The Washingtonian’s Benjamin Wofford gave Reston a big nod in a feature published over the weekend.

Titled, “The Very Uncivil War Going Down in America’s Most Civil Suburb,” Wofford writes that the once inclusive suburb is now “whiter, older and richer than its founder ever intended,” locking itself in a battle for its soul and the preservation of open space.

Calling the opponents of a recently deferred plan to increase Reston’s population cap “the Yellow Shirts,” the article lays out a narrative of the battle to preserve the community’s two golf courses, issues of affordability, and nimbyism. The article has drawn interesting responses from readers.

i grew up in Reston in the 80s, when it was still a town where working-class people could live, and watching it (from progressively farther away, lol) remake itself as Federal Tech Contractor Whole Foods Hell over the past 30 years has been the weirdest fucking thing https://t.co/w8syJNDdHR

— Yulebert Reindeerko (@AlbertBurneko) December 17, 2019

Hard to choose the best quote. Maybe "In Petrine’s eyes, the problem was that anyone had sought to bring Metro to Reston at all.The list of turncoats was vast: the county for putting its grubby hands on the town, Metro for spreading through the county, [LBJ] for conceiving Metro"

— David Schleicher (@ProfSchleich) December 17, 2019

Wofford points out some interesting U.S. Census Bureau statistics:

Lately, though, the town has followed the familiar arc of an aging suburb. Since 2000, according to Census data, the number of children has fallen by nearly 10 percent. Reston is now 17 percent whiter than Fairfax County.

He chats with one of the “Yellow Shirts”:

To that sect of the Yellow Shirts, who insisted they were not entirely opposed to growth, the fight was about preservation of idyllic values. But at the core of the movement, sentiments about Reston’s evolution were more inflamed. “It’s not even hardly recognizable!” complained Tammi Petrine, one of the earliest activists. “If I could think of another place to go, I would. Because this is a shitshow.”

A local Restonian offers his assessment of the demographics of Reston:

Bouie was willing to see the worst in this admission. “When they’re saying they’re against Metro, they weren’t thinking about people from Reston going to DC. They were thinking about people from DC coming here,” he said. “Cranky old white people,” Bouie sniffed. “There’s no diversity in that group.”

One of Bob Simon’s first salespeople — Chuck Veatch — offers his persepctive:

He chided the competing caricatures of Reston that had taken root in the haze of infighting, either a municipal kibbutz or a gated hamlet in Mar-a-Lago. “It’s not a socialist utopia,” he chuckled. At the same time, the Yellow Shirts misunderstood that “the success of the community is not about how much money your house is worth.” Amid the partisan bickering, everyone had misplaced something elemental: the town’s shared sense of community, a distinct virtue in the face of the booming metropolis surrounding it. “Bob started out by weaving the social fabric of Reston first,” Veatch said.

The article appeared in the December issue of the magazine.

Photo by Marjorie Copson

This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

Over the past several weeks I have spent more than a dozen hours digging out at least a bushel of Star-of-Bethlehem plants and bulbs even though this time of year they look pretty with their white, six-petal blossoms. Soon the plants would have gone back into a bulb, so I dig them when they are blooming, and I can locate them.

Star-of-Bethlehem (Ornithogalum umbellatum) is a winter bulb belonging to the Lily family and blooms in late spring or early summer. It is native to the Mediterranean region and is similar to wild garlic. Star-of-Bethlehem flowers, though attractive for a few weeks when in bloom, have escaped cultivation in many areas like my flower bed. When this happens, they quickly become a danger to native and other ornamental plants. The problem is it takes over and will choke out other bulbs and plants. The only solution is to dig them out. A single plant can have dozens of bulbs that continue to multiply until removed.

While certainly not a direct analogy I could not help but think while I was digging away in my garden that in public policy there are areas where false or misleading ideas get started and are difficult if not impossible to dig out to expose the truth. Certainly, the Founding Fathers who were fresh from a revolutionary war to free themselves from the British Empire recognized the need to protect themselves in the future. As they wrote in the Constitution: “A well regulated Militia, being necessary to the security of a free State, the right of the people to keep and bear Arms, shall not be infringed.” Some scholars point to the prefatory language “a well regulated Militia” to argue that the Framers intended only to restrict Congress from legislating away a state’s right to self-defense. They contend that citizens do not have an unlimited individual right to possess guns and that local, state, and federal legislative bodies therefore possess the authority to regulate firearms. The idea of an unlimited right to possess guns has taken hold and is cultivated by arms manufacturers and others to defeat the most reasonable, common-sense legislation.

