A housing company is looking to transform wooded land near Route 28 in McNair with townhomes, part of a years-old vision to bring an elementary school and additional housing to the area.

Van Metre Homes at Sunrise Valley, tied to the Van Metre real estate companies, acquired the property in December 2020 for $26.1 million. The developer submitted an application in August to build 157 traditional townhomes and 36 stacked townhomes, Dranesville District Supervisor John Foust’s office confirmed.

The company declined to discuss the project.

The property runs along Frying Pan Road and Sunrise Valley Drive in McNair, near office parks and residential neighborhoods, including the Towns at Carters Grove development that’s currently under construction.

Van Metre will need site and building approvals for the project from the county, which said yesterday (Thursday) that it is still reviewing the application.

In 2019, the Fairfax County Board of Supervisors rezoned the nearly 44-acre parcel from an industrial zone to a residential area with mixed-use commercial possibilities. The vote required the developer to dedicate 5.5 acres of land to a planned Silver Line elementary school.

Fairfax County Public Schools’ current proposed capital improvement program has planning and design work on the school slated to begin in fiscal year 2024, which runs from July 1, 2023 to June 30, 2024.

Pomeroy/Clark, a joint venture between Bethesda investment firm Clark Enterprises and Fairfax’s Pomeroy Development Company, submitted the original rezoning plan in 2016.

Plans showed a new road being extended under overhead transmission lines from Frying Pan Road to River Birch Road.

Van Metre already owns the Woodland Park apartment complex that takes up nearly 27 acres a few miles up the road.

Photo via Google Maps

Prices are rising across several new developments along the Dulles Toll Road corridor.

It’s happening as the seasons change this year, affecting locations near existing and yet-to-open Metrorail stations.

At Wiehle Avenue for The Townhomes at Reston Station, which features four-story homes with a garage, prices have increased from $786,500 to $807,500 for its lowest model over the course of this year.

Bethesda-based homebuilder EYA didn’t respond to messages seeking comment.

The three- or four-bedroom townhomes have approximately 1,690 square feet of space with luxury amenities.

The base price of another model there, townhomes with elevators, also has increased from the upper $900,000s to $1.02 million and now to $1.075 million, based on figures presented on its website.

Floorplans for different units show two-car garages, a study, three bedrooms, a loft and a rooftop terrace. But designs can vary and include four bedrooms. A base model starts at 2,420 square feet.

The townhome prices come amid a flurry of competition as apartments, affordable housing developments like one near Dulles airport and other homes spring up throughout Fairfax County.

Factors contributing to price changes

Eric Maribojoc, the executive director of the Center for Real Estate Entrepreneurship at George Mason University, noted how low-interest mortgage rates have helped buyers’ high demand for housing.

Along with easier to access to money for buyers, new home development continues, too, reshaping existing areas.

“Developers remain bullish on residential projects near the Silver Line and other metro stations,” Maribojoc said in an email. “They will continue to deliver high-rise condominium projects adjacent to stations and lower-rise townhome projects a little further away. Redevelopment of obsolete office buildings, hotels, and retail centers, particularly those impacted by pandemic-related tenant issues, to new residential units may also expand.”

But he said townhome prices are likely to moderate over the next year, noting the mortgage rates are poised to increase in 2022 due to Federal Reserve policy.

Despite the competition, not every company is responding in the same way with pricing. At least one development is even decreasing prices: At Tall Oaks Flats, located farther north on Wiehle Avenue, Stanley Martin Homes has decreased its one-floor condominium price from the mid-$500,000s down to the upper $400,000s.

Meanwhile, near the Innovation Center Station, a new development also by Stanley Martin Homes has had prices in the $500,000s for condos and $700,000s for townhomes. Construction crews have been erecting wooden frameworks for the project and setting up other construction for the company’s Liberty Park neighborhood. The homes offer two to four bedrooms and up to 2,700 square feet.

