Giant Employee Arrested in Connection with Embezzlement — A 54-year-old employee at Giant in North Point Village Center was arrested on Dec. 12 on embezzlement charges. Police said that an internal investigation found that the suspect was reportedly taking merchandise from the store without paying. [Fairfax County Police Department]

Trains Run on Silver Line Extension — Test trains have been running on the Silver Line extension in Fairfax and Loudoun County. Officials announced that the project has reached substantial completion last month. [Inside NOVA]

Plastic Bag Tax to Begin — Beginning Jan. 1, residents will have to pay a five-cent plastic bag tax for disposable plastic bags, including grocery stores, convenience stores, and drug stores in the county. [Fairfax County Government]

Reston Businessman Convicted of Bankruptcy Fraud — A Reston businessman was convicted on a series of fraud charges related to a bankruptcy case. Alan Russel Cook Sr., CEO of Metropolitan Aviation, discharged over is six million in personal debt when he file for bankruptcy. He reportedly transferred more than $350,000 to his former girlfriend and directed her to open accounts in her name and in the name of a fake company in anticipation of the filing. [U.S. Department of Justice]

NextStop Theatre Announces 2022 Schedule — The Herndon-based theatre has announced its line-up for the first half of 2022. Artistic director Evan Hoffman said the theatre company is excited to take programming to the next level after a gradual return to smaller productions this year. [Broadway World]

TransUnion Acquires Reston-based Company — TransUnion has acquired Neustar for $3.1 billion. The company’s CEO says he looks forward to the smooth integration of the businesses. Neustar is a network security company. [Cyber Wire]

Jingle on the Lake Returns — Hundreds of people attended the 50th anniversary of Jingle on the Lake at Lake Anne Plaza earlier this month. Santa arrived by a pontoon boat at the annual event. [The Connnection]

Photo via vantagehill/Flickr

A Reston man has been sentenced to more than five years in prison for a bank fraud and identity theft scheme where he created fake COVID-19 stimulus checks, the Department of Justice announced yesterday (Wednesday).

Jonathan Drew, 39, was sentenced in federal court in Alexandria yesterday by Senior U.S. District Judge Anthony J. Trenga. His 70-month prison sentence is significantly less than the maximum of 32 years that he faced for charges of bank fraud and aggravated identity theft.

He pleaded guilty to the charges on April 14.

Acting U.S. Attorney for the Eastern District of Virginia Raj Parekh announced the sentencing. He was joined by Fairfax County Police Chief Kevin Davis, Loudoun County Sheriff Michael Chapman, Treasury Inspector General for Tax Administration J. Russell George, and Daniel A. Adame, the inspector in charge of the U.S. Postal Inspection Service’s Washington Division.

“In addition to causing financial harm to the individuals from whom he stole checks and credit cards, the defendant’s sweeping criminal conduct also inflicted emotional harm and distress to his identity theft victims,” Parekh said in a statement. “As this case demonstrates, we are determined to hold accountable those who seek to illegally enrich themselves by defrauding and stealing from our residents.”

According to the DOJ news release, Drew stole the identities of more than 150 people between December 2019 and August 2020:

According to court documents, between approximately December 2019 and August 2020, Jonathan Drew, 39, stole U.S. mail addressed to more than 150 individuals in Fairfax and Loudoun counties. The mail Drew stole included bank statements, credit cards, credit card statements, W-2 forms, and more than $700,000 in checks, including a COVID-19 stimulus payment and checks Drew used to create counterfeit checks.

According to court documents, Drew used the stolen stimulus check to create counterfeit stimulus checks ranging from $1,200 to $2,400, and he negotiated his own authentically issued stimulus check twice. Drew also used the personally identifiable information of several individuals without authorization to lease an apartment; open bank accounts; and attempt to conduct fraudulent transactions through counterfeit checks, forged checks, unauthorized use of credit cards, and wire transfers.

The case was prosecuted by Special Assistant U.S. Attorneys Olivia Zhu and Roberta O. Roberts, along with Assistant U.S. Attorney Russell L. Carlberg.

Attorney General Merrick Garland established a COVID-19 Fraud Enforcement Task Force with the Department of Justice and other government agencies on May 17 to investigate and prosecute crimes related to the pandemic and the various relief programs created to address its economic impact.

