Search Results for "budget"

Every year, the county compares its salaries against similar jobs in the area to ensure pay is competitive. Though the full market rate adjustment was estimated at over 4%, County Executive Bryan Hill proposed allocating roughly $24 million for a 2% increase for FY 2025, citing revenue constraints.

Many county employees who attended the April 16-18 public hearings on the advertised budget, which will take effect on July 1, argued that wouldn’t be enough to keep up with the cost of living.

Lauren Tumbleson, a social services worker and member of SEIU Virginia 512, a union for general county employees, said she is considering leaving her job to care for her 4-year-old son, as child care costs would be too high without a bigger pay raise.

“Not fully funding the MRA this year will have a direct impact on our daily lives,” she said during the April 17 hearing.

Other SEIU members and representatives from the Fairfax Workers Coalition (FWC) said that without the pay raises, departments will continue to experience staff turnover, reducing the quality of services to residents.

FWC member Marie Kenealy, a veteran parole officer at the Juvenile and Domestic Relations District Court, noted that inadequate staffing and training puts at risk both the safety of the staff and their ability to help youth in the judicial system.

“We are part of the courts, but we do not have the protections afforded to law enforcement,” she said on April 17. “…At times, we escort violent offenders without adequate protection or training. At times, we are confronted with gang violence, aggression, exposed to fentanyl, and we’re often conducting home visits where we know firearms are likely present.”

Without fair wages and improved conditions, the court risks losing experienced personnel, Kenealy said.

Many local educators called on the Board of Supervisors to fully fund Fairfax County Public Schools Superintendent Michelle Reid’s $3.8 billion budget request — including an additional $254 million to adequately compensate the public education system’s employees.

Jennifer Ives, a special education teacher at James Madison High School in Vienna, said she knows several experienced colleagues who have left to take higher paying jobs in surrounding counties.

Ives argued that funding the superintendent’s request could mean less staff turnover, because teachers may be able to afford to live closer to where they work.

“The increase could help us find one of the cheaper rentals in the area and maybe I could have a 30-minute commute instead of an hour and a half,” Ives said. “I’d be able to sleep in past 5 a.m. and maybe get home an hour before dinner.”

When Hill presented his budget proposal in February, supervisors lamented that the burden of funding FCPS falls too heavily on the county due to limited funding from Virginia.

Earlier this month, Governor Glenn Youngkin proposed budget amendments that, according to WTOP, would reduce funding for FCPS by nearly $17 million for FY 2025 and $24 million in fiscal year 2026.

Regardless of the state budget, though, Fairfax County School Board Chair Karl Frisch argued the county needs to ensure the school system can pay its employees competitive wages at a time when enrollment and demand for services is increasing countywide.

“Our budget request does not include new initiatives,” Frisch said during the board’s April 16 hearing. “We are focusing on what is needed to continue ensuring excellence in our schools.”

Herndon Municipal Center (staff photo by James Jarvis)

Water and sewer rates are set to increase as part of the Town of Herndon’s proposed budget for fiscal year 2025.

Released on Friday (March 29) by Town Manager Bill Ashton II, the proposed budget leaves the real estate tax rate unchanged at $0.26 per $100 of assessed value, though bills are still expected to go up due to rising property assessments.

However, the water service rate is set to increase from $3.47 this year to $4.08 per 1,000 gallons of water consumption in the next budget year, which starts July 1. The sewer rate is set to increase from $8.27 to $8.93 per 1,000 gallons of water consumption in fiscal year 2025.

The changes were spurred by higher supply and treatment costs that have affected the region, the Town of Herndon said in a press release. Town staff have been examining potential increases since 2022.

Ashton emphasized that the state of the economy calls for “fiscal prudence.”

The Proposed FY 2025 Budget allows for continuation of the programs and services valued by our residents and businesses, as well as funding for new initiatives such as previously deferred public works projects as well as work on the town’s Comprehensive Plan, a document that guides our present and future in such elements as land use, transportation, historic areas, community service facilities, public buildings and utilities.

The quarterly service charge for water per bill will be $16.34 under the proposed budget. An additional fee of $6.94 per 1,000 gallons would be charged for all water consumed during peak use periods that’s in excess of the average consumption for the preceding billing periods.

The overall $74 million budget package increases spending by 19.9%. If approved, funding would go toward employee pay raises, increased pension and retirement costs, and capital projects, among other expenses.

Notable initiatives for the coming year include the Herndon Police Department’s plan to re-introduce a dedicated traffic section with motor officers “to enhance roadway safety through education and enforcement.” A second part-time parking enforcement official will be hired to help address parking violations.

“Overall, these changes reflect the town’s commitment to maintaining and improving its infrastructure, public safety, and recreational facilities for its residents,” the budget document says. “These budget changes also demonstrate the town’s responsible financial management and dedication to providing quality services to its community.”

The budget is officially adopted on June 30 following a series of meetings, including public hearings on the proposed budget on April 9 and April 23. Both meetings begin at 7 p.m. in the Ingram Council Chambers.

Fairfax County’s next budget could give its public libraries a little more spending money for books.

At the Board of Supervisors meeting on Tuesday (March 19), Hunter Mill District Supervisor Walter Alcorn proposed allocating an additional $500,000 in the upcoming fiscal year 2025 budget to Fairfax County Public Library’s book collection.

“The Library continues to be one of the most popular services provided by the county and our Library branches are a vital hub of community information,” Alcorn said in his board matter. “…We continue to face issues with meeting the demand for library materials even with the digital formats.”

County Executive Bryan Hill presented a proposed budget on Feb. 20 that increases FCPL’s funding by $410,027, partially offsetting a $1.2 million jump in personnel-related costs with cuts to the system’s operating expenses.

Planned reductions include eliminating a vacant management position, shifting to black-and-white public copiers instead of color ones, adjustments to the number of computers at each branch based on usage, taking over data storage from a third-party vendor and making FCPL’s quarterly magazine digital-only.

Overall, the county is budgeting just under $35 million in expenditures for the library system, most of which ($22 million) goes toward day-to-day operations at its 23 branches.

Alcorn noted that the county’s funding is supplemented by contributions from the nonprofit Fairfax Library Foundation and the Friends groups that support individual branches. The Friends of Reston Regional Library, for instance, donated $100,000 earlier this year to boost the children’s books collection county-wide.

