Fairfax County Supervisors are taking another look at a county meals tax, so advocates on both sides of the issue are gearing up for a fight.

Fairfax County Supervisors are taking another look at a county meals tax, so advocates on both sides of the issue are gearing up for a fight.

Several restaurant companies that have outposts in Reston have joined together to oppose the proposed 4-percent tax. At Clyde’s at Reston Town Center, for instance, there is a large sign in the restaurant’s lobby voicing Clyde’s Restaurant Group’s disapproval of the proposal.

Joining Clyde’s in the fight are Glory Days Grill Restaurants (North Point, Fox Mill and Great American Restaurants (Jackson’s).

“In a recent meeting, Fairfax County Supervisors went back to the well of bad ideas to bring back a rerun that almost nobody in Fairfax County wants to watch,” reps from the three companies wrote in a recent letter to the editor of The Fairfax Times.

“The ‘meals tax’ would levy up to a 4-percent tax for consumers to pay on all food and drinks purchased at restaurants, hotels, grocery stores, doughnut and coffee shops, and convenience stores across the county. It is taxation without justification at its worst.”

The restauranteurs say the meals tax is an unfair burden on residents who are also likely to see a 4-cent rise in real estate taxes next year.

In Reston, visitors to Reston Town Center resturants will also be paying to park starting in August.

Hunter Mill Supervisor Cathy Hudgins suggested last month that the supervisors look again at a meals tax. With the county feeling strain on its $3.99 billion Fiscal Year 2017 budget and the Fairfax County Public Schools facing a multimillion dollar shortfall, the supervisors are discussing putting a meals tax on the ballot this fall.

Hudgins said a 4-percent meals tax, similar to rates in nearby jurisdictions such as Vienna, Fairfax City, Arlington County and Alexandria, would provide close to $90 million for Fairfax County in annual revenue.

Hudgins said a 4-percent meals tax, similar to rates in nearby jurisdictions such as Vienna, Fairfax City, Arlington County and Alexandria, would provide close to $90 million for Fairfax County in annual revenue.

“You can’t keep services up if you are always trying to juggle this one revenue source [real estate taxes] up and down,” said Hudgins. “You can’t rely on one revenue source and be sure it gets to where you want to be.”

The supervisors discussed a meals tax in 2014 but did not move forward. It was last on the ballot in 1992. It failed.

The supervisors will discuss on April 26 whether to move forward.

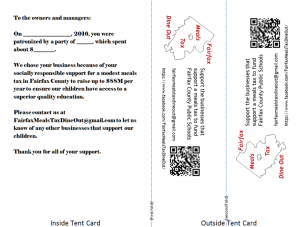

A grassroots group has recently launched to support the meals tax. “Fairfax Meals Tax Dine Out” has a Facebook page, and is encouraging residents to patronize restaurants that support a meals tax and leave a flyer outlining what a meals tax can do for residents.

Photos: Jackson’s at Reston Town Center, top; Flyer for Fairfax Meals Tax Dine Out, bottom