Giant Employee Arrested in Connection with Embezzlement — A 54-year-old employee at Giant in North Point Village Center was arrested on Dec. 12 on embezzlement charges. Police said that an internal investigation found that the suspect was reportedly taking merchandise from the store without paying. [Fairfax County Police Department]

Trains Run on Silver Line Extension — Test trains have been running on the Silver Line extension in Fairfax and Loudoun County. Officials announced that the project has reached substantial completion last month. [Inside NOVA]

Plastic Bag Tax to Begin — Beginning Jan. 1, residents will have to pay a five-cent plastic bag tax for disposable plastic bags, including grocery stores, convenience stores, and drug stores in the county. [Fairfax County Government]

Virginia is reconsidering the future of funding for transportation infrastructure, as the rise of electric and more fuel-efficient vehicles has cut into the gas tax revenue that helps pay for those projects.

One option the Commonwealth has started pursuing is a “mileage-based user fee” that drivers would pay depending on how much or little they travel. Drivers could opt into the voluntary system in lieu of paying a mandatory highway user fee that first took effect on July 1, 2020.

State Sen. Janet Howell (D-32nd District) says the highway use fee — which applies to cars that average at least 25 miles per gallon and is calculated based on the fuels tax at the time of a vehicle’s registration and the average number of miles it travels in the state — is a precursor to Virginia’s planned mileage-based user fee program.

“For most of the past decade, Virginia, like the rest of the country, has been wrestling with the challenge of identifying the best approach to generating sufficient revenues to support transportation investments,” she said in a statement. “As cars have become more fuel efficient and electric vehicle adoption increases, it is increasingly difficult to strike the right balance of raising adequate revenues from traditional sources and adhering to a usage-based philosophy of highway financing.”

The Virginia Department of Motor Vehicles is currently fielding requests from private contractors to operate the program, which it anticipates rolling out in July 2022. Led by the DMV, a workgroup tasked with developing the program is slated to deliver an interim report to the Commonwealth this December.

The working group is identifying all requirements to Virginia’s mileage-based user fee program with “a priority on consumer privacy protection and equity,” DMV spokesperson Jessica Cowardin said in a statement.

Seeking new ways to fund road repairs and transit projects, Virginia established the mileage-based fee program in April 2020 when the General Assembly adopted a major transportation bill that also established the highway use fee and raised gas taxes for the first time in more than three decades.

The bill also lowered vehicle registration fees by $10 and repealed an annual $64 fee for electric and alternative fuel vehicles.

The changes, which include tying the gas tax rate to the Consumer Price Index to keep up with inflation starting next year, will help Virginia diversify its funding sources to offset stagnant or declining gas tax revenue, state legislators say.

The consultant KPMG previously estimated that Virginia would lose nearly 33% of its gas tax revenues by 2030 due to fuel efficiency, or approximately $260 million.

“Neither the [Highway Use Fee] nor the EV Registration fee are intended to suppress the sales of fuel efficient or electric vehicles, but simply recapture the average annual revenue from the foregone gas taxes,” Howell said.

The idea of taxing drivers based on how much they travel instead of the fuel they use has been gaining traction throughout the U.S. over the past decade.

Despite inflation, the federal gas tax rate has been locked in at 18.4 cents per gallon since it went up from 14.1 cents in 1993, meaning there’s less money to fund highway improvements.

“Many cars are not using gas at all, such as electric, so that system of highway finance has been coming apart for a long time,” said Jonathan Gifford, director of George Mason University’s Center for Transportation Public-Private Partnership Policy in Arlington.

If Virginia wants to encourage a transition to clean energy and electric vehicles, which “is absolutely essential to addressing climate change, we will need to look to other options” to pay for transportation projects, Northern Virginia Transportation Alliance President Jason Stanford says. Read More

Fairfax County took a first step yesterday toward potentially taxing plastic bags used by grocery stores and other retailers.

