The Fairfax County Board of Supervisors adopted a balanced budget for fiscal year 2022 yesterday (Tuesday).

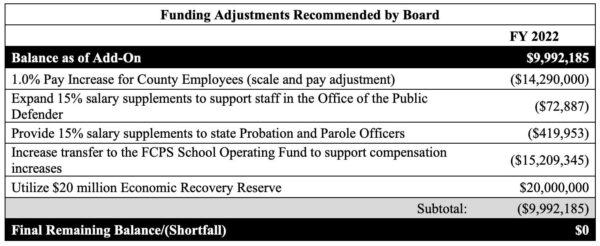

It includes some funding adjustments that the board incorporated into the proposed budget during the board’s markup session last week.

The newly adopted budget supports a 1% pay increase for county employees, a 2% raise for Fairfax County Public Schools employees, and 15% salary supplements for staff in the Office of the Public Defender and state probation and parole officers.

“While there were many constraints on this year’s budget, I am tremendously proud of what this Board was able to accomplish,” Board Chairman Jeff McKay said. “My goal was to look for balance in lowering the tax rate, with the understanding of skyrocketing property assessments, while also supporting our County employees and teachers and furthering our priorities in education, affordable housing, environmental protection, and community resources. I am pleased we were able to achieve that.”

The proposed budget from February did not include pay increases for employees, whose pay was frozen in this year’s budget. The new 1% pay increase comes after Fairfax County employees advocated for salary bumps last month.

“The 1% wage increase and one-time bonus come as a response to union members making it clear that two years of frozen pay for essential county workers was unacceptable,” SEIU Virginia 512 Fairfax Chapter President Tammie Wondong said. “We appreciate the approved change. That being said, the concessions fall short of the agreed-upon pay plan and workers are falling behind.”

The county employees’ union will now focus on its push for Fairfax County to adopt a collective bargaining ordinance. A new state law permitting localities to establish collective bargaining procedures took effect on May 1.

McKay said last week that county staff is drafting an ordinance that will be discussed at the board’s personnel committee meeting on May 25.

“Meaningful collective bargaining is the only way workers can ensure that the county keeps their promise on our pay plans so that we have the resources to provide the best services to the Fairfax community,” Wondong said.

The increase will be funded using $20 million that County Executive Bryan Hill had recommended setting aside in an “Economic Recovery Reserve.” As the county looks to rebuild, it will instead lean on the $222 million in federal relief funds it expects to receive from the American Rescue Plan Act.

“The redirection of this reserve does not exacerbate budgetary challenges in FY 2023,” the final budget document reads. “With this reserve, funding just shy of $30 million is available to be utilized for employee pay in FY 2022.”

Here are some other highlights:

As proposed in February, the real estate tax rate will decrease from $1.15 per $100 of assessed value to $1.14 per $100 of assessed value. Personal property tax rates and stormwater fees will remain the same, at $4.57 per $100 of assessed value and $0.0325 per $100 of assessed value, respectively.

As considered during the budget markup last week, the refuse disposal fee will decrease from $68 to $66 per ton, but the refuse collection fee will increase from $370 to $400 per household. The rate was reduced from $385 last year because of a reduction in yard waste collection services during the pandemic.

Funding for county government operations and contributions to Metro and Fairfax County Public Schools, or general fund disbursements, totals $4.53 billion. That marks a slight increase from the advertised $4.48 million, and an increase of $55.40 million over the current fiscal year’s disbursements.

More than half of those disbursements (52.6%, or $2.38 billion) support Fairfax County Public Schools. This includes $2.17 billion for operations, $197.12 million for debt service and $13.10 million for school construction.

Fairfax County will create 109 additional positions in FY 2022 to staff new facilities, such as the South County Police Station, a new 61,000-square-foot police station and animal shelter, and the Scotts Run Fire Station. Positions are also being added for the county’s opioid task force and Diversion First initiative.

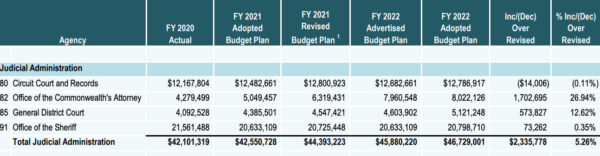

Fairfax County Commonwealth’s Attorney Steve Descano says the budget marks an important first step toward solving Fairfax’s “longstanding justice crisis,” adding that the 15 new positions his office has been allocated will enable prosecutors to take on more cases.