However, funding for books and other materials remains inadequate “to meet the needs of our residents,” who sometimes have to wait months or even more than a year for popular items, he said.

With increased demand for popular and new materials, the Library must balance a proper allocation of limited resources for those items with the needs for materials in support of K-12 students, and ensuring that materials are updated, available in print, large print, audio and digital copies and in multiple languages. Additional funds to the collection budget will ensure that we are providing the resources our community demands from our Library and decrease the wait times so that people can access those resources in a timely fashion.

The Board of Supervisors agreed unanimously on Tuesday to add Alcorn’s proposal to its list of items to consider incorporating into the budget, which includes $3.83 million in not-yet-allocated funds.

Springfield District Supervisor Pat Herrity also asked county staff to find out why FCPL is only devoting about 10% of its budget to purchasing materials and whether that guidance comes from the county, the library’s Board of Trustees or the state.

“I think we do need to clearly invest in our library collections,” Herrity said. “It’s something our citizens like. It’s a basic public service we need to promote.”

Town hall meetings on the proposed budget are currently underway, with the Franconia District holding the next one at 6 p.m. today (Friday). Public hearings are scheduled for April 16-18, and the board will mark up the budget, including determining whether to add items like the library funding, on April 30.

A final FY 2025 budget will be adopted on May 7.

(Updated at 3:35 p.m.) Congress has passed another short-term budget package, averting a partial shutdown of the federal government just hours before a midnight deadline.

In addition to funding the Justice Department, Housing and Urban Development, and other key agencies, the slate of bills passed 75-22 by the Senate on Friday (March 8) includes $12.7 billion in “pork” — money designated for local projects requested by lawmakers for their constituents.

In a joint press release, Sens. Tim Kaine and Mark Warner announced that Fairfax County and other Virginia localities will be among the beneficiaries of the more than 6,600 projects that got funding, per the Associated Press.

“I’m proud that we secured funding for 105 community projects across Virginia that will improve transportation, upgrade water infrastructure, support health care, and more,” Kaine said. “I urge Congress to take up the rest of the government funding bills as soon as possible.”

According to breakdowns provided by Warner’s and Rep. Gerry Connolly’s offices, the biggest allocation for Fairfax County is $4.1 million “to fund a new homeless and domestic violence shelter for families.”

The county’s existing domestic violence and family shelters have exceeded their useful lives, but instead of building new facilities, the Fairfax County Redevelopment and Housing Authority is planning to convert an existing “extended stay” hotel that will be able to house about 50 families a day.

“Site acquisition activities are ongoing, with the goal of securing a location that is well-served by transit, and close to jobs and services,” FCRHA spokesperson Allyson Pearce said.

Connolly’s office says the site “will entail combining rooms, creating service and office space, and other changes to the existing hotel setup,” noting that converting an existing building instead of constructing a new one will enable the county “to deliver this essential, brand new facility years earlier than might otherwise be accomplished.”

The county has two shelters specifically for people fleeing domestic violence — Artemis House and Bethany House — and two shelters that accommodate people with children — the Katherine Hanley shelter outside Centreville and the Patrick Henry shelter in Seven Corners.

The Fairfax County Board of Supervisors approved plans in August 2022 to replace the Patrick Henry shelter with supportive housing after some delays related to land acquisition challenges.

The appropriations package also includes funding for several road and pedestrian projects:

- Spring Street widening from four to six lanes between Herndon Parkway and Fairfax County Parkway ($1 million)

- Fox Mill Road and Pinecrest Road intersection improvements in Herndon ($850,000)

- Silverbrook Road and Lorton Road intersection improvements ($850,000)

- Sidewalk on Ninian Avenue and along Bush Hill Drive to improve safety and accessibility for Bush Hill Elementary School students in Rose Hill ($850,000)

- Gunston Road shared-use path from Julia Taft Way to the Pohick Bay Golf Course entrance in Lorton ($500,000)

- Compton Road bicycle and pedestrian path from the Bull Run Special Events Center access road to the Cub Run Stream Valley Trail in Centreville ($500,000)

- Stone Road trail from the I-66 interchange to an existing trail along southbound Route 28 in Centreville ($500,000)

The Fairfax County Department of Transportation applied for federal grants last summer to fund the Bush Hill and Compton Road projects. Read More

Fairfax County Public Schools is stepping up its requests for funding this year from both local and state leaders.

The school system is seeking an additional $254 million from Fairfax County for fiscal year 2025 — about 10.5% more than last year — to help fund a projected $301.8 million, or 8.6%, budget increase, FCPS Superintendent Dr. Michelle Reid reported in a presentation to the school board on Thursday (Feb. 8).

According to Reid, the increase is necessary for FCPS to meet the needs of all its students and adequately compensate its staff, even though student enrollment remains below pre-pandemic levels and no new initiatives are included in the proposed $3.8 billion budget.

With the county government bracing for a tight budget year itself, Reid stressed that the local request could be reduced if Virginia contributes more than the $42.2 million increase currently expected based on Gov. Glenn Youngkin’s proposed funding plan for the state.

“What I’m presenting…is what I believe we need to resource and sustain the excellent work that our staff are doing today and compensate our staff into the future to keep us competitive, with the hope that as our General Assembly deliberates…they’ll see the necessity of actually allocating a greater amount of state funding, which will help us out in terms of our county transfer,” Reid told the school board.

The disparity between the local and state funding for public education has long frustrated both county and FCPS leaders, who argue that the formula used to calculate funding needs for each school division is outdated and shortchanges Fairfax County — one of the wealthiest counties in the Commonwealth, but also its biggest and most populous.

Those grievances got validated last year when the Joint Legislative Audit and Review Commission released an anticipated study that found Virginia spends about $1,900 less per student than the national average, falling below nearby states like Maryland, West Virginia and Kentucky.

If the Commonwealth matched the 50-state average, it would allocate $345 million to FCPS, according to Reid.

“So, just funding us at the average would be more than what we’re actually asking for in additional funds,” she said.

Multiple school board members acknowledged that the size of the funding request may give some community members pause, especially with only a modest growth in enrollment projected for FY 2025, which starts on July 1.