The DOJ says people can stay alert for fraud involving COVID-19 vaccinations and testing, unemployment benefits, and taxes by not responding to unsolicited phone calls or emails and avoiding sharing personal or health information with anyone other than trusted medical professionals.

Anyone who thinks they might be a victim of a scam or attempted fraud involving COVID-19 can report it by calling the DOJ National Center for Disaster Fraud Hotline at 866-720-5721 or submitting a National Center for Disaster Fraud complaint form.

Photo via Google Maps

A Reston man pleaded guilty in federal court yesterday (Wednesday) to an elaborate identity theft and fraud scheme that included the creation of counterfeit COVID-19 stimulus checks, the Department of Justice announced.

According to the U.S. Attorney’s Office for the Eastern District of Virginia, which prosecuted the case at the U.S. District Court in Alexandria, 38-year-old Jonathan Drew stole mail addressed to more than 150 individuals in Fairfax County between approximately December 2019 and August 2020.

He used the stolen mail — which included bank statements, credit cards, credit card statements, W-2 forms, and more than $700,000 in checks — to open bank accounts, lease an apartment, and conduct other fraudulent transactions involving counterfeit and forged checks, wire transfers, and the unauthorized use of credit cards.

Among the stolen checks was an Economic Impact Payment check sent by the IRS as part of the federal COVID-19 relief efforts. Drew used that stolen check to create counterfeit stimulus checks ranging in amount from $1,200 to $2,400. He also managed to negotiate “his own authentically issued stimulus check twice,” according to the DOJ.

Drew pleaded guilty to bank fraud and aggravated identity theft. The plea was accepted by U.S. District Judge Anthony J. Trenga and announced by several local and federal officials, including interim Fairfax County Police Chief David Rohrer.

“We are firmly committed to holding accountable fraudsters who engage in identity theft and exploit a national economic crisis for personal gain at the expense of hardworking members of our communities,” Acting U.S. Attorney for the Eastern District of Virginia Raj Parekh said.

Drew has been scheduled for sentencing on August 25. He faces up to 32 years in prison with a mandatory minimum of two years.

Two men from China, including one from Herndon, have pleaded guilty to involvement in a $1.1 million fraud scheme involving gift cards.

One of the men, Shoming Sun, a 41-year-old from Herndon, was sentenced to seven months in prison yesterday, according to a statement from the Department of Justice’s Eastern District of Virginia office.

Court documents say the two men were part of a wire fraud conspiracy. Members of the conspiracy contacted victims by telephone or social media and assumed fictitious identities, claiming to be apart of the Internal Revenue Service or an employee of a financial institution.

The release mentioned they also told victims they were entitled to money or were under a form of immediate financial threat, tricking victims into purchasing gift cards and sending them the redemption codes.

The conspirators used the codes from the gift cards to purchase goods totaling approximately $1.15 million, said the release.

The other man involved in the incident, Yuchen Zhang, a 23-year-old from Manassas, faces a maximum penalty of 20 years in prison and will know sentencing on Feb. 10, 2021.

The Fairfax County Police Department is conducting an investigation into the Lake Anne Condominium Association.

A police spokesperson told Reston Now that the police department cannot provide any further information on the investigation because it is an ongoing case.

“We have received a report and currently we do have an investigation,” said police spokesperson Erica Webb.

Sources who are aware of the investigation told Reston Now that the review concerns the board’s past financial transactions and does not involve the board’s current operations. The investigation is not directed at any one individual, sources said.

On Feb. 18, The Connection published an opinion piece by John Lovaas on the subject.

In late 2019, three new board members were elected to the five-member body. Those members — including new president Senzel Schaefer — said there were committed to improving financial management practices and prioritizing maintenance and repairs to the Lake Anne Village Center.

Schaefer said that the association is complying with law enforcement requests for the results of an operational audit the board launched last month.

Photo via vantagehil/Flickr

Comscore, a media measurement and analytics firm headquartered in Reston Town Center, and its former CEO Serge Matta have been charged by the U.S. Securities and Exchange Commission for defrauding investors and making false and misleading statements about the company’s performance.

In a Tuesday release, the SEC stated that Comscore and Mata agreed to pay $5.7 million in penalties. Matta will also reimburse Comscore $2.1 million.