Older areas see boom

In Tysons, one project, Union Park at McLean – The Lofts, is about half a mile away from the McLean Station and has 21 homes left along with two model units. So far, 73 have been sold, according to its website.

Its lowest base price is for a two-story, three-bedroom model with a garage. That low point has risen from just under $750,000 in April to just under $770,000. Units start at 1,587 square feet.

“Commercial development has been very active adjacent to Silver Line stations with major mixed-use developments such as The Boro, Reston Station and the Capital One campus,” Maribojoc wrote. “These provide amenities such as grocery stores, retail shops and entertainment in high-density and walkable neighborhoods.”

Residents fall for the urban-like environment in a suburban setting — especially homebuyers relocating from the District, he says.

During the pandemic, a food vendor told fellow merchant Pedro Banegas, 59, who uses an electric wheelchair, that he had a surprise for him.

Later, the good Samaritan drove to his house and handed him the keys to a 2007 van, which Banegas has been using for nearly a year, the merchant says. He’s currently been selling snacks and drinks to construction workers on job sites near McNair along Sunrise Valley Drive.

He’s not the only one doing so out of a van, and food trucks also make stops to catch workers’ breaks. They have plenty of customers. A Donohoe Construction Co. spokesperson said they average 160 to 190 workers on the site each day near the Innovation Center Station.

Banegas regularly parks his maroon-colored vehicle on the curb at multiple job sites after making the commute from the Falls Church area where he lives. He doesn’t always like sharing about his personal life, but his children are in their 30s. He wakes up at 4 a.m. and takes the weekends off, going to church on Sundays.

He buys snack pack boxes to get a variety of chips like Doritos and Cheetos, and customers make their own coffee with a mix he provides along with an orange and white beverage dispenser filled with hot water.

Two of his merchant stops include building sites where tower cranes have been: one for a 274-unit affordable housing development called Ovation at Arrowbrook by Centreville Road and another for the Brightview Senior Living facility that Donohoe is building.

A third site he visits includes the 155 townhomes and condominiums that Stanley Martin is building by office buildings. He sticks to those sites, but other nearby construction includes a six-story multifamily development, Passport NoVA, as well as retail and luxury residence along Dulles Station Boulevard for a development called Makers Rise.

Banegas says he operated heavy equipment before he lost his right leg. Now, selling chips and coffee helps him get by. Other food vendors give him food for his own meals, too, as they work by construction sites.

Whether it’s a familiar or unfamiliar face, he greets people with a smile and chatter, both in English and Spanish, which translates well with numerous construction workers doing the same.

A residential development project that’s stalled for years and would run along Hidden Creek Golf Course is moving forward.

Project leaders with Golf Course Overlook LLC and Golf Course Plaza LLC say they could demolish an office complex that housed a Montessori school, law offices and more.

“We get excited for each and every new development and measure of progress that we come across each day,” said Curt Adkins, vice president of Golf Course Overlook, which is based at the site (11480 Sunset Hills Road).

All of Golf Course Plaza’s tenants have vacated and a crew involved in the project remains at the site.

“We were asked to leave,” attorney JohnPaul Callan of The Callan Law Firm said, noting his office moved to Sterling. “It was probably about two months ago.”

Another tenant, Berthold Academy, says on its website that it’s moved to the heart of Herndon (2487 McNair Farms Drive).

A county database says a demolition permit for the property was processed in March but the permit’s “date issued” status is listed as not available. The county’s Land Development Services department wasn’t immediately able to address a Reston Now message seeking clarity on the matter by the time this article published.

The project was submitted to the county in 2016, put on hold in 2017 and downsized in 2019.

The project has called for constructing a 300-unit residential complex that’s nine stories tall. A rendering shows the project with rectangular building wings meeting into a center that has floor-to-ceiling glass walls on each level for that section.

A hauler or hauling companies to remove the debris could be picked in six weeks, Adkins said.

The developer plans to submit a building permit soon.