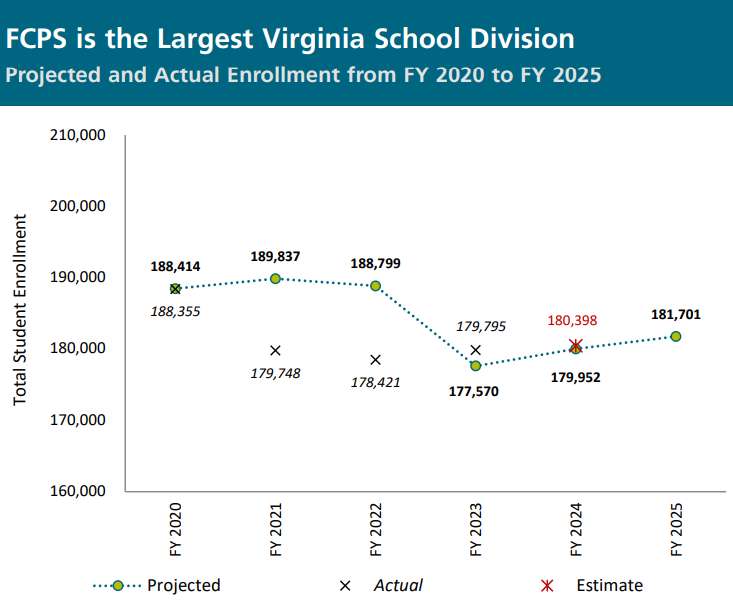

According to the proposed budget, FCPS expects to have 181,701 students next school year. Enrollment has ticked up over the past few years, reaching an estimated 180,398 students this year, but before the COVID-19 pandemic shuttered classrooms in March 2020, the school system had over 188,000 students.

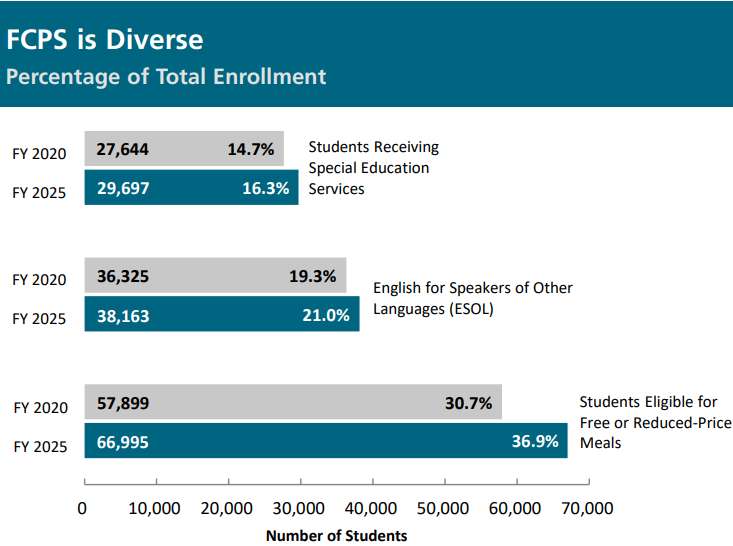

Even though there are fewer students, the cost of serving those students has grown, Reid said. In addition to adjusting for inflation and rising costs of living, FCPS is seeing more students who need more intensive support, including those in special education, non-English speakers and low-income students.

For example, an FY 2025, FCPS projects that nearly 37% of all students will be eligible for free or reduced-price lunches, compared to 30.7% in the 2019-2020 school year, according to the budget.

“The needs are constantly changing,” said Rachna Sizemore-Heizer, who represents Braddock District on the school board. “Therefore, the amount of money we need to service those needs are constantly changing, and on top of that, we’re putting more and more on what we expect public schools to do. It’s educating, it’s mental health supports, it’s supporting families.”

What’s in the proposed budget

After the school board designated teacher recruitment and compensation as a top priorities, Reid has proposed allocating $170.7 million to a 6% salary increase for all employees. Another $55.3 million would cover the cost of a 2% compensation supplement adopted by the state, effective Jan. 1, and $24.1 million would go to retirement and health insurance costs.

FCPS is also considering creating a deferred retirement option program similar to the one available to county government workers.

However, the proposal only includes enough funding — $46.6 million — to maintain current class sizes, which range from an average of 21 students per teacher for elementary schools to 25 students per teacher for high schools.

Initiatives funded by the budget include:

- An expansion of inclusive preschool programs for kids under 5 ($2.1 million)

- Energy and environmental goals, including future grants for electric school buses ($1.9 million)

- “Extra duty” stipends for music and theater staff, mostly at the high school level ($1.1 million)

- The addition of boys’ volleyball and girls’ wrestling programs at all 25 high schools ($800,000)

- The third year of an ongoing human resources and payroll technology update ($700,000)

- Five additional athletic trainers, continuing a multi-year plan to provide two positions at every high school ($600,000)

All of those initiatives are either already underway or have been planned for several years, according to Reid.

“We’re not launching new work. We were very clear this year,” the superintendent said. “We want to fund the work we’ve planned and set out to do over the last several years and maintain the phases of the plans we’ve already begun.”

The school board will get a more detailed presentation and discussion on the budget at a work session this afternoon (Tuesday). Public hearings scheduled for tonight and, if needed, Feb. 20 will be held at 6 p.m. in the auditorium at Luther Jackson Middle School (3020 Gallows Road).

The FY 2025 advertised budget will then be approved by the school board on Thursday, Feb. 22.

Teacher recruitment, school safety and controlling class sizes have been designated as top priorities for funding by the newly sworn-in Fairfax County School Board.

However, the county’s expected financial constraints may make it challenging for the board’s entire wish list to get funded in the upcoming budget cycle, which will start July 1.

Last week, the school board approved a resolution to serve as a guide for Fairfax County Public Schools Superintendent Dr. Michelle Reid as she crafts the school system’s proposed fiscal year 2025 budget.

The resolution highlights improving teacher compensation, particularly for special education and Title 1 schools, as a key priority. Board members also stressed the importance of increasing access to universal breakfast and lunch programs, reducing school meal debt, expanding preschool options, lowering class sizes, and providing additional funding for mental health and academic support.

While some of those priorities are broad in scope, Mason District School Board Representative Ricardy Anderson noted the board has been discussing these issues with the superintendent and her staff in both public and private meetings for months.

“This is not a surprise,” she said. “They have been part of these conversations, and they understand what the board finds important.”

Aside from Anderson, Braddock District Representative Rachna Sizemore Heizer, and Hunter Mill District Representative Melanie Meren, who supported the resolution, most school board members are newcomers who were not part of the initial discussions on the board’s budget priorities last year.