“As the budget takes effect in July and we fill those, we will be able to expand our caseload to encompass all cases other than minor traffic infractions,” the Commonwealth Attorney’s office said. “We are already scaling up our caseload now and are prioritizing cases that contain an indication of violence between now and July.”

Descano says his office will complement its expanded case load with a “growing use of diversion and alternative sentencing to ensure we are keeping the community safe in a manner that accords with our values.”

Additional staffing alone won’t solve the problem, however. Descano says a multi-year investment is needed to address the “chronic shortcomings that plagued our system,” including a culture of producing as many convictions as quickly and cheaply as possible.

Charts via Fairfax County

FY 2022 Budget Markup Approved — The Fairfax County Board of Supervisors approved a markup package for the county’s fiscal year 2022 budget yesterday (Tuesday) that includes a 1% pay raise for county government employees and an additional $15 million for Fairfax County Public Schools, partly to support compensation increases. [Fairfax County Government]

Virginia Reviewing New Mask Guidelines — The CDC released new guidance yesterday (Tuesday) stating that people who have been fully vaccinated don’t need to wear masks outdoors except when in a big crowd of strangers. Gov. Ralph Northam’s press secretary said in a statement that the governor’s office is reviewing the guidelines “to determine if and where we need to make changes” to Virginia’s mask requirements. [Office of the Governor]

New Police Chief Use-of-Force Record Scrutinized — Incoming Fairfax County Police Chief Kevin Davis lost two lawsuits over his use of force when he worked in the Prince George’s County Police Department in the 1990s. In the first case, the plaintiff said Davis pulled him over without giving a reason and violently arrested him, while the second victim alleged that “Davis and other officers essentially kidnapped him for a night.” [NBC4]

Nonprofit Hits Record for Food Donations to Feed Students — Food for Neighbors received more than 21,000 pounds of food from over 1,200 households during its April 24th Red Bag Program food collection, including 5,547 pounds from 366 households in Herndon and Reston neighborhoods. [Patch]

Reston Defense Contractor Acquires Seattle-Based AI Company — SAIC announced on Monday (April 26) that it has entered into an agreement to acquire Koverse, a software company that “provides a data management platform enabling artificial intelligence (AI) and machine learning on complex, sensitive data.” [Koverse]

Community Helps Reston Resident with Medical Expenses — A GoFundMe for Reston resident David Vlcek, who suffered a ruptured brain aneurysm, has raised more than $55,000, getting the fundraiser halfway to its $100,000 goal. Started by a family friend, the campaign funds will help defray medical costs not covered by insurance and pay for airfare for Vlcek’s parents, who need to travel from the Czech Republic. [Patch]

Photo via vantagehill/Flickr

The Fairfax County Board of Supervisors won’t approve a budget for the next fiscal year until May 4, but the bulk of the work to get to that final document will be done today (Tuesday) when the board meets at 10 a.m. to mark up the proposed budget.

Unveiled during a budget committee meeting on Friday (April 23), Board of Supervisors Chairman Jeff McKay’s proposed adjustments to the advertised fiscal year 2022 budget include a small raise for county employees and support for County Executive Bryan Hill’s recommendation of a one-cent decrease in the real estate tax rate.

The proposed cut would put the tax rate at $1.14 per $100 of assessed value, but rising residential property values mean that county homeowners will still see their tax bills go up by $224 on average.

“We all know that many families are struggling because of the impacts of COVID-19,” McKay said. “While the one-cent decrease isn’t a tax reduction for most families, I chose to support it because it provides some relief to families while still allowing the County sufficient funds, particularly with the stimulus dollars, to continue to stand up the programs that I know are needed in the community.”

The county is also considering lowering its refuse disposal fee from $68 to $66 per ton, but the board has proposed increases in sewer charges and for the refuse collection fee, which would go from $370 to $400 per household.

“It should be noted that this rate was reduced last year from $385 per household based on the inability to provide yard waste collection during the pandemic,” the proposed mark-up summary says.

With Fairfax County expecting a total of $222 million in federal relief funds from the American Rescue Plan Act, McKay has suggested redirecting $20 million that Hill had recommended setting aside as an economic recovery reserve fund to instead give county government employees a 1% pay raise.