The Board of Supervisors voted 9-1 yesterday (Tuesday) to direct county staff to draft an plastic bag tax ordinance, but even supporters of the measure allowed that there remains some uncertainty around how exactly the tax would be implemented if approved.

“Let’s definitely try this, but we may end up back in the General Assembly in the foreseeable future to try to get clarification,” Hunter Mill District Supervisor Walter Alcorn said, noting that the county is subject to the Dillon rule. “…This is probably a prime example of when we probably need a little more flexibility, but I’m all for it.”

The Virginia General Assembly passed legislation during its 2020 session giving localities the authority to impose a five-cent tax on disposable plastic bags, starting on Jan. 1, 2021.

Roanoke became the first jurisdiction to take advantage of the new law when it adopted an ordinance in May that’s set to take effect on Jan. 1, 2022.

Under House Bill 534, which was identical to Senate Bill 11, cities and counties can tax each disposable plastic bag provided to customers by grocery stores, convenience stores, and drugstores. The tax would not apply to plastic bags designed to be reused, garbage bags, bags used to hold or package food to avoid damage or contamination, and ones used to carry prescription drugs or dry cleaning.

The legislation allows retailers to retain two cents from the imposed tax on each bag until Jan. 1, 2023, when the amount that goes to retailers drops to one cent.

That “dealer discount” provision is intended to help offset additional expenses retailers might incur from adjusting their operations, but it also puts added pressure on localities to adopt an ordinance as soon as possible, according to Board of Supervisors Chairman Jeff McKay.

“We want to start the process of the ordinance review, looking at the language, the public input, because the clock literally is ticking,” McKay said.

Complicating matters is the fact that the Virginia Department of Taxation has not yet released guidelines clarifying what a plastic bag tax ordinance should look like, leaving questions around the definition of a grocery or convenience store, how the tax will be enforced, and other issues, County Executive Bryan Hill told the board in a Nov. 30 memorandum.

Braddock District Supervisor James Walkinshaw, who introduced the board matter on Tuesday, said the draft guidance that county staff has seen and provided input on through the Northern Virginia Regional Commission will clear up many of those questions.

He hopes the guidelines will be finalized soon so county staff can incorporate them into the ordinance that they have now been directed to draft and present to the board in September.

Springfield District Supervisor Pat Herrity, the lone Republican on the board, opposed the board matter, taking issue with the timing of the proposal. Read More

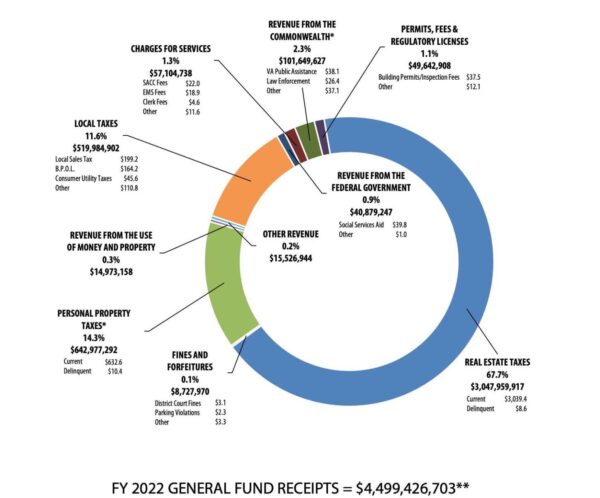

With tax season in full swing and Fairfax County plugging away at its latest budget proposal, you may wonder where exactly your tax dollars go.

Fairfax County is hammering out the details of its spending for the 2022 fiscal year, which is expected to gross more than $8.5 billion. But your tax dollars go to a smaller piece of the pie that encompasses funding for county government operations and contributions to Metro and Fairfax County Public Schools.

Totaling $4.48 billion, the general fund disbursements money comes from taxes — primarily real estate and personal property taxes, but also taxes on hotels and retail sales — as well as fees for licenses and permits. About $1.6 billion of this bucket sustains the operations of all county departments.