“As the SEC orders find, Comscore and its former CEO manipulated the accounting for non-monetary and other transactions in an effort to chase revenue targets and deceive investors about the performance of Comscore’s business,” said Melissa R. Hodgman, Associate Director in the SEC’s Enforcement Division. “We will continue to hold issuers and executives accountable for such serious breaches of their fundamental duty to make accurate disclosures to the investing public while giving appropriate credit for a company’s prompt remedial acts and cooperation.”

The investigation revealed that the company — which measures audience engagement across different platforms — overstated revenue by roughly $50 million. Between February 2014 and February 2016, the company attempted to increase its reported revenue by exchanging data sets with another party by inflating revenue, according to the release.

The SEC also said Comscore and Matta create an “illusion of smooth and steady growth in Comscore’s business” by making false and misleading public disclosures about the company’s customer base and products. Specifically, the SEC found that Matta lied to the company’s internal accountant and external audit firm, allowing the company to artificially exceeds its analysis’ revenue target in seven consecutive quarters.

The last few months have been rocky for the media measurement firm. In April, the Wall Street Journal reported the company’s chief executive, Bryan Wiener, left the company after less than a year due to disagreements over the board’s execution of the company’s strategy.

Comscore is located in the heart of Reston Town Center at 11950 Democracy Drive.

Image via Google Maps

Google moving in Reston — “The Mountain View, California-based company is close to announcing plans to move from Reston Town Center to 1900 Reston Metro Plaza, the trophy office building Comstock Holding Cos. Inc.” [Washington Business Journal]

Fox Mill Road now open — A car crash and downed pole on Valentine’s Day shut down Fox Mill Road at Lawyers Road shortly after 2:30 p.m. The road opened up a few minutes ago. [Fairfax County Police]

Tolls tanked — “Tolls are off the table for Fairfax County Parkway, and long-planned High Occupancy Vehicle Lanes in the Virginia County may even be a stretch.” [WTOP]

Todd Hitt pleads guilty to fraud — “Former Kiddar Capital CEO Todd Hitt pleaded guilty to orchestrating eight counts of securities fraud that ultimately cost investors $20 million, according to a plea deal announced Wednesday by the Department of Justice.” Hitt admitted to soliciting about $30 million from investors over a period of four years while making false statements. Part of the $30 million included $17 for Kiddar Capital’s purchase of a Herndon office building. [Washington Business Journal]

Fishing workshop — A hands-on workshop at Lake Fairfax Park (1400 Lake Fairfax Drive) will cover tackle, rods and reels. The program runs from 6-7 p.m., and the cost is $8 per person. [Fairfax County]

The CEO of Kiddar Capital, a Falls Church asset management firm, is accused of lying about the size and value of his company and defrauding investors about a $33 million office building in Herndon, according to charges filed in federal court.

Todd Elliott Hitt, 53, was charged with securities fraud and surrendered to the FBI on Friday.

According to court documents, which were unsealed on Friday, Hitt raised nearly $11 million by falsely claiming to buy the building near a planned Herndon Metro stop. He spent around $9 million to purchase the 4.8-acre office building and relied on bank loans for the remaining balance on the purchase.

Prosecutors say Hitt was involved in an alleged $16 million scheme to defraud investors.

The U.S. Securities and Exchange Commission also found Kiddar claimed to be a global firm with $1.4 billion under management in London, Houston, and Florida, but in reality, the local company only had one office in Falls Church and managed far less than $1 billion.

They also noted that Hitt failed to disclose to investors his “extravagant spending,” which included leasing private jets and buying sports tickets and jewelry.

The complete release can be found online.

Photo via Kiddar Capital

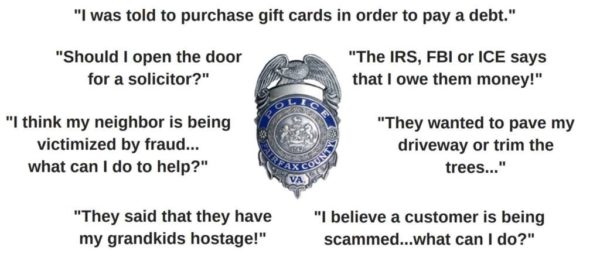

The Reston District Station of the Fairfax County Police Department is hosting a scam and fraud awareness event on September 26 from 4-7 p.m.