(Updated 3:35 p.m.) Mark Sugden, a familiar face to customers and employees of the Target on Sunset Hills Road in Reston, has died, family and friends have told Reston Now.

Known for his ever-present smile and balloons, Sugden had been a constant sight at the back of the Target parking lot for the last six years. He usually sat on the curb and waved at passersbys, who sometimes stopped to hand Sugden money or groceries.

Sugden had been experiencing homelessness, and a GoFundMe had been set up to help with the costs of staying in a nearby hotel. He also suffered from bipolar disorder, depression, and several other physical limitations, as he told Reston Now back in May.

Despite these challenges, Sugden continued to have a positive attitude.

“He was just a really, down-to-earth, good person. He always treated everybody well,” his brother George Sugden told Reston Now. “[He was] one of those things that’s pretty rare these days — a good soul.”

A memorial and tribute was set up this morning (Thursday) in his honor in front of the Sunoco station on Sunset Hills Road. It’s expected to be there for at least the next few days for those who would like to pay their respects, friend David Ritter tells Reston Now.

There may also be a remembrance service at a later date, but the logistics are still being figured out, Ritter notes.

According to the original GoFundMe page, Sugden died on Aug. 27. The Fairfax County Police Department confirmed the death, though a cause is not immediately known. FCPD does not suspect foul play.

A new fundraiser has been launched to help with funeral costs. The goal is to raise $2,000.

Ritter met Sugden a few years ago and was immediately struck by Sugden’s positivity. He believed that attitude rubbed off on everyone Sugden met.

“It never ceases to amaze me how Mark affected people,” Ritter said.

Once, when it was snowing during the winter, Ritter went to check on Sugden and make sure he had everything he needed. When Ritter arrived, he found a line of cars already waiting to give supplies and food to Sugden.

In May, Reston Now joined Sugden for about an hour at his usual spot between the Target and Sunoco on Sunset Hills Road. Six people in cars stopped to say hello and help him out.

Each time, Sugden greeted them with a wave, a smile, and a thank you.

“Your smile makes me happy,” one woman told Sugden. After she drove away, Sugden said, “I love to see them smile back.”

Over the last several days, both Ritter and George have been hearing from the community about how much Sugden meant to them.

“[From] the stories and the people I’ve met in the last 24 hours, it’s obvious that he touched a lot of people without really going out of his way,” George said. “It was just the way he was.”

Fairfax County Kids Return to School — “We are back, ready to experience all the great things that come with learning together, five days a week in person. We can’t wait to see our students arrive at school…Show off that first-day excitement by posting photos to your favorite social media site and tagging them with #FirstDayFairfax and #FCPSReturningStrong.” [FCPS]

MWAA Proposes New Tech on Dulles Toll Road — “The Metropolitan Washington Airports Authority wants to add digital signs and closed-circuit monitoring technology along the Dulles Toll Road. The airports authority is looking for a contractor to build the infrastructure and install an intelligent transportation system — which would include six dynamic message signs and 15 closed-circuit television installations — along the widely-used commuter route.” [Washington Business Journal]

W&OD Trail Near Wiehle Reopens After Utility Work — The Washington & Old Dominion Trail has reopened east of Wiehle Avenue in Reston after closing earlier this summer so Dominion Energy could relocate overhead electric transmission lines. The utility work was necessary to prepare the site for construction on a pedestrian bridge over Wiehle that’s expected to begin next summer. [The W&OD Trail/Twitter]

Virginia Leads in Rent Relief Funding After Past Stumbles — “From January through May, Virginia distributed more dollars than any other state from the first round of the Emergency Rental Assistance Program, according to U.S. Treasury figures. By the end of June, Virginia ranked second only to Texas…As of late July, Virginia has spent more than $335 million in rental relief funds and assisted more than 51,000 households, according to state figures.” [Associated Press/WTOP]