The proposed mark-up doubles the increase in transfer funds to Fairfax County Public Schools from $14.1 million to $29.3 million — mainly to cover a 2% pay raise for school employees — and includes salary supplements for state probation and parole officers and support staff in the Public Defender’s Office.

“The Board remains committed to both acknowledging the hard work of our employees and maintaining competitive salaries relative to the market,” McKay said when outlining his mark-up proposal.

The board also plans to amend in its FY 2021 third-quarter review package to include $12.6 million for one-time bonuses for employees, along with funding for Celebrate Fairfax Inc., planning studies, athletic scholarships for at-risk kids, and environmental initiatives, including a green bank and zero-waste policies.

The county government employees’ union SEIU Virginia 512 said in a statement that it was “heartened” to see the board respond to the concerns that workers raised at public hearings on the FY 2022 budget last week about the possibility of having their pay frozen for a second consecutive year.

“However, the basic fact remains: the cost of living continues to rise, while Fairfax County workers continue to fall behind,” SEIU Virginia 512 Fairfax Chapter President Tammie Wondong said. “We urge the Board of Supervisors to continue to work to fund the county’s agreed-to pay plans.”

The union has also been advocating for the Board of Supervisors to adopt an ordinance allowing county employees to engage in collective bargaining.

“A union contract would bring consistency, improve recruitment and retention, and improve services for the community,” Wondong said.

According to McKay’s office, county staff are currently drafting a proposed ordinance, and the board will discuss the issue during its personnel committee meeting on May 25.

While the mark-up package mostly focuses on employee compensation, the Board of Supervisors also hopes to address affordable housing needs by allocating at least an additional half-penny from real estate tax revenues to the county’s affordable housing fund, which currently receives one half-cent, in FY 2022 and FY 2023.

Hunter Mill District Supervisor Walter Alcorn said he was glad to see that guidance in McKay’s mark-up proposal, even if it would still fall short of the two-cent allocation he campaigned on when running for office in 2019.

“Getting us back to a penny, at least historically, has been on the agenda for a long time,” he said. “I see the federal money as the opportunity, if you will, to pay back a lot of what we weren’t able to do in some previous years, so I do want to see us get to one penny as soon as possible.”

Fairfax County’s government workers union urged the Board of Supervisors yesterday (Tuesday) to adopt a fiscal year 2022 budget that includes increased compensation for employees, whose year-long pay freeze would be prolonged if the county’s proposed budget takes effect.

The testimony came during the first of three public hearings on the advertised FY 2022 budget that have been scheduled for this week. There will also be hearings at 3 p.m. today and tomorrow (Thursday).

Service Employees International Union Virginia 512, which represents social workers, librarians, maintenance staff, and other general county government employees, says that its top priorities for the new budget are ending the pay freeze and establishing rules for collective bargaining.

“For over one year, we have worked tirelessly to keep the community running,” SEIU Virginia 512 President Tammie Wondong said. “We have done everything we can to keep Fairfax families healthy and safe, even when we have not been healthy and safe ourselves. Today, we are asking that you recognize and value county employees in this year’s budget.”

Wondong acknowledged that the county has made an effort to support employees during the COVID-19 pandemic by expanding leave options and providing hazard pay. The board is also considering offering one-time bonuses in the FY 2021 budget as part of its third-quarter review, which will be approved on April 27.

However, the union argues that that remains insufficient compensation for employees who are essential to maintaining county services but often struggle with the rising costs of housing, healthcare, and other needs.

Fairfax County Health Department employee Jenny Berkman-Parker said in a video that played during the public hearing that the most recent evidence of the ongoing pay freeze’s impact on her family came in the form of an email from her son’s university, which announced that it will raise tuition costs by 5% next year.

“I was trying to be understanding the first year. The second year is definitely more stressful,” she said. “…Now that we’re having pay freezes for two years in a row and we’ve had pay freezes in the past, my income is no longer keeping up with the cost of living.”

Fairfax County Public Schools employees would also have their pay frozen again under the advertised FY 2022 budget. The Fairfax County School Board requested a 3% pay raise for all employees, but that was not incorporated into the county’s proposal, which increases funding for the school system by just $14.1 million.