Despite that, Anderson noted that the new members — all elected in November with Democratic endorsements — have shown strong support for many of the same issues as the previous board, which was similarly all Democratic.

“There was a lot of overlap with what the former board found important and with what the new board finds important,” she said.

Still, there is the hurdle of getting the county on board.

Fairfax County staff told the school board and the Board of Supervisors at a joint meeting last November to prepare for a tough budget year, forecasting a $284.5 million shortfall mainly due to a “flat real estate market,” according to the county website.

At a Nov. 14 school board work session, FCPS Chief Financial Officer Leigh Burden predicted a $202.6 million gap in the revenue needed to fund a 6% salary increase for all FCPS employees, address rising student service demands, and cover inflationary costs.

FCPS has a total operating budget for the current fiscal year of $3.5 billion — a $221.7 million increase from the previous cycle.

The superintendent is set to present her budget proposal to the school board next Tuesday, Feb. 6. How her office will address the revenue gap and incorporate the school board’s priorities into the proposal remains unclear.

However, Anderson said she doesn’t anticipate the school board’s entire wish list will be fulfilled.

“They’re big ticket items, and there’s only so much you can do in any given year,” she said.

Town of Herndon officials estimate a modest influx of general fund revenues in fiscal year 2025 as work begins on preparing the upcoming budget.

At a Herndon Town Council meeting on Jan. 2, Director of Finance Marjorie Sloan said the town expects roughly $41.1 million in general fund revenues — down from $47.6 million in fiscal year 2024, which began on July 1, 2023.

Town council members emphasized the need to find ways to maintain the town’s current level of services, given the overall revenue picture.

“My concern has always been our revenues are not increasing that I think that we need to maintain,” said Councilmember Cesar del Aguila.

Still, Town Manager Bill Ashton II said Herndon is likely “one of the best capitalized localities in Northern Virginia.”

So far, occupancy and meals taxes are “trending favorable” in the budget, according to Sloan. Revenue has also been buoyed by higher-than-average interest rates on investments, and the town is able to shed some costs after deciding to discontinue the Herndon Festival.

Despite the town’s relatively strong cash position, however, high staff turnover — nearly 50% for some positions — remains a challenge.

Councilmember Pradip Dhakal said he’s concerned about the high costs of onboarding new staff and potential implications for turnover in future years.

“50 percent new hires…To me, that’s a little scary, but I think we’re awesome so we can handle it,” del Aguila said.

Tax increases or increases in some town fees may be inevitable, some council members concurred. Still, Sloan said it was important to consider that the current outlook was simply an estimate.

“The bottom line is you can’t always look at the mid-year update and see exactly where we are,” she said.

The council will review a resolution on budgetary guidance at its Jan. 16 meeting. Work sessions on the budget kick off in February — including discussions of a 7% rate increase by Fairfax Water. The proposed budget is scheduled to be publicly released around March 31, followed by the beginning of public hearings on May 9.

At the halfway point of his administration, Virginia Gov. Glenn Youngkin unveiled a budget proposal that calls for significant income tax cuts, increases in state sales and use tax — and a push to get rid of the car tax, which the Republican called “the single most hated tax” in Virginia.

“The car tax belongs in the trash can and not in your mailbox,” he said.

Speaking to the state’s joint money committees Wednesday morning, Youngkin reiterated his familiar themes that Virginia must take action to reverse ongoing population losses to other states and reduce residents’ tax burdens.

“Across the country today, there are winning states and there are losing states,” he said. “Virginia must compete even harder.”

But the governor’s speech took a less political tone than earlier addresses to the state’s legislative budget architects, offering fewer criticisms of prior administrations and acknowledging that Virginia government remains divided after Democrats narrowly won control of both chambers of the legislature this November. That outcome dampened Youngkin’s prospects for a presidential run and will force him to work across the aisle to achieve his key priorities.

Because Virginia operates on a two-year budget that is amended annually, the “Unleashing Opportunity” budget presented by Youngkin Wednesday represents the governor’s first crack at crafting a state spending plan from whole cloth. The last two-year budget, which was passed in 2022, was based on a plan from outgoing Democratic Gov. Ralph Northam.

With power divided between Democrats and Republicans in Richmond and historic state surpluses fueled by pandemic-era relief spending, the past few years have seen unusual levels of contention over the state budget. Amendments to the spending plan, ordinarily passed at the time the General Assembly adjourns in late February or early March, took until September this year to come to fruition as the parties bickered.

“I would ask us to deliver a budget on time when you adjourn sine die in March,” Youngkin told the money committees on Wednesday, referring to the final adjournment of the legislative session. “Virginians deserve it, and I know we can do it.”

This year, lawmakers will have less money at their disposal, with pandemic-era infusions of cash at an end and state economic officials projecting a mild recession beginning in the last quarter of fiscal year 2024.

The “overwhelming consensus” of state leaders, said Youngkin, was that in developing the budget, “we should build in caution.”

Democrats have already signaled concerns with the governor’s spending plan — and some surprise.

“I heard the governor say this was halftime. And he came back out as a Democrat, a lot of tax increases,” wisecracked incoming House Speaker Don Scott, D-Portsmouth, in an exchange with Virginia Secretary of Finance Stephen Cummings.

Senate Democrats on Wednesday afternoon issued a statement calling the governor’s budget “absolutely disgraceful” and “a slap in the face of our most vulnerable individuals.”

“We are smart enough and bold enough to know that his speech was the highlight reel and that he omitted the dirty details of his plan,” the caucus wrote. “Governor Youngkin believes that ensuring more tax cuts for wealthier individuals is most beneficial for low income individuals in our commonwealth.”

The proposal put forward by the governor Wednesday marks only the beginning of the state’s budget season. When the General Assembly convenes Jan. 10, both chambers will have a chance to modify Youngkin’s budget, removing parts they don’t like and accepting or strengthening those they do. The House and Senate will then need to reconcile their two versions of the plan — a process that historically has occurred behind closed doors through the legislature’s opaque conference committee system — and send it to the governor for his review.

“While we appreciate Governor Youngkin for sharing his budgetary vision today, it is imperative that we have a thorough examination of his proposal,” said Del. Luke Torian, D-Prince William, the incoming chair of the House Appropriations Committee. “This is the starting point to construct a budget that not only reflects our dedication, but also secures prosperity and fairness for every resident in the commonwealth.”