Fairfax County Fire Team Deploys to Haiti — 65 rescue professionals and four search canines with Virginia Task Force 1, the Fairfax County Fire and Rescue Department’s urban search and rescue team, left for Haiti yesterday (Sunday) to assist federal disaster response crews after the country was hit by a devastating earthquake on Saturday (Aug. 14). The confirmed death toll has exceeded 700 people as of yesterday afternoon. [NBC4]

Virginia Offers Third COVID-19 Vaccine Doses — “Virginia will make third doses of the Pfizer-BioNTech and Moderna COVID-19 vaccines available for moderately and severely immunocompromised Virginians, starting as early as August 14. This move comes after the Centers for Disease Control and Prevention (CDC) updated its vaccination guidelines to recommend third mRNA doses for people who have significantly compromised immune systems.” [Virginia Department of Health]

Fairfax County Seeks Affordable Housing Proposals — Projects to acquire, develop, or rehabilitate affordable rental housing can apply for nearly $2.5 million in newly available federal Community Development Block Grants (CDBG) and HOME funds from Fairfax County. The Department of Housing and Community Development is soliciting proposals to support the county’s goal of producing at least 5,000 new units of affordable housing by 2034. [Fairfax County Government]

FCPS to Hold Back-to-School Town Hall Tonight — Superintendent Scott Brabrand will host a virtual town hall on the return to five days of in-person learning from 6-7 p.m. today (Monday) with Fairfax County Director of Epidemiology and Population Health Dr. Benjamin Schwartz. The meeting can be watched on TV or online, and a second town hall in Spanish will stream on Facebook tomorrow (Tuesday). [FCPS]

Fairfax County officials support the recent reinstatement of the federal eviction mortarium and plan to continue providing rental assistance to those in need.

Earlier this week, the Centers for Disease Control and Prevention — at the behest of President Biden — renewed the ban on evictions through Oct. 3 in areas that have “substantial” or “high” community transmission of the novel coronavirus.

Fairfax County currently has “substantial” transmission, according to the CDC’s COVID data tracker.

County officials have expressed their support for the eviction mortarium, despite some debate over its legality.

“We are glad that the eviction moratorium has been extended, which will continue to provide peace of mind for families across the country,” Fairfax County Board of Supervisors Jeff McKay wrote in a statement.

Early this year, the county received $34 million for emergency rental assistance from a COVID-19 relief package passed by Congress late last year.

This allowed the county to launch a new Emergency Rental Assistance (ERA) program in early June aimed at helping not only residents, but landlords as well. Since the program launched, McKay says the county has distributed more than $8 million to 997 households through the ERA.

“In Fairfax County, we’re not dragging our feet,” McKay said. “We know our residents need assistance now, and we’re continuing to build upon our existing human services programs to meet the vastly increased need within our community.”

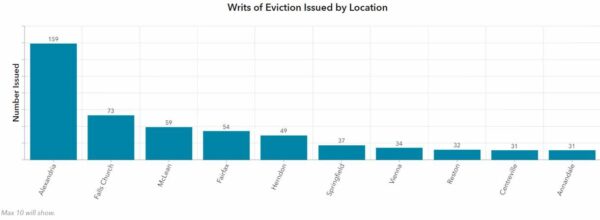

Help is still needed, though. Even with the federal eviction mortarium in place for most of the last 18 months, 668 writs of eviction and 1,562 unlawful detainers have been issued to county residents since July 2020, according to an Eviction Data Dashboard created by county staff.

Overall, the data shows that the threat of eviction is higher in areas hit harder by COVID-19.

According to the dashboard, the zip codes with the highest number of writs of eviction are 22102, which covers west McLean and parts of Tysons, and 22306 in Alexandria, covering the Groveton neighborhood and parts of the Lee District.

Late last year, Fairfax County created an eviction prevention task force to coordinate a countywide approach to helping keep people in their homes.

Fairfax County Neighborhood and Community Services Deputy Director Sarah Allen said in a statement that outreach to the county’s most vulnerable communities is ongoing:

Outreach efforts are underway, particularly to support our most vulnerable communities. Fairfax County agencies partner with numerous providers and are available at community events including vaccine equity clinics, health fairs and back-to-school events to ensure that residents are informed of the assistance and services available to them. We are also partnering with non-profit organizations, houses of worship and other faith-based organizations to reach communities in need.