Real estate taxes paid by individuals and businesses contribute about $3 billion (or 68%) of the money needed to support county departments, schools, Metro, and debt services. In fact, residents’ property taxes make up about 74% of the county’s real estate tax income. The rest comes from commercial properties, such as apartments, offices, retail spaces, and hotels.

While homeowners could see their real estate tax rate lowered by one cent to $1.14 per $100 of assessed value in the upcoming budget, they will likely still see their bill increase due to rising property values. The one-cent reduction, however, will bring in $27 million less than if the current rate remained in place.

The county, meanwhile, is contending with falling commercial property values for its income from non-residential real estate taxes, a nationwide phenomenon.

But where does this tax revenue go?

After schools, which receive slightly more than half of the general fund disbursements, the county’s next two largest allocations go to public safety, including police and fire, and health and welfare, including family and neighborhood services.

Within those areas, much of the recurring spending is tied to personnel, both existing staff and requests for additional hires. The county government says an additional 109 positions are needed to staff new facilities and continue initiatives previously funded by grants and stimulus funding.

County Executive Bryan Hill’s proposed FY 2022 budget devotes $11.91 million to fund 46 positions to continue implementing the police department’s body-worn camera program and to staff the South County Police Station, a new 61,000-square-foot police station and animal shelter, and the Scotts Run Fire Station.

There is also additional funding to support the Fairfax County Office of the Commonwealth’s Attorney, which Commonwealth’s Attorney Steve Descano said last year is in a state of crisis and needs more staff, especially to handle the body-worn camera program.

The proposed budget adds seven positions to the county’s opioid task force and five positions for the Diversion First initiative.

Police and fire are the biggest drivers of the public safety budget, each accounting for around 41% of expenses, or $219 and $218 million, respectively. Overall, public safety accounts for 33% of the total general fund direct expenditures of $1.6 billion. Fairfax County lands in the middle of Virginia localities for how much it spends per person on public safety ($671 per person). Read More

Like other localities across Northern Virginia, the Town of Herndon is taking a cautious approach to its budget proposal for fiscal year 2022, which was made public this morning (Wednesday).

Requesting $55.7 million in total expenditures, the proposed FY 2022 budget calls for a 8.7% decrease in spending compared to FY 2021 and reflects the financial toll that the COVID-19 pandemic has taken on local governments in a demanding, unpredictable year.

“The fiscal year we are now concluding has been, to put it succinctly, a year like no other,” Herndon Town Manager Bill Ashton said. “The COVID-19 pandemic upended all aspects of daily life. Town services and programs were significantly impacted, as were revenues across the board.”

According to the budget document, Ashton developed his proposal around a 1.7% uptick in assessed property tax values, including new construction and improvements. Gains in residential values, which account for 56% percent of the town’s real property tax base, were offset by dropping commercial real estate values.

The proposed budget maintains the town’s current real estate tax rate at 26.5 cents per $100 of assessed value.

While the town projects a “modest” increase in revenue from business and professional and commercial licenses, business closures and restrictions necessitated by the pandemic are expected to continue affecting revenue from Herndon’s meals and transient lodging taxes during the first half of the coming fiscal year, which starts on July 1.

Herndon saw a 20% year-over-year decrease in meals tax receipts during FY 2021 and a 75% drop in transient lodging tax receipts, according to the FY 2022 budget proposal.

Ashton says the budget “reflects the austerity under which we are still operating.”

“It focuses on core services — public works, public safety — as well as pandemic-related relief that is in the town’s jurisdiction to provide,” Ashton said. “It anticipates an improving economy, but any recovery will likely be gradual. This budget outlines a prudent response to a fiscal crisis that is very much still with us.”

While the town is anticipating “a mild recovery” in the second half of FY 2022 as COVID-19 vaccinations become more widespread and public health restrictions lift, Ashton says he asked town departments to submit budget requests at 5% and 10% reduction levels in recognition of the “fiscal uncertainty that still lies ahead.”