Here’s some of what Youngkin is proposing at the starting line.

Tax reforms

Youngkin has heavily emphasized tax reduction over the course of his administration, and the issue is the centerpiece of his budget proposal. Reducing the cost of living for Virginians, he argued Wednesday, requires reducing tax burdens and modernizing the state’s sales tax code.

He is calling for a 12% cut in income taxes across the board that would see the tax rate drop from 2% to 1.75% for the lowest bracket and from 5.75% to 5.1% for the highest.

“This cut reduces the personal income tax burden on Virginians by $1.1 billion in fiscal year 2025 and $2.3 billion in fiscal year 2026 and is a major, major step towards competing,” Youngkin said. “The data is clear: Since 2021, 26 states have cut individual income tax rates.”

To partly offset that loss in state revenues, the governor is proposing to increase the state’s sales and use tax from 4.3% to 5.2%, as well as expand the base of goods and services that tax applies to.

“Virginia taxes a narrow set of goods while our peer states tax a broader set of goods and services,” said Youngkin. To remedy that, he is asking the state to close what he called the “Big Tech tax loophole” on digital goods such as software packages, digital downloads, streaming services and more, “on which today, Virginia collects nothing.”

Democrats have already pushed back against the tax changes. In a statement, Scott said Virginia “must champion policies that address the pressing issues faced by our citizens – not those that would be detrimental to the financial well-being of low-income and middle class households, exacerbating economic disparities. By lowering taxes for the wealthiest Virginians and raising local and state sales tax, the burden is shifted onto those least able to afford it.”

Asked about those concerns, Youngkin said he was “very cognizant” of them, “and that’s why we included an increase in the earned income tax credit, so that in fact there would be support for Virginians who are on the lower-income scale.”

Under the governor’s plan, lower-income residents would be able to claim an enhanced earned income tax credit equal to 25% of the federal credit, rather than the existing 20% credit.

“We can reduce the tax burden and include a very important tax reform, which is shifting the burden of personal income taxes onto a sales tax system that is truly outdated and archaic,” he said.

Car tax

While not included in his budget plan, the governor urged lawmakers to work to permanently eliminate the car tax local governments are currently allowed to levy and instead have localities rely on further increases in sales tax.

“Everywhere I go, I consistently hear, ‘Please help us get rid of the car tax,’” he told reporters. “We need to work together to get rid of this.”

Outgoing Sen. John Edwards, D-Roanoke, noted the commonwealth spends almost $1 billion annually to reduce the car tax in localities and asked whether getting rid of the tax would require a constitutional amendment.

“The [Virginia] Constitution gives the car tax to the localities,” he said. “So how’s [he] going to do that, to abolish the car tax?”

Cummings said eliminating the tax would require a complex process and “a lot of changes and legislation.”

After his presentation, Youngkin told reporters, “I believe we would not eliminate the state subsidy of $950 million a year, that we can work in collaboration with local governments to settle on an increase in local and state sales and use taxes.”

Continued increases in education spending

Over the next biennium, Youngkin is proposing an additional $764 million for Virginia’s K-12 schools, including $160 million for re-benchmarking — the process of updating the amounts the state provides in direct aid to schools — $122 million to cover another 2% raise for teachers in fiscal year 2026 and $53 million for a 1% bonus in fiscal year 2025.

Youngkin also proposed investing $61 million to expand the hiring of reading specialists, $40 million to support students seeking industry-recognized credentials through “Diploma Plus” grants and $40 million to develop a new state assessment system.

More behavioral health investments

Youngkin is proposing $316 million in the budget for his “Right Help, Right Now” plan to further expand access to behavioral and mental health services across the commonwealth. This includes over $150 million to add additional developmental disability waivers, which fund services for people with long-term care needs. The governor’s plan aims to provide waivers to the 3,400 Virginians currently on the “priority one” waitlist — consisting of those individuals who urgently need the services and support offered by the waiver in a year or less.

“This is going to be a big initiative, but with the providers out there seeing this money is there, I think we can generate the kind of infrastructure we need to help address this important area,” said Virginia Department of Planning and Budget Director Michael Maul.

Over $35 million will go toward funding additional crisis services, like Virginia’s 988 suicide and crisis system and crisis stabilization units, to minimize response services that rely on emergency rooms and hospitals.

An additional $58 million is being invested in behavioral health loan repayment, more clinical training sites and residency slots and salary increases for state hospital clinicians. A new JLARC report this month found Virginia’s nine psychiatric hospitals are increasingly short on both beds and staff, which poses risks for both patients and personnel.

When it comes to hiring, “we are competing with McDonalds and Starbucks,” Maul said, “and it’s hard sometimes to get the people we need.”

Medicaid spending

The budget includes $714 million to fund the cost of Medicaid while adjusting for inflation.

Maul said this biennial budget includes significantly more money than the previous two-year spending plan because the state’s Health Care Fund, which is sourced from tobacco taxes, has less money to cover Medicaid costs than it did in prior years.

During COVID, Maul said Medicaid enrollees “weren’t going to their doctors or getting their checkups,” so Virginia spent less to pay for providers than what was initially budgeted. Now, he said, the state is expecting a significant rise in utilization.

“We’re not expecting very big amounts to go into the Health Care Fund, and tobacco tax revenues are going down,” Maul said. “We believe we’re going to need over $250 million a year to help offset the fact that those funds will not be available to help with Medicaid.”

Child care

The Building Blocks for Virginia Families initiative, announced by Youngkin earlier this month, would put $437 million toward child care and early childhood education programs in an effort to keep child care accessible to families struggling to shoulder its high costs.

Wednesday’s proposal is $10 million less than the governor previously outlined but would put $412 million toward the state child care subsidy program and $25 million to help with startup costs for providers in areas that lack child care services.

“We were using a big chunk of one-time funding, of public funding, to help subsidize the cost for child care,” said Maul. “That’s one of our biggest economic development issues, because if workers can’t find child care, they can’t get to work.”

A state report by the Joint Legislative Audit and Review Commission recently found that child care is unaffordable for the vast majority of Virginians.

“The whole goal is to make sure that anybody in the program today and those who would likely be in the program can continue to do so in the next biennium,” said Maul.

No new increases for Metro

Despite Metro’s threats of potential service cuts and fare increases in response to a $750 million shortfall, the governor’s budget includes no additional funding for the bus and rail operator above the state’s normal allocation.