Allen also notes that tenant and landlord checklists and a guide to the eligibility requirements for rent assistance are available in multiple languages, including Arabic, Amharic, Chinese, Farsi, Korean, Spanish, Urdu, and Vietnamese.

There’s another potentially complicating factor.

The eviction moratorium initially expired on July 31 and was extended on August 3. The CDC order says any eviction completed between August 1 and August 3 is not subjected to the order since it does not operate retroactively, meaning evictions completed during Aug. 1-3 are potentially valid.

However, Allen says the county does not know of any completed evictions during that three-day period.

“We are not aware of any evictions during that gap in time as there is still a court process required to evict,” writes Allen. “County staff is working closely with non-profit legal assistance organizations such as Legal Services of Northern Virginia for support and guidance around the eviction process.”

Fairfax County Flies Flags at Half Mast for Pentagon Officer — Fairfax County flags will fly at half-mast today (Wednesday) after a Pentagon police officer was killed in a shooting incident that prompted a lockdown around the Department of Defense’s headquarters. Fairfax County Board of Supervisors Chairman Jeff McKay said in a statement that there was no threat to the county and no county resources were deployed. [Jeff McKay/Twitter]

CDC Revives Federal Eviction Moratorium — “The Centers for Disease Control and Prevention on Tuesday issued a new moratorium on evictions that would last until October 3, ending some of the political pressure being placed on President Joe Biden. The new moratorium could help keep millions in their homes as the coronavirus’ delta variant has spread and states have been slow to release federal rental aid.” [Associated Press/WTOP]

Leidos Brings Back Mask Mandate — The Reston information technology contractor doesn’t anticipate scaling back operations like when COVID-19 hit last spring, but CEO Roger Krone said during a second-quarter earnings call yesterday (Tuesday) that “we are essentially going back to a mask mandate…and we expect all of our customers to do that.” Leidos is also dealing with concerns about international travel restrictions and supply chain disruptions. [Washington Technology]

Local Private School Prepares for New School Year — Like many other private schools, the all-girls Oakcrest School saw an uptick in enrollment during the pandemic and is planning to provide in-person classes five days a week when school starts in early September. Officials say construction on a new athletic center on the school’s campus at 1619 Crowell Road in the Vienna/Reston area is set to begin later this year. [Sun Gazette]

Reston Mother Among Those Affected by Return of Evictions — “Gladys Suarez has lived in her Reston apartment for 20 years with her daughter and 4-year-old grandson. When she fell behind on rent after COVID-19 affected her housecleaning job, a federal eviction moratorium gave her some peace of mind. Now that the moratorium has ended, Virginia eviction courts are busy processing the pandemic backlog of cases, and Suarez has found herself packing all her family’s belongings into boxes, with her scheduled eviction just days away.” [WUSA9]

Nonprofit Seeks Recall of Fairfax County Top Prosecutor — A nonprofit called Virginians for Safe Communities is planning recall campaigns against three liberal prosecutors, including Fairfax County Commonwealth’s Attorney Steve Descano, who defended his reform efforts. The group’s leaders include a former FBI assistant director, a policy director for the Law Enforcement Legal Defense Fund, and the Department of Justice’s deputy director of public affairs under the Trump administration. [The Washington Post]

Boston Properties Reports Rent Drops in Reston — Boston Properties “reported the 508-unit Signature at Reston saw average monthly rent drop to $2,143, a 7.6% decline compared to the second quarter of 2020, while the 359-unit Avant at Reston Town Center saw an 8.1% decline to $2,180 a month. On Boston Properties’ earnings call last week, President Douglas Linde said the company’s rents are below pre-pandemic levels but it too is cutting concessions, believing people are moving back to cities.” [Washington Business Journal]

The Town of Herndon is looking to update decades-old rules involving accessory dwelling units to make the process less burdensome for homeowners.