The proposed budget says “several essential items” had to be deferred to the next fiscal year to maintain a balanced budget, though the town council could authorize additional spending in the future depending on the town’s finances and the arrival of new federal stimulus funds.

Areas where the town plans to significantly cut back on spending include professional services, tree maintenance and removal, recreational programs, mowing, special events, and office supplies.

The proposed budget also decreases capital expenditures by 57.4% from the adopted FY 2021 budget. It suggests making no major capital expenditures until revenues are collected late in the fiscal year, unless there is an emergency.

The budget maintains a hiring freeze on non-essential staff positions and omits market-rate adjustments for town employees for a second consecutive year. Herndon still hopes to give all of its workers a 3% pay-for-performance increase, unlike Fairfax County, which has proposed freezing worker compensation increases.

“Though in a funding shortfall situation, it is critical for the town to recruit, retain and develop employees to remain competitive in the marketplace,” Ashton’s budget says.

Projects in the proposed FY 2022-2027 Capital Improvement Program include alignment of Center Street, Elden and Monroe Street intersection improvements, vehicular and pedestrian access to Metro and Van Buren Street improvements, according to the town news release.

The Herndon Town Council will hold public hearings on the proposed budget at 7 p.m. on April 13 and 27.

Photo via Google Maps

Local Police to Hold Meeting on Recent Crimes — The Fairfax County Police Department will host a community engagement forum on March 23 to discuss recent crimes in Reston. The meeting takes place via Zoom. [RA]

Virginia Extends Tax Deadline — Gov. Ralph Northam has exceeded the deadline for filing individual income taxes from May 1 to May 17. The federal government also recently pushed the deadline for federal income tax filings and payments from April 15 to May 17. [Northam]

Nearly a Quarter of Virginians Receive At least One Vaccine Dose — ‘ Virginia surpassed 2 million residents with at least one COVID-19 vaccine dose, representing 23.9 percent of the population. According to Virginia Department of Health data, 3,075,086 total doses have been administered, with 2,039,437 people receiving at least their first dose.’ [Reston Patch]

Answers Sought in Reston Shooting — ‘Detectives from the Fairfax County Police Department’s Major Crimes Bureau were knocking on doors in Reston Wednesday seeking information about a recent fatal shooting in the area, according to a post on FCPD’s Twitter account. On March 11, officers responded to the report of gunshots in the 2200 block of Winterthur Court.’ [Reston Patch]

Photo by Ray Copson

Great Falls Fire Captain Honored — The Greater Reston Chamber of Commerce honored Capt. Mike Allen as the first responder of the year. He works in the Fairfax County Fire and Rescue Department’s Station 12 in Great Falls. [Inside NOVA]

South Lakes Students Make School More Inviting — Students at South Lakes High School beautified bathroom stalls with paintings in order to make the return to school more inviting. The effort was coordinated by the school’s campus environment commission committee. [Fairfax County Public Schools]

County Board Advertises Flat Tax Rate — The Fairfax County Board of Supervisors voted yesterday to set an advertised real estate tax rate of $1.15 per $100 of assessed value for fiscal year 2022. County Executive Bryan Hill had proposed decreasing the rate by one cent. [@JeffreyCMcKay/Twitter]

Severe Tornado Drill Set for March 16 — “Virginia Severe Weather Awareness Week, which is the first time Virginia is promoting this combined awareness effort, will be held March 15-19…As part of the awareness week activities, Virginia’s annual tornado drill will be conducted on Tuesday, March 16, at 9:45 a.m.” [Fairfax County Government]

Photo via vantagehill/Flickr

The Fairfax County Office of Environmental and Energy Coordination has proposed a process of drafting a five-cent plastic bag tax ordinance in Tuesday’s Fairfax County Board of Supervisors Environmental Committee meeting.