So far in the first 120 days of this year according to the press there have been more than 100 mass shootings, more than 4,500 gun deaths not counting suicides with many being by assault weapons, and more than 8,400 gun injuries. These numbers have increased exponentially over the last couple of decades and show no indication of decline.

Reasonable gun safety legislation would not confiscate all guns despite what the fear mongers who lead the opposition to any gun safety legislation would have us believe. I support gun safety legislation — not eliminating gun ownership. We need to continue digging out the truth and do the hard work to have future generations act on facts and not fear. It is the only way to stop an invasion of misinformation that threatens the safety of individuals and families.

File photo

Lunchtime with the Arts at Mason — Performers from George Mason University’s College of Visual and Performing Arts offer free lunchtime concerts in Reston Town Square Park. The first performance kicks off today from 12:30 to 1:30 p.m. [Reston Community Center]

Fish Survey Underway in Reston — The Department of Game and Inland Fisheries will be out and about to conduct a fish survey of Reston’s lakes. The effort is in partnership with Reston Association. [Reston Association]

Reston Has a Problem — In this opinion piece, Michael Freedman-Schnapp argues that the community’s founding vision of inclusion has “begun to slip into the background.” [Greater Greater Washington]

File photo

Have thoughts about Reston Now’s coverage of Reston, Herndon and Great Falls? Want to share your opinions about local issues?

Reston Now welcomes letters to the editors and op-eds of specific interest to the Reston, Herndon and Great Falls community.

The key difference is that an op-ed can be an opinion piece about a local issue, while a letter to the editor responds directly to a Reston Now story.

Please email it to [email protected]. You are also welcome to contact us with your idea for feedback before submitting it.

While there is no word limit, we suggest under 1,000 words. Contributions may be edited for length, content and style/grammar.

Reston Now does not publish op-eds relating to a specific candidate running for political office — either from the candidate’s team or opponents.

Thank you to everyone who has submitted op-eds and letters to the editor already.

Have thoughts about Reston Now’s coverage of Reston, Herndon and Great Falls? Want to share your opinions about local issues?

Reston Now welcomes letters to the editors and op-eds of specific interest to the Reston, Herndon and Great Falls community.

The key difference is that an op-ed can be an opinion piece about a local issue, while a letter to the editor responds directly to a Reston Now story.

Please email it to [email protected]. You are also welcome to contact us with your idea for feedback before submitting it.

While there is no word limit, we suggest under 1,000 words. Contributions may be edited for length, content and style/grammar.

Reston Now does not publish op-eds relating to a specific candidate running for political office — either from the candidate’s team or opponents.

Thank you to everyone who has submitted op-eds and letters to the editor already.

This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

The opening of the 2019 session of the General Assembly is rapidly approaching! Just a little over a month away!

This session, held during the 400th anniversary of the founding of a representative legislative body in Jamestown in 1619, is shaping up to be a transitional — if not a transformative — one. The heightened awareness of the public on issues and the widened interest in public participation in civic matters add to the importance and significance of the General Assembly meeting this coming year beginning on January 9.

While I gather information on issues of public concern throughout the year from talking with individuals and groups, I have found that leading up to the legislative session is a time when others want to step up and make their opinions known.

That’s why Senator Janet Howell and I sponsor a community meeting twice each year and encourage public testimony. As has been announced in my newsletter and on social media, we will be meeting with constituents Wednesday evening, December 12 from 7:30 to 9:00 p.m. at the Reston Community Center at Lake Anne. All are welcome. No advanced registration is required.

Likewise, you can make your views known to the entire Northern Virginia delegation on January 5. Pre-registration is recommended as there are many people who offer testimony at that event.

Another option of sharing your views with me is through my online Legislative Survey. Access the survey through my website, www.kenplum.com and click on Legislative Session Survey (top right). The information gathered through the survey is helpful to me not as a poll, but as an opportunity for anyone to express an opinion.

Polling information is valuable to get the overall pulse of the community. The most recent poll of Virginia voters on issues that primarily affect the Commonwealth was conducted by the Wason Center for Public Policy at Christopher Newport University. The poll found that 81 percent of Virginians sampled support ratification of the Equal Rights Amendment.