The Herndon Planning Commission held a virtual public hearing on Monday (July 26) on a proposed ordinance that the town council will ultimately vote on whether to approve.

“Our current regulations are 38 years old,” the town’s zoning administrator, David Stromberg, said, adding that the age of the existing ordinance is not problematic in and of itself, but the town has changed over the decades.

In the works since April, the decision to revisit the rules for ADUs — smaller dwellings that exist on the same property as a primary residence — was prompted by frustrations expressed by some residents who recently underwent the permitting process, according to Stromberg.

Neighboring governments have already loosened restrictions. Fairfax County revised its rules for accessory units, which it calls accessory living units, as part of a larger zoning overhaul this summer, dropping a requirement that the units be restricted to older adults and people with disabilities.

Herndon also plans to remove those restrictions.

The town’s planning commission is considering making the process less restrictive in other ways, too, such as by allowing many types of ADU additions to occur by right as opposed to requiring an approval process. That could also include allowing second kitchens under certain circumstances.

The town has also noted that smaller homes may be confined by the existing code, so officials are considering possible changes to square footage requirements.

Currently, attached, internal, and detached units can be up to 1,200 square feet or 35% of the gross floor area of a principal dwelling unit, whichever is less. So, if a home is 1,000 square feet, you are currently limited to a 350 square-foot addition, Stromberg noted.

That could change to 1,200 square feet or 40% of a principal dwelling unit for attached and internal dwelling units and be a one-size limit of 800 square feet for detached dwelling units.

Among a variety of issues, the commission has also been looking at limiting the number of wet bars as well as possibly dropping an extra parking space requirement for an ADU if it’s within 0.25 or 0.5 miles of the Herndon Metro station.

Officials have time to continue their review: The second phase of Metro’s Silver Line project has faced delays with no confident expectations any longer for when the new stations will actually open.

Only one member from the public commented during the hearing: resident Gordon Dean, who said that he’s a strong proponent of accessory dwelling units and hopes future ones could help with Section 8 housing.

The planning commission is continuing the matter to its Aug. 23 meeting, which it plans to hold in person.

One of the two residential towers planned for the Faraday Park development near the Wiehle-Reston East Metro station is now open to residents.

Move-ins for 242-unit Faraday West tower officially began on April 17, a spokesperson for the property confirmed to Reston Now. Reston Skylines reported in June that the building had opened to its first residents.

Delivery of Faraday East, however, is taking a little longer than anticipated. Developer Rooney Properties previously projected that construction on both towers would finish in May, but two months later, work is still going on the eastern tower, which will consist of 166 apartments.

“No exact completion date to share at the moment beyond being in the next few months,” the Faraday Park spokesperson said by email.

When completed, the seven-story towers will have more than 400 residential units and a total of about 10,000 square feet of retail space. On-site amenities include a maker’s workshop, a rooftop pool and sundeck, a fitness center, coworking spaces, dining room, commercial and baking kitchens, and a bike repair space.

The towers are accompanied by 13 four-story townhomes, according to Rooney Properties.

“The Rooney team is proud that Reston residents are officially calling Faraday Park home!” Rooney Properties senior associate Jake Ballard said in a statement. “The development is one of the fastest-leasing properties in Reston, and was designed with community in mind and meant to be a hub for active and amenity-filled living.”

Redevelopment of the 3.85-acre site at 11201 Reston Station Boulevard has been in the works since 2017, when the Fairfax County Board of Supervisors approved conceptual plans for mixed-use development to replace an existing office building.

Faraday Park is part of a larger boom in development along Sunset Hills Road spurred by the arrival of the Wiehle-Reston East Metro station, which opened in July 2014.

Next door to Faraday Park, the developer Knutson started selling the Union Towns townhomes that it built on Easterly Road in September.