According to Susan Hafeli, the Deputy Director of OEEC, Fairfax County legislation allows the county to adopt an ordinance imposing a five-cent tax on most disposable plastic bags provided by grocery stores, convenience stores and drugstores.

As of right now, there are no guidelines from the state regarding the creation of a plastic bag ordinance, rather, the state intends to wait until a locality adopts an ordinance to consider guidelines, according to the presentation.

The revenues are to be appropriated for environmental clean-up, mitigation of pollution and litter, education and the provision of reusable bags to recipients of a federal food support program, according to Hafeli.

The proposed plastic bag tax could generate annual aggregate local revenues of between $20.8 to $24.9 million statewide, although, the tax may be more of an “impetus to behavior change rather than a revenue generator,” said Hafeli.

Across the region, the Northern Virginia Regional Commission Waste Management Board has begun exploring the issues laid out in the legislation, according to Hafeli. Additionally, Arlington County is planning to convene a public workgroup in early 2021 to discuss the adoption of a plastic bag tax, with the discussion of issues regarding equity in the county.

OEEC anticipates that action for this process will occur in two phases. The first phase will focus on public engagement, from developing an informative website, to holding one or more workshops for input, to releasing an electronic survey.

The second phase will focus on the development of the ordinance, including updating the webpage with the proposed ordinance and requests for comments, presentations to the Board’s Environmental Committee, and requests to advertise and hold a public hearing, according to Hafeli.

Concerns from several supervisors regarding the ordinance included confusion regarding state guidelines, equity issues within the community, and ensuring there is good research on the issue, especially in the midst of the pandemic.

However, most supervisors agreed that the environmental issue with plastic bags is significant, and that data from other major water sources, including the Anacostia River, has shown a plastic bag tax to have positive environmental effects.

Moving forward, the Board is looking to clarify the state’s policies while working in conjunction with regional partners and plan for further conversation on how to create the ordinance.

The next Environmental Committee Meeting will take place on Tuesday, Feb. 2 at 11 a.m.

Photo by Brian Yurasits/Unsplash

Fairfax County officials are in the early phases of considering the implementation of a five-cent tax on plastic bags.

In March, the Virginia General Assembly passed a state bill that allows municipalities to collect taxes on disposable bags. Gov. Ralph Northam signed the bill on April 10.

Jurisdictions can levy taxes on disposable plastic bags given by grocery stores, convenience stores, and drugstores. Tax revenues are allocated for environmental cleanup, pollution and litter management, providing educational programs to reduce environmental waste, and the funding of reusable bags to recipients of federal food support programs.

The Virginia Department of Taxation estimates the tax could generate between $20.8 million to $24.9 million in annual aggregate local revenues across the state.

A board matter approved by the Fairfax County Board of Supervisors in late July also directs the Office of Environmental and Energy Coordination to create a plan to implement the plastic bag fee next year.

In a Nov. 30 memo to the Fairfax County Board of Supervisors, Fairfax County Executive Bryan Hill said county departments are currently “exploring the issues associated with development and implementation of a plastic bag tax ordinance.” Other jurisdictions like Arlington County have cited concerns about adopting the tax amid a pandemic due to equity-related dissues.

Hill noted that several ambiguities in the state’s ordinance need to be addressed. For example, the ordinance does not explicitly define what constitutes a convenience store and offers scant information on how tax commissioners will enforce the tax and issue penalties for non-compliance.

“At least at this time, there appears to be no mechanism to contest a retailer’s categorization short of a court challenge and sufficient facts to support a locality’s different categorization,” Hill wrote.

The county anticipates launching a public engagement process, including public meetings and an online survey, to gauge input on the move.

If the Board of Supervisors directs staff to create a plastic bag ordinance, county departments would launch a second public engagement process and consult with county entities like the Environmental Quality Advisory Council prior to consideration by the board.

The board will discuss the issue at an Environmental Committee meeting tomorrow (Dec. 8).