The Fairfax County Federation of Teachers, which represents all non-administrative FCPS staff, said in a press release issued on Monday (April 12) that 60% of respondents to a poll it conducted reported living paycheck to paycheck. Three out of four respondents said they have considered leaving for another school district due to the pay freeze.

“These statistics should not be the case in one of the wealthiest districts in the Commonwealth,” FCFT President Tina Williams said. “…Our district and county must do better.”

County Executive Bryan Hill’s proposed budget largely limits spending in response to the ongoing demands of the pandemic and uncertainty about the county’s future recovery.

When he presented his proposal on Feb. 23, Hill told the Board of Supervisors that it would cost more than $55 million to fund the county’s employee compensation program, including almost $30 million for a 2% market rate adjustment.

He recommended reducing the real estate tax rate by one cent to provide some relief to property owners, though rising home values mean that residents will still see a 4.25% increase in their tax assessments on average. The Board of Supervisors voted on March 9 to advertise a flat rate of $1.15 per $100 of assessed value as the ceiling for the new rate.

The question of how to support county services and workers while giving taxpayers some relief has formed the crux of the community conversation around the FY 2022 budget.

“So many folks in Fairfax County are hurting. The last thing they need is a tax increase,” said Fairfax County Republican Committee parlimentarian James Parmalee, the lone speaker at Tuesday’s public hearing on the tax rate.

Residents expressed differing points of view on whether the tax rate should be lowered at a town hall on the proposed budget hosted by Hunter Mill District Supervisor Walter Alcorn on March 29.

One resident, who identified herself as a county employee, said that she was disappointed at the potential extended salary freeze, while another resident worried that climbing housing values will exacerabate the county’s affordability issues.

The Board of Supervisors will mark up the budget proposal on April 27 before adopting an approved budget on May 4. Fiscal Year 2022 begins on July 1.

With tax season in full swing and Fairfax County plugging away at its latest budget proposal, you may wonder where exactly your tax dollars go.

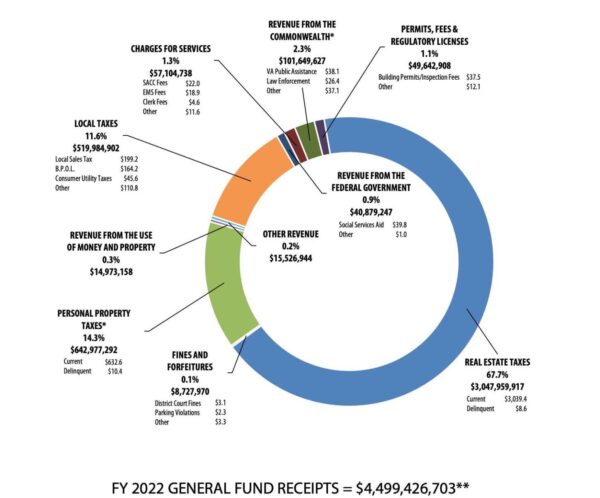

Fairfax County is hammering out the details of its spending for the 2022 fiscal year, which is expected to gross more than $8.5 billion. But your tax dollars go to a smaller piece of the pie that encompasses funding for county government operations and contributions to Metro and Fairfax County Public Schools.

Totaling $4.48 billion, the general fund disbursements money comes from taxes — primarily real estate and personal property taxes, but also taxes on hotels and retail sales — as well as fees for licenses and permits. About $1.6 billion of this bucket sustains the operations of all county departments.

Real estate taxes paid by individuals and businesses contribute about $3 billion (or 68%) of the money needed to support county departments, schools, Metro, and debt services. In fact, residents’ property taxes make up about 74% of the county’s real estate tax income. The rest comes from commercial properties, such as apartments, offices, retail spaces, and hotels.

While homeowners could see their real estate tax rate lowered by one cent to $1.14 per $100 of assessed value in the upcoming budget, they will likely still see their bill increase due to rising property values. The one-cent reduction, however, will bring in $27 million less than if the current rate remained in place.

The county, meanwhile, is contending with falling commercial property values for its income from non-residential real estate taxes, a nationwide phenomenon.

But where does this tax revenue go?

After schools, which receive slightly more than half of the general fund disbursements, the county’s next two largest allocations go to public safety, including police and fire, and health and welfare, including family and neighborhood services.