There is a strong advocacy effort underway throughout the state to make Virginia the 38th and final state needed to ratify the amendment. As a supporter of the ERA throughout my legislative career, I look forward to the amendment getting out of committee and being voted on by the entire legislature.

My effort going back to the beginning of my legislative career to establish a nonpartisan redistricting process to draw legislative boundaries has the best chance of approval ever. Nonpartisan redistricting has the approval of 78 percent of voters. Amending the constitution requires legislative approval of two sessions of the General Assembly and a referendum of the voters in order to pass. Passage of an amendment this year is critical to having a process in place for redrawing district lines based on the 2020 census.

The poll found that 49 percent of Virginians sampled support an across-the-board tax cut. At the same time, there is support for increasing funding for education programs at all levels.

Please let me know your opinion on issues of importance to you.

File photo

Lane and ramp closures this week — Phase two of the Silver Line project ushers in several lane, shoulder and road closures this week along the Dulles Toll Road, the Dulles International Airport Access Highway, Herndon Parkway, Sunset Hills Road and Sunrise Valley Drive. The complete list of closures is available online. [Dulles Corridor Metrorail Project]

Not denser than Manhattan — Canaan Merchant responds to an opinion piece published on Reston Now that asserts Reston is going to be denser than Manhattan. [Greater Greater Washington]

Bechtel brings it — The engineering giant moved its global headquarters from San Francisco to Sunset Hills Road in Reston this year. The company has become one of Washington’s biggest privately held players. [The Washington Business Journal]

Suspicious package cleared by Metro transit police — A package found on Friday at Wiehle-Reston East Metro Station was cleared by police. [Metro Transit Police]

Corn night moon gathering tonight — View this month’s full moon, which, according to American Indian folklore, is named the Corn Moon. It indicates the time of the year to harvest crops. View the moon through the park’s telescope and enjoy a corn-inspired treat over the fire. Registration is $8. [Fairfax County Government]

Flickr pool photo by vantagehill

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Reston’s future lies largely in the numbers that define the county’s plan for Reston’s transit station areas (TSAs)–the areas roughly within a half-mile of each Metro station. The results of looking at those numbers are shocking, but not really surprising.

The Board of Supervisors-approved Reston Master Plan calls for 44,000 dwelling units (DUs) in Reston’s TSAs, virtually all of which will be high-rise (“elevator”), high-density DUs–condos and apartments.

County planning assumes 2.1 people will live in each high-rise, high-density DU.

Put together, that means a potential population of 92,400 people in Reston’s station areas. That’s without any affordable housing “bonuses” or development waiver approvals or other uncounted DUs or people, a frequent fact of life in Fairfax County.

When the Reston Master Plan Task Force was working on a new plan for the station areas, the county provided several different numbers for the actual acreage of the study area. These ranged from 1,232 acres (1.925 square miles) to 1,683 acres (2.630 square miles) of land in Reston’s TSAs. The county provided no explanation for the range of values.

Dividing the number of people by the acreage, the resulting number is somewhere between 55 and 75 per acre. On a square mile basis, that Reston TSA density is between 35,200 and 48,000 persons per square mile (pers/SM).

According to Wikipedia, Manhattan has a density of 26,403 pers/SM. That makes the planned population of Reston’s TSAs at least one-third denser than and potentially nearly twice as dense as Manhattan is today.

Wikipedia adds that Manhattan’s residential density “makes it the densest of any American municipality with a population above 100,000.” And Reston’s TSA population may well exceed that 100,000 number if the county continues its bonus and waiver giveaways to developers.

I don’t think anyone who lives in Reston thinks that two square miles of super-density in Reston’s TSAs cutting through the middle of our community is consistent with any definition of preserving, much less improving, Reston’s quality of life. And the county has no meaningful plans or means to meet the infrastructure requirements of this population or the needs of the surrounding Reston community.

This is an op/ed submitted by Paul Anderson, a Reston resident, on February 28. It does not reflect the opinions of Reston Now.

I was saddened to see that Ms. Fulkerson “resigned” last week. Saddened and disheartened that the populist anger that has so gripped our country seems to be very active right here in our own little community. Clearly the purchase of the Tetra property was the last straw, but I suspect that this has been simmering over a long time with many initiatives and changes causing increasing ire and angst; the new RA Headquarters, the Nature House, the Lake Anne land swap and finally Tetra. Add to that anything at all that happens in small tax district 5 and paid parking at Reston Town Center and boom! One head on a stake and sadly probably more to come.