That same month, EYA broke ground on its Townhomes at Reston Station, the first step forward in the Reston Midline development that the company is working on with JBG Smith and The Chevy Chase Land Company. That project will eventually bring 1.8 million square feet of new development south of Sunset Hills Road and east of Wiehle Avenue.

On the other side of Wiehle Avenue, Comstock Companies has been building out the first phase of its massive Reston Station development, which will eventually consist of four districts.

Retailers that have been confirmed for Faraday Park so far include the gym F45, the salon A+ Nails, and the Vietnamese restaurant Alo Vietnam.

Those prospective tenants were first announced in December 2019, but the Faraday Park spokesperson says it’s still too early to give a timeline for when they will move in.

F45, which added a site at Reston Town Center in February, told Reston Now then that they expect to open at Faraday Park this summer. Alo Vietnam opened a location near the future Innovation Center Metro station in January, though they’re still waiting to get the anticipated boost from the long-delayed Silver Line Phase 2 opening.

Thanks to federal relief funding, Fairfax County is getting an infusion of emergency housing voucher money to help people who are at risk of homelessness or fleeing from domestic violence and others in need.

The American Rescue Plan Act signed into law in March is providing $10 billion to address homelessness, including 70,000 vouchers to local housing authorities, including Fairfax County.

The county will partner with community groups to provide the housing assistance, which could last 10 years — the length of the program — for each recipient.

“We are very grateful to receive these Emergency Housing Vouchers to serve many of our most vulnerable residents and neighbors and help them achieve safe and stable housing,” Fairfax County Redevelopment and Housing Authority Chair C. Melissa McKenna, who serves as the Dranesville District commissioner, said in a statement.

The Fairfax County Redevelopment and Housing Authority approved a county framework last Thursday (July 15) to receive the money, which involves 169 vouchers that will be made available in coming weeks.

Recipients will need to be referred to the program by county case managers or other service points, such as homeless services, Coordinated Services Planning (703-222-0880), or the Domestic and Sexual Violence 24-Hour Hotline (703-360-7273).

Money will go to landlords, and recipients will be required to pay 30% of their income toward rent and utilities.

The emergency housing vouchers can cover a variety of costs, including security deposits, moving expenses, and essential household items such as bedding and tableware.

Even outside the vouchers, ARPA has dedicated billions of dollars to addressing housing issues, as people have struggled to pay rent amid statewide shutdowns last year and uncertain employment due to the COVID-19 pandemic.

The need to provide housing assistance is expected to become especially urgent in the coming months after the Centers for Disease Control and Prevention’s eviction moratorium expires on July 31.

“The [assistance is] designed to prevent and respond to [the] coronavirus by facilitation the leasing of the [emergency housing vouchers], which will provide vulnerable individuals and families a much safer housing environment to minimize the risk of coronavirus exposure or spread,” Dominique Blom, a general deputy assistant secretary with the Housing and Urban Development Department, said in a May memo describing the funding.

Vaccinations have helped bring the virus under control, but cases have been rising in Virginia and the U.S. amid the spread of the highly contagious delta variant, which is now the source of 83% of all new COVID-19 cases, according to CDC estimates.

“Individuals and families who are homeless or at-risk of homelessness are often living in conditions that significantly increase the risk of exposure to coronavirus in addition to other health risks,” Blom said in the memo.

Eligibility for the vouchers is limited to individuals and families who are experiencing homelessness, at risk of homelessness, or were recently homeless and “for whom providing rental assistance will prevent the family’s homelessness or having high risk of housing instability.”

People fleeing — or attempting to flee — domestic violence, dating violence, sexual assault, stalking, or human trafficking are also eligible for the vouchers.

“These vouchers — in addition to the existing programs and services offered through a robust partnership — offer yet another valuable resource to help position individuals and families on a reliable foundation from which they can achieve their fullest potential,” McKenna said in her statement.