Within those areas, much of the recurring spending is tied to personnel, both existing staff and requests for additional hires. The county government says an additional 109 positions are needed to staff new facilities and continue initiatives previously funded by grants and stimulus funding.

County Executive Bryan Hill’s proposed FY 2022 budget devotes $11.91 million to fund 46 positions to continue implementing the police department’s body-worn camera program and to staff the South County Police Station, a new 61,000-square-foot police station and animal shelter, and the Scotts Run Fire Station.

There is also additional funding to support the Fairfax County Office of the Commonwealth’s Attorney, which Commonwealth’s Attorney Steve Descano said last year is in a state of crisis and needs more staff, especially to handle the body-worn camera program.

The proposed budget adds seven positions to the county’s opioid task force and five positions for the Diversion First initiative.

Police and fire are the biggest drivers of the public safety budget, each accounting for around 41% of expenses, or $219 and $218 million, respectively. Overall, public safety accounts for 33% of the total general fund direct expenditures of $1.6 billion. Fairfax County lands in the middle of Virginia localities for how much it spends per person on public safety ($671 per person). Read More

Fairfax County is considering lowering its real estate tax rate by one cent for the next fiscal year in an attempt to give relief to homeowners during the ongoing COVID-19 pandemic.

County Executive Bryan Hill presented the proposal to the Fairfax County Board of Supervisors yesterday (Tuesday) as part of an advertised Fiscal Year 2022 budget that illustrated how the pandemic has curtailed the county’s ability to fund top priorities, from education and employee pay to affordable housing and environmental initiatives.

According to Hill, the county’s residential real estate market has been “very strong” over the past year with 88% of residential properties seeing an increase in assessed value, but that also places a greater burden on homeowners at a time when unemployment is up and many people are struggling to pay their bills.

Noting that upticks have been highest for properties that typically house lower-income residents, like townhomes and condos, Hill says that, with no change to the rate, the average tax bill would increase by almost $285 for the coming year. Lowering the rate by a cent to $1.14 per $100 of assessed value would bring the average increase closer to $224.

“Homeowners have struggled due to a loss of income during the pandemic,” Board of Supervisors Chairman Jeff McKay said. “I appreciate that the County Executive has created a budget that reflects these uncertain financial times. Next year’s proposed budget does not meet every community need, but shows our commitment to preserving County programs and working to protect our residents in these uncertain times.”

The proposed tax rate decrease was coupled with an overall conservative approach to the advertised budget, which freezes pay increases for county employees for the second consecutive year and funds only a fraction of Fairfax County Public Schools’ request.

The Fairfax County School Board sought an additional $104.4 million from the county, primarily to cover a proposed 3% pay raise for all FCPS employees, but Hill’s advertised budget increases the county’s transfer by only $14.1 million.

During a press conference following the budget presentation, education advocates in the Invest in Fairfax Coalition — a grassroots organization comprised of county employee groups, residents, and other community members — urged the Board of Supervisors to give the school system more funds to pay workers and provide mental health services for students, among other needs.

“We’re very disappointed with the county executive’s proposed budget and its failure to prioritize schools,” Fairfax County Federation of Teachers President Tina Williams said. “To help students and staff recover from this pandemic, we urge this county to adopt a budget that keeps our community whole and opens our schools safely.”

Hill’s advertised budget makes similarly modest investments in the county government, providing a net revenue increase of just $11.7 million.

According to Hill, funding the county’s employee compensation program would cost more than $55 million, including almost $30 million for a calculated 2% market rate adjustment.

“We simply do not have the resources available at this time,” Hill said.

Outside of FCPS, the most substantial investments in the advertised budget are related to public safety, including the rollout of the police body camera program, the Office of the Commonwealth’s Attorney, and staff for the new South County Police Station and Scotts Run Fire Station.

The proposal also includes funding for new health department staff, Coordinated Services Planning, collective bargaining work, and two new positions in the Office of Elections. In addition, Hill recommends that the board set aside $20 million to support economic recovery efforts.

“As I look ahead into fiscal [year] 2023, I have hope for a more positive budget year, but it will still be a challenge,” Hill said. “Employee compensation and other board priorities, such as affordable housing and school revenues, which have not been adequately addressed as part of this budget, will be at the forefront of our conversations.”