The spite of board member John Bowman’s attempt to have the Tetra purchase reviewed by the Commonwealth Attorney even after a professional review by highly regarded StoneTurn, which found no evidence of malfeasance, was shocking in what it exposed. A well of vitriol whose depth is breathtaking to behold.

The orchestration of this separation before the new board is seated in April was also disheartening. Clearly there is a core on the current board with a mission, they needed to act while they knew that they had the numeric advantage. Which brings me to the election.

We have for the first time that I can recall a large “slate” running for the four vacancies. Two of the incumbents were previously appointed to their positions and two are running for the first time. Three of the four have past experience in the same Reston organizations, RCA – the Reston Citizens Association and Reston 2020. Since the four are using a single piece of co-branded campaign material it would appear that the old agreement that current Board Members do not endorse candidates has gone out the window. We could check the Ethics Rules on this topic but wait, no, we can’t because this board after making scene after scene about ethics found it inconvenient to actually get that task done.

My point in all of this is simple. The health of the Reston Association Board depends on a diversity of independent opinions, not groupthink that has been hobbled together by our most angry citizens. I’m not telling my fellow Reston citizens who to vote for but I hope that they’ll consider the new faces and differing opinions that are seeking election this term because that’s what will move this community forward in positive ways. To the current Board; you’ve got your pound of flesh in Ms. Fulkerson. Let’s move on.

File photo.

Money Magazine has rated Reston as one of the best places to live in the country. Nothing new here. Reston has long been ranked among most desirable locations to live, work and play. As the magazine notes, “Robert E. Simon mapped out a vision of a community that upheld open space, recreational facilities and aesthetic beauty.” Further, Money explains, Reston “offers a woodsy atmosphere that includes expanses of parks, lakes, golf courses and bridle paths.”

Money Magazine has rated Reston as one of the best places to live in the country. Nothing new here. Reston has long been ranked among most desirable locations to live, work and play. As the magazine notes, “Robert E. Simon mapped out a vision of a community that upheld open space, recreational facilities and aesthetic beauty.” Further, Money explains, Reston “offers a woodsy atmosphere that includes expanses of parks, lakes, golf courses and bridle paths.”

Of course, Money’s brief report doesn’t capture all of Reston’s attractions, like the fact that we have always been a big hearted community that welcomes everyone, that we value development when it is appropriately supported by infrastructure and that preserving a quality of life for our children and grandchildren is more important than the passing obsessions of the day.

Perhaps more interesting than which communities are considered great places to live is to look at the sort of communities not on the list. You will search in vain for a Ballston, a Tysons, or a Rosslyn – and yet these are the models for what our County officials want us to become.

A show of hands – does anyone think that advocates of massively increased density in Reston care about your family’s quality of life? Anyone?

Reston has been a planned community for over fifty years. And for more than fifty years Reston has generally delivered on its promise of being a great place to live. Ballston and Tysons have many attractions – I have friends who are quite happy in both places – but they aren’t Reston. Nor do they want to be. And that’s fine. Let Tysons be Tysons – but let’s let Reston be Reston.

If you care about keeping the “planned” in our planned community, support the efforts of the community groups working to make sure Reston is on Money’s lists in 2023, 2028 and beyond. Please go to https://plannedreston.wordpress.com from more information. It’s your future.

Dennis Hays

President, Reston Citizens Association

(Editor’s note: If you wish to submit an op-ed, email [email protected].)

This is a commentary from Del. Ken Plum (D-Fairfax), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

This is a commentary from Del. Ken Plum (D-Fairfax), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

The strong positive response to my recent Staycation column caused me to think that I should write another one with travel suggestions for a different part of the Commonwealth. With the first column we went south through the beautiful Piedmont of Virginia.

For this trip I suggest that we go further west on I-66 to the Shenandoah Valley. Before turning south you might want to consider going north to Winchester on I-81 particularly during apple picking season. Also north is the wonderful Museum of the Shenandoah Valley (www.themsv.org) with its permanent exhibits as well as special shows.

Next door to the Museum is Historic Rosemont Manor, for many years the home of former governor and senator Harry F. Byrd, Jr. whose machine ran Virginia politics for decades. It has limited lodging available to the public but can be rented for special events. Also in Winchester is the home of Patsy Cline, the queen of country music, which is open to the public.