The event, which will be held at Reston Associations headquarters (12001 Sunrise Valley Drive), is free and open to the public. A panel will offer insights on how scams that frequently target the older adult community. Subject matter experts will also discuss warning signs of fraud.

Families, caregivers, and businesses are encouraged to attend the event. Parking is free.

For more information, call 703-479-5167.

Photo via FCPD

A U.S. Congressman was the victim of a Reston financial planner’s scheme that bilked investors out of more than $35 million, according to media reports.

A U.S. Congressman was the victim of a Reston financial planner’s scheme that bilked investors out of more than $35 million, according to media reports.

Alan Grayson (D-Florida 9th) lost about $18 million investing with William Dean Chapman. Chapman, the founder of Reston-based Alexander Capital Markets, was sentenced to 12 years in prison in federal court in Alexandria on Friday. Prosecutors say 122 investors lost a collective $36 million over several years.

Grayson was identified in court papers only by the initials A.G., but the Congressman on Monday confirmed he is the A.G. in the report. Greyson is a lawyer elected first elected to Congress in 2009.

Officials said that investors would transfer stock holdings to Chapman as collateral for loans. Chapman then sold the stocks, despite promising investors that they would get back the value of their stocks. If the stocks did not perform, borrowers could keep the money they were loaned. If the borrowers’ stocks did well, they would repay the loan with interest, and Chapman was supposed to return the stocks to the investor at their increased value.

According to the court papers, Chapman, who pled guilty to the charges in May, sold the stocks and had no way to fulfill his obligations if a client’s stock portfolio did well.

“That’s why (Chapman) is going to prison for a long, long time,” Grayson told the New York Daily News. “At least in the end, some kind of justice was served.”

More from The Daily News:

Lawyers for Chapman said it was the strength of Grayson’s stocks that caused Chapman’s scheme to crumble. Chapman and Grayson negotiated a payment plan, according to court records, but it was not enough to keep Chapman’s positions from collapsing.

“Because the return on A.G.’s commodities investments were so astronomical, ACM could not meet its obligations under the loan agreements,” defense lawyer Whitney Minter wrote.

In 2007, Grayson had $9.35 million in a stock portfolio that Chapman was supposed to be holding as collateral. In that year alone, the portfolio’s value increased by 147 percent, to $23 million, according to a chart in the court documents.

It is not the first time Grayson, who represents parts of the Orlando area, has lost tens of millions of dollars in a fraud scheme. In 2009, he won a $34 million judgment after filing a lawsuit in South Carolina under federal racketeering laws against a company called Derivium Capital. Derivium’s business plan for hedging an investor’s stock profile was nearly identical to the plan outline by Chapman.

Grayson said he first entered into deals with Chapman in 2003, well before the deal with Derivium went south, so he had no reason to be suspicious the arrangement.

And he said the loans themselves were a perfectly reasonable way to manage his portfolio, but relied on Chapman and Derivium to hold up their end of the bargain. He disputed that the astronomical returns to which he was entitled caused Chapman’s downfall.

“If they had not sold the collateral, it all would have worked,” said Grayson, who is generally listed as one of the 20 wealthiest members of Congress with assets of more than $20 million. His financial disclosure forms list holdings in dozens of stocks. His dealings with Chapman preceded his time in Congress, which began in 2009.

The owner of a Reston-based financial services firm was sentenced to 12 years in prison on Friday after pleading guilty to a wire fraud that prosecutors say cheated investors out of more than $35 million.

The owner of a Reston-based financial services firm was sentenced to 12 years in prison on Friday after pleading guilty to a wire fraud that prosecutors say cheated investors out of more than $35 million.

William Dean Chapman, 44, of Sterling, was the founder of Reston-based Alexander Capital Markets. Prosecutors say 122 investors lost a collective $36 million over several years. One investor, an elected official identified in court papers only by the initials A.G., lost $18 million.

Officials said that investors would transfer stock holdings to Chapman as collateral for loans. Chapman then sold the stocks, despite promising investors that they would get back the value of their stocks.

Chapman tried to withdraw his guilty plea before Friday’s sentencing in federal court in Alexandria but was denied.