Invest in Fairfax Coalition Chair David Edelman says he was “a little surprised” to see the tax rate decrease in the proposed budget, since the group had anticipated the rate would remain the same. While the coalition consists of people with different backgrounds and focuses, their overall goal is to encourage Fairfax County to invest in public services and employees.

“Now more than ever, it’s critical that our budget reflects the values, priorities, and urgent need of our diverse community,” Edelman said.

The Board of Supervisors will officially approve an advertised tax rate on Mar. 9, and public hearings on the FY 2022 budget will take place on Apr. 13-15.

Each supervisor will host a budget town hall for their magisterial district. The schedule for districts in the Tysons area are as follows:

- Dranesville: Mar. 1 at 7:30 p.m. through the McLean Citizens Association

- Hunter Mill: Mar. 29 from 7-9 p.m. through WebEx and Supervisor Walter Alcorn’s YouTube Live channel

- Providence: Mar. 8 from 7-9:30 p.m. It will be streamed on TV, Fairfax County’s website, and Facebook Live.

The board will adopt a final FY 2022 budget on May 4.

Staff photo by Jay Westcott

Lake Thoreau Pool Work Begins — Contractors will be on-site at Lake Thoreau pool later this week for soil sampling. This step is necessary to begin the engineering and design of the pool’s retaining walls and parking lot. [Reston Association]

County Executive Releases Podcast — County Executive Bryan Hill discusses the COVID-19 pandemic, the search for a new police chief, and the upcoming fiscal year 2022 budget in his latest podcast. [Fairfax County Government]

Reston Songwriter Releases New Single — Singer and songwriter Amanda Cunningham has released a new single about breaking free from bad relationships. [Reston Patch]

Photo by Marjorie Copson

In response to Fairfax County’s revised budget, Hunter Mill District Supervisor Walter Alcorn stressed that flexibility is key as the county weathers the economic impact of COVID-19.

The upcoming fiscal year 2021 budget, which is expected to be adopted on May 12 and begin on July 1, underwent revisions earlier this spring to address uncertainties stemming from the pandemic.

Though he expressed disappointment that COVID-19 altered the budget, he said he hopes for economic recovery.

“I strongly believe that we will recover and it should be noted that the Board of Supervisors will have the opportunity to make adjustments at our quarterly reviews,” he said. “This budget is by no means a done deal.”

In the future, Alcorn said he expects the budget to be a living document.

“It is also clear that we still don’t know what the final impacts of the virus will be, so we must continue to be flexible and strategic,” he said.

Earlier in April, he expressed displeasure with the revised budget draft. Now, Alcorn’s latest statement includes many of his previous concerns over a lack of support for local business owners.

“Going forward, I anticipate additional funds being used to help small businesses and others offset the impact of the pandemic on the most vulnerable in our county,” Alcorn said in his statement.

In the statement, Alcorn also reflected on the FY 2020 third-quarter review, saying there is now $200 million in additional funding for the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

The act benefits both families and small businesses, according to the U.S. Department of Treasury.

One of Alcorn’s main concerns was how Latino populations are being hit harder by the virus than other demographics around the county.

“Latinos represent 55% of all COVID-19 cases in Fairfax County even though they represent only 16% of the population,” he said, adding that “in Fairfax County stopping COVID starts with the Latino community.”

To address this, Alcorn suggested the application of the county’s One Fairfax policy, which aims to promote social and racial equity, but did not expand on how One Fairfax would directly be applied.

Photo courtesy Hunter Mill District

County Budget Hearings Begin Next Week — “The Board of Supervisors and county staff value public input on the revised FY 2021 Budget proposal. To keep everyone safe during the COVID-19 pandemic, there will be no in-person testimony during the rescheduled budget public hearings, Tuesday through Thursday, April 28 to 30, but there are many ways to share your input.” [Fairfax County Government]

Hunter Mill District Town Hall Today — Hunter Mill District Supervisor Walter Alcorn is hosting an online budget town hall today (Friday) from 12:30-1:30 p.m. Board member Melanie Meren will also attend the town hall. [Walter Alcorn]

How to Join Reston Association’s Annual Meeting — The association offers an update on how to take part in the annual meeting via zoom. The meeting takes place on Thursday, April 30 at 7 p.m. [Reston Association]

Photo via vantagehill/Flickr

Alcorn to Host Budget Town Hall — Hunter. Mill District Supervisor Walter Alcorn is hosting a town hall on Friday at 12:30 p.m. to discuss the updated budget for the next fiscal year. Residents can take part by submitting Facebook Live comments, emailing video, and calling in during the meeting. [Patch]