Photo by Griffin Wooldridge/Unsplash

The Herndon Town Council is considering a move to create new incentives for art-focused redevelopment projects.

The Herndon Town Council is considering a move to create new incentives for art-focused redevelopment projects.

The language of the proposal applies to projects in downtown Herndon, but a town spokesperson did not indicate how the plan applies to the stalled redevelopment of downtown Herndon, which is a joint effort between the town and Reston-based company Comstock.

Economic incentives include:

- A 50-percent reduction in fees for water, sewer and building permits in the initial establishment of the project

- An annual rebate of up to 100 percent of real property taxes linked to the total. Redevelopment project for taxes due to the town for up to a decade.

- Exceptions that allow a reduced number of parking spaces required for multi-family residential use

- Deferral of developer contribution for recreational amenities

“These amendments create additional opportunities to expand the type, quantity and quality of. Art offerings to town residents and increase the town’s presence as a destination for art activities,” according to an Oct. 20 staff report.

It’s unclear how the incentives will be applied to the redevelopment project in downtown Herndon. A town spokesperson did not provide comment by the publication deadline.

The $85 million redevelopment project, which includes a new arts center, would transform nearly 4.7 acres of land in downtown Herndon into a vibrant mixed-use district.

A meeting on the matter is set to take place today (Tuesday) at 7 p.m.

Image via handout/Comstock

The county is considering a plan to establish an economic incentive program for Lake Anne Village Center and other areas with limited development activity and dipping competitiveness.

The Economic Incentive Program, if approved by the Fairfax County Board of Supervisors, would incentivize parcel consolidation by reducing site plan fees by 10 percent and offering real estate tax abatement for up to 10 years.

It is designed to target areas with limited development activity, declining competitiveness and outdated land development and architectural designs, according to county documents. Projects must be limited to commercial, industrial, multi-family or mind use development. Additionally, up to 20 percent of existing development can be retained or repurposed.

Preliminarily, the board has identified several areas for revitalization for the following locations:

- Annandale

- Seven Corners

- Lincoln

- McLean

- Richmond Highway, Huntington

- Springfield

Lake Anne Village Center’s 41-acre Community Revitalization Area (CRA) is primarily focused on the plaza, which was the first area developed in Reston. Efforts to revitalize the plaza have been on the table for several years. The county designated the village center as a CRA in 1998 in order to stimulate reinvestment and development. Currently, roughly 22 percent of the village center is covered by surface parking, which needs repairs.

A public hearing is tentatively set for Sept. 15. If approved, the county will begin meeting with applicants to discuss potential projects. An executive outreach and education campaign about the program is also planned.

The board’s Economic Initiatives Committee is set to discuss the plan at a meeting tomorrow (Tuesday) at 11 a.m.

File photo

The Fairfax County Board of Supervisors approved today (Tuesday) giving taxpayers more time to file and pay their taxes.

Now, individuals and businesses in the county will have until June 1 to file their personal property tax returns. Additionally, the first half of payments for real estate taxes won’t be due until Aug. 8.

“Both these resolutions are intended to alleviate the negative impact threatened by the potential spread of COVID-19,” according to county documents.

“I’ve been asked a lot about this since a lot of folks in the county have found themselves without paychecks,” Chairman Jeff McKay said.

McKay said that people won’t accrue late fees for following the new deadlines.

By pushing the deadlines, the county will likely be delayed in receiving tax revenue, according to the county. However, county staff said that the benefits to the community by pushing the deadlines outweighs potential impacts on revenue.