There are many civil war sites in the Valley. A Civil War Trails map is available at www.civilwartraveler.com. You can also head south at Front Royal until you come to the entrance to the Skyline Drive. The views are beautiful; in the first segment you can see seven bends of the Shenandoah River. The Drive gets crowded during the fall foliage season, but the beauty of the drive makes it all worthwhile.

If you have not been to a natural cavern, get off the Skyline Drive at Route 11 heading west to Luray. Most people agree that the natural beauty of the Luray Caverns cannot be beaten. Luray is in Page County where I grew up as a youngster. Head further west on Route 211 until you get to I-81 that runs down the center of the Valley. For a more scenic drive consider going south on Route 11. It is a little narrower with slower speed limits, but remember–on a staycation we take our time to enjoy the sights.

The campus of James Madison University in Harrisonburg is beautiful, especially the early limestone buildings. Stop on Court Square in town and have lunch at Capitol Ale House. Further south to Staunton a recommended stop is the American Frontier Culture Museum, an outdoor museum with homes from the seventeenth century relocated from England, Ireland, Germany and other countries to show the kind of housing the early settlers had. If you need a meal, stop at Mrs. Rowe’s (Mrs. Rowes Family Restaurant). You will think you are back in the 1960s. A slice of pie is a must, and you can buy Mrs. Rowe’s pie cookbook.

We have about reached our limits for a one-day trip, so we can head home. It will add to the time of your trip, but if you go east on Route 64 you can pick up the Skyline Drive at Afton Mountain. Heading north you can eat at Big Meadows Lodge or spend the night at Skyland Lodge where I worked in the summers during high school.

If you want, we can plan a longer trip where we go to beautiful Abingdon, home of the Barter Theater or further west on the Crooked Road of Country Music (Crooked Road). I have traveled around Virginia all my life and never get bored with it. Glad to have you along.

This is a commentary from Del. Ken Plum (D-Fairfax), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

This is a commentary from Del. Ken Plum (D-Fairfax), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

Just when you think things are changing you can be shocked to realize just how much they stay the same. Politics in Virginia are a prime example.

For more than a century after the Civil War, the consistent factor in politics was race-baiting. The then-called Democrats in the South, who later became known as Dixiecrats and today are the conservative wing of the Republican Party, were successful with a variety of laws that disenfranchised African Americans. Even with the few African Americans who could get through the labyrinth of laws that included blank-sheet registration forms, literacy tests and poll taxes, the scare tactic employed by too many candidates was to suggest that their opponent was a lover of black people — but using a derogatory term. That fear of black people has its roots back to the centuries where black people were enslaved and brutal enforcement and fear were used to keep them that way.

The Civil War did not resolve the feeling between blacks and whites, and slave codes were replaced with Jim Crow laws that whites could use to assert supremacy over black people. For a candidate to take a position that could be interpreted as being favorable to African Americans would mean almost certain defeat at the polls. Only Supreme Court decisions and federal laws like the Civil Rights Act and the Voting Rights Act created a more level political playing field between the races. Continued efforts to suppress the votes of minorities and to unnecessarily complicate the voting process are still employed by some trying to maintain a structured society of white supremacy.

More recently, those who want to keep or expand their political power have swept immigrants — whatever their status — into the realm of those who are to be feared and suppressed from participating in the democratic process.

Many strive to gain maximum political advantage through whatever means while at the same time wanting to keep the appearance of respect and patriotism. The recent television ad with scary images and references to fear and the MS-13 gang intends to scare voters into rejecting a compassionate medical doctor with an ad that fact-checkers have found to be untruthful.

Another concern from the current campaign is the suggestion from a white female candidate for lieutenant governor that her black male opponent does not understand the issues well enough to discuss them “intelligently.” Disregarding the excellent academic credentials of her opponent, her comments had the tone of the past that one observer said seemed more appropriate for 1957 than 2017.

At the national level, there are daily statements and actions that hearken back to the racial climate of the Old South. This year in Virginia, we have a unique opportunity on Nov. 7 to make a statement with our votes that we reject the discrimination of the past. It is always important to vote, but it is more important than ever this year. Despite efforts to romanticize the Old South and the Confederacy, we need to learn the truth and understand why we need to move on.

This is an op/ed submitted by Dennis Hays, president of the Reston Citizens Association. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Dennis Hays, president of the Reston Citizens Association. It does not reflect the opinions of Reston Now.