Youngkin said before any funding is appropriated, a plan must be created to address the change in ridership and demand for services.

A view of the Tysons Corner Metrorail Station in Fairfax County. (Nathaniel Cline/Virginia Mercury)

“I am a huge supporter of Metro,” Youngkin said after his presentation. “It is critically important to Virginia and the entire DMV. But we need to face reality here and develop a business plan that works for Virginia, for the District and for Maryland, and then we will talk about what we will do in order to support it.”

Metro said Virginia’s proposed contribution for fiscal year 2025 is $347.9 million.

Metro said it needs notification of what the neighboring jurisdictions will provide by mid-March to make any budget adjustments.

Photo via Virginia House of Delegates/Flickr. This article was reported and written by Sarah Vogelsong, Nathaniel Cline, Charlie Paullin and Meghan McIntyre for the Virginia Mercury, and has been reprinted under a Creative Commons license, with some edits for length.

Local and state officials in Virginia say the path to dig Metro out of its looming $750 million deficit is uncertain — but action is necessary to avoid the significant service cuts, systemwide fare hikes, layoffs and station closures laid out in the transit agency’s newly proposed budget.

Leaders in Fairfax County — which already faces lean economic times — say they don’t plan to offer up additional funds unless jurisdictional and federal partners can throw some more skin into the game.

“What we have said is there’s absolutely no way that local governments can bear the responsibility of that entire bill,” Fairfax County Board of Supervisors Chairman Jeff McKay told FFXnow in an interview before the Washington Metropolitan Area Transit Authority released its official budget proposal.

WMATA has been sounding the alarm on its projected budget shortfall since June.

“What I think you’re going to see happen is there’s going to be some matching and some partnerships,” McKay said.

In a first glimpse of the proposed budget, which was released last Tuesday (Dec. 12), Metro General Manager Randy Clarke laid out what would happen if Metro can’t secure local, state and federal funds to address a problem that has been coalescing for years.

“Metro is facing an unprecedented, existential crisis that requires our region to rally together if we want to avoid the catastrophic impacts this budget would have on our region,” he said.

The system would close at 10 p.m. every day and shutter 10 low-ridership stations. Silver Line trains would turn back at Stadium-Armory, with trains running between Ashburn and that station. Similar reduced turn-backs would take place on the Red Line.

Trains would run every 15 minutes for most stations — a 17 to 67% increase in wait-times across the board on weekdays — and every 20 minutes on weekends for most stations — a 40 to 70% increase. Fares would also jump by 20%.

Among other cuts and more than 2,000 layoffs, Metro would use $193 million from its capital funds to cover operating maintenance expenses — essentially borrowing against the future.

“Such a large transfer of capital funds to operating expenses puts the system’s state of good repair, including safety and reliability, at risk, and threatens to delay, defer, decrease, or cancel several long-term projects to modernize the system,” WMATA cautioned in a press release.

But it’s unclear when and if local and state bodies will offer up enough funding. The subsidized system relies on annual subsidies from Maryland, Virginia and D.C., as well as fare revenue and federal dollars. The fiscal year 2025 budget begins July 1, 2024.

Metro needs subsidy increases of $180 million from Virginia, which has already allocated $348 million. Similar increases are sought from other jurisdictions. The upcoming General Assembly session will determine how much the state is willing to put down to assuage the bleeding after federal COVID-19 funding ends for the system.

Recent news that the Washington Capitals and Wizards plan to move near the new Potomac Yard Metro station in Alexandria emphasizes Metro’s “pivotal role” in the region, Hunter Mill District Supervisor Walter Alcorn says.

“Funding from Virginia will be critical in limiting the additional burden to be borne by local property taxpayers,” Alcorn said.

He also stated that a long-term solution that extends “beyond property taxes is critical to make Metro truly sustainable for Virginia residents and businesses.”

On the federal side, Rep. Gerry Connolly (D-11) said finding more funding for WMATA will be “very difficult,” particularly after the government provided $2.4 million in emergency Covid relief funding that staved off a major deficit for four years.

“We renewed the $150 million annual federal capital funding commitment to WMATA as part of the Bipartisan Infrastructure Law,” Connolly said in a statement. “And the WMATA Board just removed its second Inspector General in two years the day after the Inspector General reported that WMATA was not in compliance with statutory conditions for federal funding — conditions I authored to address a culture at WMATA that resists accountability at every turn from the IG to the safety oversight commission.”

Still, he believes the federal government needs to step in more.

“It is long past time that the federal government pay its fair share to support the system’s operating costs, conditional of course on WMATA improving safety, reliability, and customer service,” he said.

Phyllis Randall, chair of the Northern Virginia Transportation Authority and the Loudoun County Board of Supervisors, noted that NVTA has pledged to invest $258 million in Metro’s capital improvements, signifying its commitment to support the system.

“Stakeholders must work together to secure sufficient state and federal funding and implement operational changes to ensure that Metro continues to meet the transportation and economic development needs of the region,” she said.

But McKay told FFXnow he still expects to see service cuts in the short term, even if state, federal and local entities can team up to at least limit the impact of the budget shortfall.

In the long term, he says the federal and state government need to pony up more funds to support Metro, noting that the federal funding is currently “a fixed-dollar amount” that doesn’t adjust with inflation.

“There are discussions underway about putting in place a longer-term fix to Metro that will probably require a lot of things, not the least of which is some reforms at Metro to improve management,” McKay said. “…I think the county has a role to play, but we’re not willing to play a role unless all of our funding partners are also making a commitment to do that.”

The Fairfax County School Board will vote next week on $847,000 in funding for security cameras at nine elementary schools.

That project is among those that could be funded as part of Fairfax County Public Schools’ midyear budget review, which Chief Financial Officer Leigh Burden presented to the board on Monday (Dec. 4).

FCPS has also proposed allocating $100,000 to cover costs associated with renaming Woodson High School after Carter G. Woodson. The change from former FCPS superintendent W.T. Woodson was approved on Nov. 9 and will take effect with the 2024-2025 school year.

“Historically, renaming costs have typically been about $300,000, but many items at Woodson just say ‘Woodson,’ so those items will not have to be replaced,” Burden said.

The board-authorized funding for security cameras would supplement money the county has received from two Virginia Department of Education grants to fund security cameras at eight elementary schools.

“Prioritization is determined by the building age, the number of existing cameras, the number of incidents at a school location as well as access to uninterrupted power,” Burden said in her presentation.