Letter from Reston Association Hank Lynch — Lynch says that the core business of the association continues. Work on capital projects, including the dredging and dock replacement at Lake. Staff are making contingency plans for later starts for various events and activities. [Reston Association]

Herndon Village Network Answers the Call — The network, which is part of the county’s Neighbor to Neighbor program, has offered volunteer rides for older adults. Recently, the network coordinated grocery drop-offs for residents. [Fairfax County Government]

Photo via vantagehill/Flickr

Fairfax County Executive Bryan Hill is pitching major revisions to his budget proposal for fiscal year 2021 in response to the COVID-19 pandemic.

The revised budget, which was released yesterday evening, eliminates a proposed three-cent tax rate increase and fee increases across-the-board in order to relieve pressure on the county’s taxpayers. Hill’s proposal also shifts spending to essential services only and removes all salary increases.

No net increase in the county’s revenues is expected.

The proposal maintains funding increases for the county’s health department the school’s health programs, as well as coordination for programs for those with developmental disabilities, and IT infrastructure for the November elections.

Roughly $9.6 million will be set aside in reserve funds to address the pandemic, in addition to eight new positions in the health department to address the county’s response.

“Protecting the jobs and current pay levels of the county’s existing employees continues to be of utmost importance as we progress through these challenging times,” Hill wrote in a letter to the Fairfax County Board of Supervisors.

Hill cautioned that uncertainty about the extent of the economic downtown complicates the budget process.

“At this time, we are unsure how long the current economic downturn will last as we do not yet know how long it will take for our country to begin to control the spread of the COVID-19 virus.”

The county expects next year’s general fund revenues will rest at the 2020 level of $4.5 billion. This estimate assumes that the health crisis is over by July and that gradual recovery prompts the resumption of economic activity, according to the county.

Major hits to revenue streams like the sales tax, transit occupancy tax, and business occupancy tax are also expected. These losses are expected to offset an expected real estate tax revenue increase of 3.7 percent or $107.4 million. Hill said it was unlikely the state would be able to absorb the impact of revenue losses without adjusting allocations to local jurisdictions.

Here’s how revenue streams could be impacted:

- Personal property tax: Decrease of $9.5 million or 1.5 percent

- Sales tax: Decrease of $26.7 million or 13.5 percent

- Transient occupancy tax: Decrease of $7 million or 30 percent

- Business, professional and occupational licenses: Decrease of $17.2 million or 10 percent

- Land development services building and inspection fees: Decrease of $4.2 million or 10 percent

- Interest on investments: Decrease of $36.7 million or 62.6 percent

Fairfax County Public Schools will receive 0.3 percent more than last year’s budget, a fraction of the previously proposed 3.65 percent increase.

Residents can provide testimony on the budget via video, phone or online for upcoming budget hearings, which are rescheduled to April 28-30. The county board is expected to adopt the budget on May 12, after a mark-up meeting on May 5.

“As Fairfax County finds itself in a different reality, we will need to think about changes that may be necessary to maintain our premier status. Our future may be leaner, and will certainly be more efficient, as we use different tools to provide the services that are needed for our community,” Hill said.

Alcorn to Host Virtual Budget Town Hall Today — Hunter Mill District Supervisor Walter Alcorn is hosting a town hall today form 7-9 p.m. on the updated budget. Christina Jackson, the county’s budget director, will join Alcorn during the meeting via Crowdcast. [Crowdcast]

Fairfax Connector Scales Back Service — The county’s transportation department is reducing service on several routes due to reduced ridership. Changes will go into effect on Saturday, April 11. [Fairfax County Government]

Hold on to Your Yard Waste — The county is strongly discouraging from taking their yard waste to the I-66 Transfer Station or I-95 Landfill in order to allow employees to focus on collecting trash and encouraging social distancing. [Fairfax County Government]

New Grocery Store Changes — Harris Teeter and Giant will limit the number of shoppers in their stores. Giant is also implementing one-way aisles. [Washington Business Journal, WTOP]

Photo by Marjorie Copson

As Fairfax County officials adjust to digital meetings and remote work, Hunter Mill District Supervisor Walter Alcorn said he’s unsure how the COVID-19 pandemic might affect upcoming budget discussions.