It seems like every day, a major new development project in Reston is announced. And it seems like every day, traffic gets a little worse and schools and athletic fields get a little more crowded.

Is there a connection here? Well, of course there is.

Reston, since its founding, has excelled and prospered as a planned community. And the plan has been that development and the requisite infrastructure would go hand in hand. The problem is not (always) new development; the problem is that new development calls for a corresponding investment in roads, bridges and underpasses, schools, playgrounds, storm drainage, additional open space and, yes, trees — and this isn’t happening.

Economists often point to a phenomenon called “the Tragedy of the Commons” — the observation that when individual users of a commonly held resource are free to maximize their personal benefit at the expense of the larger community, they will generally do so. The “commonly held resource” in this case being the unique and special nature of a Reston where one can Live, Work and Play in harmony with nature. In a perfect world, everyone — the County, the developers and residents of Reston alike — would work together to grow Reston while preserving those things that make this community what it is.

Sadly, we don’t live in a perfect world.

The County and the developers want to dramatically increase the population density of Reston. They are naturally driven by, and give priority to, a desire for tax revenue and profits respectively. Not bad things in themselves, of course, unless they come at the unwarranted expense of others — which, in this case, they do.

That leaves those of us who live and work here as the ones with both the most to gain and the most to lose as decisions about our future are made. In the coming weeks a number of key issues — ranging from whether to triple the density of Reston, to what kind of library we will have, to how crowded our schools will be — are to be acted upon. As individuals, we have scant ability to ensure infrastructure is given equal priority to development. But this is Reston, and Reston being Reston, we have a vast community of engaged citizens with a deep commitment to balance and fairness and a future we can proudly pass on to our posterity.

Three weeks ago, over 400 individuals turned out for the County’s fourth attempt to justify the density increase — only to have the meeting canceled because we far exceeded the room’s capacity. Now the meeting has been rescheduled for 7 p.m. Monday, Oct. 23 at South Lakes High Schools. The County will draw upon the full-time lawyers and urban planners we as taxpayers pay for to tell us what they say is in our best interest. On our side we have — each other. We need everyone who believes in defending the Commons to attend this meeting.

As Margaret Mead observed, “Never doubt that a small group of thoughtful, committed citizens can change the world. Indeed, it is the only thing that ever has.”

This is a commentary from Del. Ken Plum (D-Fairfax), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

This is a commentary from Del. Ken Plum (D-Fairfax), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

Candidate Terry McAuliffe promised during his campaign for governor that he would work to build a new economy in Virginia. A reduction of federal spending in the state along with the decline of traditional mining and manufacturing jobs had left the Virginia economy sluggish.

If there was any doubt as to what Gov. McAuliffe had in mind, one only needs to look at his performance in office. His latest performance figures — although these numbers increase daily — are 1,027 new projects, 215,100 jobs created and $165 billion in capital investments. No other governor has come close to these kinds of numbers. But he clearly is not done yet.

Just last week, Gov. McAuliffe announced that Facebook will bring more than $1 billion of new investment to the Commonwealth. Facebook is directly investing $750 million to establish a 970,000-square-foot data center in the White Oak Technology Park in Henrico County. The project will bring thousands of construction jobs to the region and more than 100 full-time operational jobs. Virginia is already a leader in data centers with a record number in Loudoun County.

An exciting aspect to this new project is that with a new renewable energy tariff designed by Dominion Energy Virginia and Facebook, hundreds of millions of additional dollars will be invested in the construction of multiple solar facilities in the Commonwealth to service Facebook’s Henrico data center with 100 percent renewable energy. That feature continues a trend that has been going on in Virginia in the use of solar-generated electricity with new and expanded business projects.

In another project, Amazon is behind what had been the state’s largest planned solar installation to date, an 80-megawatt system in Accomack County. Early last year another solar project was introduced that spurred Virginia’s solar energy market by a partnership among the state, Dominion Virginia Power and Microsoft Corp. to bring a 20-megawatt solar farm to Fauquier County. The 260,000 panels on 125 acres represented more solar energy than was available across all of Virginia two years ago.

Recent evidence demonstrates that the new economy of the Commonwealth is being recognized nationally. Recently, Virginia was ranked in Area Development magazine’s 2017 “Top States for Doing Business” annual survey for the first time since 2010. Overall, the Commonwealth placed 11th out of 20 states ranked in the prestigious annual site consultants’ survey.