During the first year of the pandemic, homelessness decreased throughout the D.C. region except in Fairfax County, which saw a 17% increase from 1,041 people in 2020 to 1,222 in 2021, and Prince George’s County, which had a 19% increase, according to a Metropolitan Washington Council of Governments report.

Fairfax County has attributed the increase to expanded services supported by COVID-19 relief funding.

D.C. Area Under Code Orange Alert — A Code Orange Air Quality Alert has been issued for the D.C. area, including Fairfax County, as smoke from wildfires in the West carries over to the East Coast. The alert means that “air pollution concentration is unhealthy for sensitive groups, especially those w/medical conditions like asthma. Limit strenuous outdoor activity.” [Ready Fairfax/Twitter]

Former Fairfax County Police Indicted — Police Chief Kevin Davis and Commonwealth’s Attorney Steve Descano announced yesterday (Tuesday) that former Fairfax County police officer John Grimes was indicted by a grand jury indicted on Monday (July 19) for unwanted sexual contact with a 16-year-old. The incidents took place between Nov. 12 and Dec. 16, 2019 when Grimes was conducting ride-alongs with the victim. [Patch]

County Announces Millions in Affordable Housing Funds — “The Fairfax County Redevelopment and Housing Authority (FCRHA) has announced the availability of local, state, and federal funds to support the development and preservation of affordable housing in Fairfax County. More than $18.7 million is currently appropriated and is now available for multifamily affordable housing development projects; an additional $15 million in federal funding has been preliminarily identified for this purpose; and additional state funding will be announced in the very near future.” [Fairfax County Housing and Community Development]

Reston Software Company Acquired — “Avantus Federal, a McLean-based IT defense contractor and NewSpring Holdings company, has acquired Reston-based software company Occam’s Razor Technologies LLC, it announced Thursday…ORT, founded in 2011, is a software engineering and consulting firm that works with defense and intelligence clients.” [Virginia Business]

Photo via vantagehill/Flickr

With a federal moratorium on evictions set to expire at the end of July, Fairfax County officials are preparing for a surge in evictions and accompanying demand for rental assistance and other social services.

Even with various federal and state protections in place during the COVID-19 pandemic, 599 writs of eviction and 1,411 unlawful detainers were issued to Fairfax County residents between June 2020 and 2021, according to an Eviction Data Dashboard created by county staff.

Presented to the Board of Supervisors during its health and human services committee meeting on Tuesday (June 29), the dashboard map indicates that the residents at risk of being evicted tend to be concentrated in neighborhoods of color and ones that have been hit hard by the novel coronavirus, Fairfax County Housing and Community Development Deputy Director Tom Barnett told the board.

As of June 14, residents of the 22306 zip code in Alexandria have been issued 54 writs of eviction — court notices directing the Fairfax County Sheriff’s Office to remove a tenant’s belongings from the property — the most of any zip code in the county.

That zip code has also recorded 3,641 COVID-19 cases, which translates to 11,263 cases per 100,000 people, the highest rate in the county. Within that zip code, eviction notices have been clustered south of Groveton and around Woodley Hills, census tracts with relatively high Black and Hispanic/Latino populations.

The Alexandria area in general has been particularly affected by housing instability during the pandemic with 159 writs of eviction issued, more than twice as many as any other part of the county. Falls Church comes in second with 73 writs issued.

Alexandria and Falls Church have also seen the most unlawful detainers, which are issued when a landlord seeks court assistance in removing a tenant from their property.

There are some exceptions to the overall correlation of eviction notices and COVID-19 cases. The 20171 zip code, which encompasses Herndon south of the Dulles Toll Road, has seen 35 writs of eviction issued — the third most in the county — but it has also reported a relatively low rate of 5,304.3 COVID-19 cases per 100,000 people.

Fairfax County Health and Human Services staff put together the dashboard using real-time information obtained from the Fairfax County Sheriff’s Office and General District Court, thanks to a partnership that the agencies formed last summer in response to the pandemic.

“We’re using this data and other data that is available to the county to target our outreach and our rental assistance,” Barnett said. Read More