The elementary schools slated to receive funding through the mid-year budget review are Deer Park, Coates, Springfield Estates, Bull Run, Terra Centre, Greenbriar East, Freedom Hill, Bush Hill and Graham Road.

Another eight schools — Pine Spring, Great Falls, Fort Hunt, Sunrise Valley, Newington Forest, Rose Hill, Forest Edge and Glen Forest — will get cameras through the VDOE grants, which had different criteria for each application, according to an FCPS spokesperson.

When selecting the schools, FCPS considered factors such as the number of students eligible for free and reduced meals, the number of incidents at a given school, when the school was built, the availability of uninterrupted power and how many other schools in each region already had security cameras, the spokesperson told FFXnow.

Superintendent Michelle Reid told the school board in May that about half of the elementary schools in FCPS had exterior video cameras, along with all high schools. Installations at all middle schools were expected to finish this year, and she hoped to expand the program to all elementary schools in the “near future.”

Overall, FCPS has just over $6.1 million in additional funding to allocate in its mid-year budget review, most of which comes from higher-than-anticipated sales tax revenue identified after the end of fiscal year 2023, according to Burden. About $1 million comes from federal Individuals with Disabilities Education Act grants, which support the school operating fund, she said.

The mid-year budget review also includes $88,000 to support restorative justice interventions and $80,000 for improvements to power sources used for Advanced Placement digital testing at select high schools. About $3.1 million would be held for fiscal year 2025, which starts on July 1, 2024.

“We generally like to try to keep the beginning balance around the same level as it is in the previous year because otherwise, if it’s less than that, then that just increases the local request to the county,” Burden said.

Braddock District Representative Megan McLaughlin asked about funding for school maintenance and repairs. She suggested Reid confer with Janice Szymanski, chief of facilities services and capital programs, and her team about addressing some “backlog maintenance issues” ahead of the board’s vote on Dec. 14.

“We just keep telling our communities, in particular our athletic boosters that work hard, tirelessly, year after year to bring money to the table, and then to get told, ‘We’re sorry we promised you that repair project, but there’s no money dedicated to it,’” McLaughlin said. “I think we’re losing faith and support and confidence from our families when we make promises and then we don’t deliver.”

Anticipating slow growth in the real estate tax base and only a modest increase in general fund revenues, local officials are preparing for a slim budget in the next fiscal year.

At a joint meeting on Tuesday (Nov. 28), the Fairfax County Board of Supervisors and the school board got an early forecast of projected revenues, expenditures and general priorities for the county government and public school system’s fiscal year 2025 budgets.

Christina Jackson, the county’s chief financial officer, emphasized that the forecast is an early estimate of the budget.

“We recognize that this was going to be a challenging year,” said Jackson.

County officials anticipate a combined net budgetary shortfall of $284.5 million.

Based on last month’s projections, non-residential tax revenue is expected to grow by 1.9% from the current fiscal year 2024 rate of 3.6%. In fiscal year 2023, non-residential tax revenue stood at 7.3%.

That’s coupled with substantially lower growth in the real estate tax base for next year — a mere 1.7% compared to 6.6% in the current fiscal year. The residential real estate market has softened as a result of high mortgage rates, but values are still expected to increase by 2.1% due to low supply, county staff said.

Funding conversations continue in the background of a study that found Virginia’s school divisions receive 14% less funding from the state than the average for all 50 states.

Calling the state’s underfunding “a generational wrong,” McKay said the report by the Joint Legislative Audit and Review Commission (JLARC) is a critical opportunity to shift the statewide conversation about the state’s funding formulas.

“This study can either collect dust and be ignored, or this study can be acted on and Virginia can get ahead of West Virginia and Kentucky, which frankly should embarrass everyone who lives in Virginia,” McKay said.

Ricardy Anderson, who represents Mason District on the school board and chairs the board’s budget committee, highlighted the space constraints that Fairfax County Public Schools already faces.

“We cannot trailer our way out of this issue, because the schools are growing,” she said, noting that at one school, the entire fifth grade is housed in trailers.

She suggested that the county restart a conversation about adopting a meals tax in order to generate revenue. County voters rejected a referendum in 2016, but the General Assembly approved a bill in 2020 that gave counties the authority to tax food and beverages without a referendum.

Further clouding the less-than-rosy forecast for the county, Metro has projected a deficit of $750 million in fiscal year 2025. Possible efforts for short-term relief include fare increases, service reductions and preventative maintenance transfers. Metro’s general manager is expected to release the draft budget this month.

This year’s budget includes an additional $37.5 million to support collective bargaining with the police and $23.7 million for the fire and emergency services bargaining unit. Overall, the county is planning to increase its employee salary and benefits funding by roughly $180.5 million.

To prepare for the shortfall, all county agencies were asked to slim down their proposed budgets by 7% — resulting in roughly $20 million savings.

Priorities that the county doesn’t expect to fund include information technology initiatives, infrastructure upgrades and renewals, and increased investments for affordable housing and environmental and energy programs. On the schools side, affected needs include an expansion of middle school athletics and a special education enhancement plan.

Franconia District Supervisor Rodney Lusk said the county must look into ways to shore up revenues in the future.

“We’ve definitely got to be thinking about how we do things a little differently,” Lusk said. He also asked the school system to explore ways to remove the cost of reduced lunches for students and a fine arts stipend review.

FCPS Superintendent Michelle Reid said the school system is actively looking for ways to address food insecurity.

Braddock District Supervisor James Walkinshaw said that if the county wants to raise user fees — a possibility floated in the budget forecast — it should consider establishing a “regular cadence” to increases in fees.

“If it is ad hoc, it could create the impression that when we need revenue, we jack them up,” Walkinshaw said.

Reid will release her proposed budget for FCPS on Jan. 25. County Executive Bryan Hill will then present the county’s advertised budget on Feb. 20. After several months of deliberation, the Board of Supervisors adopts the budget on May 7 and school board adopts the budget on May 23.

The budget year begins on July 1.

Reston Association’s Board of Directors has increased the annual member assessment by 7% as part of its $22.1 million budget for next year.

At a special meeting on Nov. 20, the board set the assessment at $817, up from $763 last year.

In a change from previous years, the fee includes recreational passes for members. Director Jennifer Jushchuk cast the lone dissenting vote against the proposed assessment.