The Commonwealth ranked in the Top 10 in five of 12 subcategories that impact companies’ location and facility plans, including: Cooperative & Responsive State Government, fifth; Leading Workforce Development Programs, seventh; Competitive Labor Environment, eighth; Favorable Regulatory Environment, ninth; and Speed of Permitting, ninth. These rankings represent significant advances for Virginia as the state has not placed in any subcategories since 2013. This year also marks the first time Virginia has ever placed in the Cooperative & Responsive State Government, Competitive Labor Environment, and Speed of Permitting categories.

The new economy is proving to be good for jobs, with record low unemployment, and good for communities that were struggling to recover from the Great Recession. At the same time, it is good for the environment, with record growth in solar energy production.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

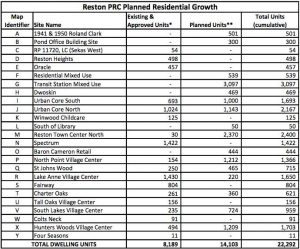

Restonians turned out in droves two weeks ago for a County-organized community meeting on its proposed Reston PRC zoning ordinance amendment. The essence of the proposed language change is to increase the cap on Reston’s population from 13 to 16 people per acre, but that ignores several other factors including station area development, affordable housing and “bonus” market rate housing for developers. The crowd was so large that Supervisor Hudgins was forced to cancel the meeting. Those hundreds of people were there because, contrary to what the County keeps telling the community, the proposed zoning change opens the door for an overall tripling of Reston’s population.

But that is only part of the story.

An important element of the zoning amendment proposal is the residential development it would not only allow, but is already planned, in our Village Centers. The Village Centers–North Point, Lake Anne, South Lakes, and Hunters Woods–are currently our neighborhood shopping centers and intended to be “neighborhood gathering places” in Bob Simon’s vision. They are where we buy our groceries, purchase our prescriptions, dine out in locally-owned restaurants, and meet many of our other family needs.

Here is what the Reston Master Plan has to say about the role of our Village Centers:

The general vision for Reston’s Village Centers addresses the fundamental elements necessary for any Village Center to achieve the desired goal of becoming a vibrant community gathering space. The Village Center general vision is an elaboration of the Reston Vision and Planning Principles. Recognizing that each Village Center faces unique circumstances, redevelopment proposals should take advantage of this to creatively interpret the general vision to provide a unique, vibrant community gathering space:

• Enhance Village Centers as vibrant neighborhood gathering places.

• Advance excellence in site design and architecture.

• Strengthen connectivity and mobility.

• Protect and respect the surrounding residential neighborhoods. . . .(The) Central Public Plaza should (h)ighlight the Village Centers as neighborhood scale gathering places, in contrast to the regional scale gathering places in the Town Center or the community scale gathering places in the other TSAs.

In short, our Village Centers are meant to be our hyper-local “gathering places” to live, work, and play with our families, friends, and neighbors. Nothing in the whole section of the Comprehensive Plan on Reston’s Village Centers suggests they should be anything other than neighborhood serving and, indeed, the plan suggests the opposite.

But that is not what the proposed Reston PRC zoning ordinance would allow and, indeed, what is already being planned according to the County’s data. The county’s table of proposed redevelopment sites, which provides the county’s justification for raising the population cap, projects huge increases in dwelling units and population that are totally out of character and will overwhelm North and South Reston.

But that is not what the proposed Reston PRC zoning ordinance would allow and, indeed, what is already being planned according to the County’s data. The county’s table of proposed redevelopment sites, which provides the county’s justification for raising the population cap, projects huge increases in dwelling units and population that are totally out of character and will overwhelm North and South Reston.

Approval of the PRC zoning amendment to raise the population cap to accommodate such growth will allow developers to add nearly 13,000 residents to our Village Centers, including new affordable and bonus market rate housing that could be added under the county’s rules but is not included in the county’s table. In the worst case example, North Point Village Center, the PRC re-zoning proposal shows a potential twelve-fold increase in dwelling units (DUs), an increase of nearly 1,700 DUs and 3,600 residents. At the low end of the spectrum is Lake Anne Village Center whose redevelopment plan has already been approved with a near tripling of the number of residents to more than 2,600. Across Reston’s four Village Centers, population would be allowed to nearly quintuple.