Reston Man Charged with Aldie Assault — “A man was arrested in Aldie Thursday morning after allegedly assaulting a coworker at the workplace, according to the Loudoun County Sheriff’s Office. Deputies responded to the 41000 block of Collaboration Drive around 8:06 a.m. for reports of the incident.” [Loudoun Times-Mirror]

Surviving Tax Season — The county offers several resources on how to navigate rules and filing procedures. The Board of Supervisors is also hosting a series of free tax relief workshops through the county. [Fairfax County Government]

Endorsements for Reston Association Board Election — The Coalition for a Planned Reston endorsed Bob Petrine, a candidate for an at-large seat of three years, and Sarah Selvaraj-Dsouza, a candidate for an at-large seat for one year. [Reston 20/20]

Photo via vantagehill/Flickr

This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

This is an opinion column by Del. Ken Plum (D), who represents Reston in Virginia’s House of Delegates. It does not reflect the opinion of Reston Now.

The arrival of W-2 forms in the mail reminds us, even if we may have momentarily tried to forget, that tax season is upon us. This is no ordinary tax year, however. Massive changes in federal tax laws will result in significant changes at the state level as well. No one can speak with authority as to what the differences will be for an individual taxpayer as the General Assembly has not revised state tax law to reflect the federal changes.

The situation we are in is not new. Anytime the Congress makes changes in federal tax policy, the state must adjust to those changes and decide whether to adopt the federal policy or to put in new state provisions. As a conformity state, Virginia has generally followed federal policy allowing taxpayers to file state returns using the information on their federal form.

The difference this year is that the federal changes are so massive that conformity is not realistic without major changes in the way state forms are filed. Adding to the fact that the forms may be different is that there are major differences between the way deductions and credits have been handled and what will constitute taxable income. High-income taxpayers that were the winners with the federal changes could significantly reduce monies to a state that is already struggling to meet its obligations to funding schools, mental health programs and other priorities.

Essentially, Gov. Ralph Northam proposed that additional revenues be used for investments in education, workforce development, expanded broadband and targeted tax relief to those who work at the lowest wages. Republicans have proposed a plan to return more monies to taxpayers, but there is strong concern that the Republican plan will make big dents in the state budget.

All agree that a decision needs to be reached soon for taxpayers to file their tax forms as soon as possible and as accurately as possible. In past years as many as 650,000 taxpayers have filed in the first 10 days of February.

I am the patron of a bill supported by Northam that would make a portion of the Earned Income Tax Credit (EITC) refundable to taxpayers based on their income and family size. The current Virginia EITC set at 20 percent of the federal EITC does not allow for a refund of its full value as is done in 23 other states. Under the bill I introduced, it is estimated that as much as $250 million would be returned to the pockets of hard-working Virginians who are at the lowest pay levels. This helps not only those workers, but — since low-income residents typically spend that money on goods and services — it boosts the local economy as well.

There is a sense of urgency in the General Assembly that this issue needs to be resolved as soon as possible, because it impacts every household. Not only is there a great deal of confusion, but that confusion will be multiplied many times as people start to prepare their returns with incomplete directions. The challenge has been known for several months. Tax season is upon us. Our tax policy needs to be resolved now.

File photo

The AARP Foundation Tax-Aide Program is offering free help with tax preparation and electronic filing services to taxpayers.

In the Hunter Mill District, locals can find the drop-in services at the Reston Community Center (2310 Colts Neck Road) starting on Friday (Feb. 1).

Trained counselors will be on hand to help with federal and Virginia tax returns.

Locals don’t need an appointment, but they will need to bring a photo ID, Social Security cards for themselves and their dependents, a copy of last year’s tax returns and all tax documents received.

The Reston Community Center tax prep will be available on the following days:

- Tuesdays: 9 a.m. to 2 p.m.

- Thursdays: 4:30-8:30 p.m.

- Saturdays: 9 a.m. to 3 p.m.

The free tax preparation will also be available from 10 a.m. to 2 p.m. from Mondays to Fridays at the SunTrust Bank of Vienna (515 Maple Avenue East) and on Saturdays from 9:30 a.m. to 1:30 p.m. at the Providence Community Center in Fairfax (3001 Vaden Drive).

The program is open to people of all ages and runs until Feb. 15.

File photo