The budget also includes increased lifeguard salaries and a 4% increase in boat mooring, garden plot rentals and other fees. The cost of non-member recreational passes was also bumped up by 35%.

“We heard consistently throughout the year that our members value our recreational amenities; however, things like pool availability and recreational fees were barriers to many of our families,” RA CEO Mac Cummins wrote in a statement. “We wanted to provide a budget that prioritizes what our members have told us they value most.”

At the meeting, board president John Farrell lamented that the fee is higher than necessary, because 3,000 residential units are “freeloading” off of RA by using its facilities without formally joining the association.

“This assessment is not as low as I’d like it to be, but I think it’s the lowest one that we can adopt with reasonable business judgment,” Farrell said. “The problem is this assessment is about $100 to 120 higher than it should be because we have 3,000 units that are freeloading.”

Member assessments, which are paid by all RA property owners, are due by Jan. 1. In a press release, RA notes that “the vast majority” of its revenue comes from the annual fees, paying for programs, facility maintenance and other operations.

(Updated at 11:30 a.m.) Reston Association is considering a 10% increase in its annual membership assessment as part of a preliminary budget draft for fiscal year 2025.

The proposal — which is the first of what will likely be several drafts — was discussed at a Sept. 28 Board of Directors meeting. As previously reported, the budget would include new positions and cover membership recreational passes in the assessment fees.

Cummins said he plans to eliminate two positions in the budget — a staff accountant and a communications manager.

“These additions represent a more strategic approach to interdepartmental coordination, decision making and providing service for the membership,” Cummins wrote in a memo.

The fee would stand at $840 compared to $763 last year if RA uses $700,000 in cash to buy down the true cost of the membership fee. Without a cash infusion, the assessment would rise to $872.

New proposed positions could include a chief financial officer, land use planner, information technology director and business analyst.

Recreational passes would also be free for all RA members, returning the organization to a previous model that wrapped passes into the annual assessment paid by members. Some programs — like Totally Trucks — would also be included in the assessment. Nonmembers would still have to pay for passes and other events.

Cummins also hopes to increase lifeguard wages to bring them along with decreases in some recreation and Central Services Facility staff. The total increase amounts to $90,000.

“We are fairly behind in terms of the hourly pay rate,” Cummins said.

The budget also includes $30,000 in funding for a salary and compensation study and merit increases of up to 5%.

The proposal also included adding a convenience fee for credit card use, allowing RA to avoid absorbing $245,000 in annual charges from credit card companies. The convenience fee of $2.95 per credit card swipe would result in $25,000 in annual revenue.

A 20% “nominal” fee increase for boat permits is also proposed, Cummins said.

Final action on the budget is not expected until November.

“Tonight is just the beginning of the process,” RA board president John Farrell said at the Sept. 28 meeting.

A walking path into the Fairfax County Park Authority’s Ellanor C. Lawrence Park in Chantilly (staff photo by Angela Woolsey)

The Fairfax County Park Authority is seeking roughly $8 million in funds to support park operations, maintenance, and capital equipment for fiscal year 2025.

The proposed budget includes a little over $1 million to expand Accotink Stream Valley Park, Blake Lane Park in Oakton, the Elklick Preserve, Mount Vernon Woods Park, and the new Woodlands Education and Stewardship Center in Chantilly.

Several items from fiscal year 2024, which began July 1 and lasts until June 30, 2024, also remain unfunded, including a maintenance facility at Riverbend Park and improvements at Chandon’s playground.

Roughly $2.1 million is allocated for funding to restore park operations, $890,000 of which is allocated to remove high-risk trees and forestry management, athletic field mowing, trail maintenance funding, and athletic court maintenance.

Another $400,000 is allocated to remove bamboo on parkland, along with nearly $700,000 to find operating increases for administration and operations.

Major maintenance contracts are driving large increases in staffing especially, according to FCPA.

The budget includes $3.4 million for zero waste trash and recycling — a critical need as many maintenance staff spend almost half of their work week managing trash and recycling. The funds would include eight trucks and eight compactors.

“We need to have dedicated crews in all of our maintenance areas,” Mike Peter, director of the FCPA’s business administration division, said at a Sept. 27 board meeting, where park authority staff presented a final budget proposal.

As part of this year’s budget process, the county executive directed all departments to identify reductions of 7% in general fund appropriations, FCPA staff told the board at a Sept. 13 meeting.

The reductions can’t include existing staff positions, leaving only FCPA’s operating funds open for potential cuts. Suggested items included bathroom closures and reduced mowing and trail and court maintenance.

After soliciting public feedback, the park authority received several comments urging the county not to cut funding for local parks.

FCPA’s board will endorse the final budget proposal on Oct. 25. County Executive Bryan Hill will advertise the fiscal year 2025 budget in February.

Reston Association has begun the planning phase for the next fiscal year’s budget.

Possible changes to the structure of the yearly assessment and changes to some capital projects may be on the horizon. A joint work session between RA’s Board of Directors and fiscal committee is planned for Wednesday (Aug. 16).

In an early draft, RA CEO Mac Cummins said staff have proposed pushing several major projects out from 2024 to 2025 or later, including the renovation of the tennis facilities at Newport and improvements at Golf Course Island Pool.

Cummins said the changes were driven by a recent community survey that “will have a large impact” on facility renovation and improvement decisions and by delays associated with improvements at the Barton Hill and Glade tennis facilities.

“Staff is concerned about too many facilities being under construction at one time during peak seasons next year will affect membership,” Cummins wrote.

The draft capital improvements plan is about $2 million less than what RA typically budgets. An updated reserve study and an evaluation of a recent community survey will determine next steps, Cummins said.

The association is also considering adding the cost of using of its recreational facilities to the annual assessment charged for members. So far, Cummins and staff support the proposal.

It’s unclear what direction the assessment will go this year based on the presented draft proposal.

Cummins said that if the board wishes to freeze the assessment rate at $763 per year, reductions in staff and services to members may be needed.

“The primary reasons for this conclusion are that we are a service driven organization and as such our primary expenses are people related; and specifically, to provide service to the membership,” he said.

Cummins also said using surplus cash to effectively buy down the assessment, as the RA board did in 2022, may not be a sustainable solution in the future.

“A ‘no increase’ assessment budget will not be accomplishable without considering reduction or elimination of some services to the membership,” Cummins said.

Cummins is expected to present a complete version of the budget at the board’s September meeting.