some 88 percent of residential properties saw an increase from 2013 to 2103. The average increase, was about 6.5 percent, according to county data. About 9 percent of county homeowners saw no change.

In Reston, some homeowners saw a much bigger jump, leading some Realtors to say, anecdotally, that the increase in value expected with the opening of Metro’s Silver Line later this year is already happening.

That is good news if one is trying to sell, but bad news for one’s wallet if staying.

Want to appeal your assessment. Visit the Fairfax County Department of Taxation website.

More from Fairfax County:

During 2013 the residential market continued to improve in Fairfax County. This market improvement has meant fewer foreclosures, faster sales and price appreciation in most neighborhoods.

The number of days a property was listed for sale decreased from an average of 50 days in 2012, to an average of 36 days in 2013, or an improvement of 28 percent (44 percent of these properties actually sold in 10 days or less).

Sale prices also were closer to their list price than last year, selling on average at about 98% of their list price, providing another indication of the strong residential market.

Residential sales volume in the county increased over 10 percent from 2012 sales, providing staff with more than 14,000 fair market sales to analyze in determining 2014 assessments.

While foreclosures generally have a dampening effect on competitive sale prices, their influence has had much less impact on 2014 assessments due to the decline in foreclosure activity.