Changes to the protocol called to attention a shifting reality for public officials, Alcorn told reporters during an online meeting on Wednesday (March 25).

“I think we are starting over for the FY2021 budget based on all the changes that have happened in the last few weeks,” he said.

Still, the county’s Budget Committee is going to be meeting virtually next Tuesday (March 31), according to Alcorn. The county executive is expected to present the proposed budget with updated numbers and assumptions based on COVID-19 responses, he said.

“That’s going to be a particularly important budget meeting,” he said. “I’m particularly interested to see what assumptions are going to go into revenues for next year.”

As of right now, the county executive suggested that roughly $11 million be set aside as an emergency fund for COVID-19 response, Alcorn said.

Though the dates and times are still up in the air, Alcorn said that the county will schedule a virtual town hall after next Tuesday.

As originally expected, he also said constituents can expect public hearings to be held in mid-April.

“If we are still in the situation we are in here, we’ll have to be a little bit more creative in terms of how we hear testimony and how the public can participate in that process,” he said, adding that the county staff is brainstorming solutions to this dilemma.

(Update at 10:41 p.m.: The town hall has been postponed due to uncertainty of available financial resources for the upcoming. budget).

An upcoming town hall meeting on Fairfax County Executive Bryan Hill’s budget proposal will take place online.

Instead of conducting the town hall on March 30 in Reston, Hunter Mill District Supervisor Walter Alcorn says the meeting will take place on his Facebook page this Saturday (March 21) from 10-11 a.m. The meeting will also air on Channel 16 and be live-streamed online.

Alcorn said the shift was prompted by fears of the spread of the novel coronavirus.

Residents can send questions on the budget to [email protected] with the subject “Town Hall Question.”

Hill is seeking to increase the county’s real estate tax by three cents.

One cent of the proposed tax, which increases the annual tax bill by roughly $346, will be earmarked for affordable housing initiatives. The remaining two-cent increase will go toward the general fund and other board priorities.

The real estate tax could increase by three cents in the next fiscal year if the Fairfax County Board of Supervisors accepts a budget proposed by County Executive Bryan Hill.

Hill pitched the budget to the board at a meeting today (Tuesday). One cent of the proposed tax, which increases the annual tax bill by roughly $346, will be earmarked for affordable housing initiatives. The remaining two-cent increase will go toward the general fund and other board priorities.

The increase is expected to bring in nearly $80 million to the county’s coffers.

“Unfortunately, we cannot provide appropriate levels of funding in these areas with no adjustments to our tax rates,” Hill wrote in a statement.

Hill is also proposing a four percent tax on tickets for movies, theater, and concerts. If approved, the tax would take effect in October. County officials say that the move could bring in $2.3 million in revenue to the county that would fund arts and tourism efforts.

The $4.6 billion budget represents a nearly four percent increase over last year’s budget. Although Fairfax County Public Schools would receive 3.7 percent more county funds than last year, Hill’s budget leaves $4 million in unmet needs for the school system.

Hill anticipates that the school system can make up the difference between what was requested and what will be allocated through expected increases in state funding this year.

At the meeting, Hill also unveiled the county’s new strategic plan, which outlines nine priority areas that will guide the county’s decision-making over the next 30 years.

9 priority areas of the strategic plan: pic.twitter.com/b49xZktANk

— Fairfax County Government (@fairfaxcounty) February 25, 2020

Highlights of the plan are below:

Funding to expand school readiness programs like the new Early Childhood Birth to 5 Fund and a recommended $25 million bond referendum for early childhood facilities in 2020 in the Lifelong Education and Learning priority area.

Dedicating one cent of the proposed tax increase to affordable housing under Housing and Neighborhood Livability.

Body-worn cameras and staff for the new Scotts Run Fire and South County Police stations under Safety and Security.

Funding to expand environmental initiatives, Diversion First and the Opioid Task Force under the Health and Environment priority area.

Funding for expanded library hours (11 of 22 locations will move to standardized hours), scholarship assistance for parks programs and use of admissions tax revenue to increase funding for the arts under the Cultural and Recreational Opportunities priority area.

Public hearings on the budget are set for April 14-16. The board will make changes to the proposed budget on April 28, followed by adoption on May 5.

Photo via Fairfax County Government