The Fairfax County Board of Supervisors voted on Tuesday to put the question of a meals tax to Fairfax County voters this November.

The Fairfax County Board of Supervisors voted on Tuesday to put the question of a meals tax to Fairfax County voters this November.

The tax would add 4 percent to your meal. That’s in addition to a 6-percent sales tax, and would be applicable on restaurant meals, poured beverages, takeout food and prepared food from grocery and convenience stores.

The tax would give Fairfax County an estimated $100 million annually. The supervisors said 70 percent of that would go to Fairfax County Public Schools; the rest would help fund county services.

Nearby jurisdictions, including Arlington, Alexandria, D.C. and the towns of Herndon, Vienna and Fairfax, already have a food tax. They would bot be subject to the Fairfax County tax.

So, how do you plan to vote?

The Fairfax County Board of Supervisors voted 8-2 on Tuesday to add a meals tax referendum question to the Nov. 8 general election ballot.

The Fairfax County Board of Supervisors voted 8-2 on Tuesday to add a meals tax referendum question to the Nov. 8 general election ballot.

They say they are now prepared for a real fight on both sides of the issue, but ultimately it will be up to Fairfax County voters whether the 4 percent tax gets implemented in summer 2017.

The addition of a meals tax has been discussed for years, but was last put to referendum in 1992, where it failed.

However, the county is continually finding itself in an annual budget crunch, particularly as the needs of Fairfax County Public Schools are growing. The board says it will allocate 70 percent of the nearly $100 million annual expected meals tax revenue to the schools, with the remainder going for county services.

About $3 million of the nearly $100 million in revenue would go to back to restaurants/businesses to offset costs of implementing the meals tax, the county says.

The supervisors’ transfer to the schools was $2 billion this year.

Several supervisors said prior to Tuesday’s vote that they would like to see more specifically what the schools will do with the money. Hunter Mill Supervisor Cathy Hudgins, a proponent of the meals tax, made a motion to delay the vote until after a joint retreat with the school board, which is scheduled for next week. The motion failed.

Still, several supervisors said the schools need to show a good faith effort in how they spend the extra money. FCPS teacher pay continues to lag behind neighboring counties, and Supervisor John Cook (Braddock) said “we are at a tipping point on needing to bring teacher pay up to market.”

“If I hear [the schools] say they are spending the money on an elite, special program and not on teacher pay, then I will campaign against it,” said Cook. “I am not happy about a meals tax. I worry about local places without a liquor license and a high profit margin. But it is time to have a dialogue.” Read More

The Fairfax County Board of Supervisors is expected to approve on Tuesday the steps necessary to get a meals tax referendum on the ballot for November’s general election.

The Fairfax County Board of Supervisors is expected to approve on Tuesday the steps necessary to get a meals tax referendum on the ballot for November’s general election.

The supervisors are seeking to add a 4-percent meals tax because it will give the county an extra estimated $99 million annually. Seventy percent of that would go to Fairfax County Public Schools, which has faced budget constraints the last several years.

FCPS, which has nearly 200,000 students, received a transfer of just over $2 billion from the supervisors this spring. The county gives 52 percent of its budget to the schools.

The tax would be on restaurant meals, of course, but also prepared foods sold at grocery and convenience stores. Surrounding jurisdictions such as the towns of Herndon and Vienna, as well as Arlington and Alexandria, have meals taxes.

The Fairfax County Board of Supervisors Budget Committee has recommended that a meals tax referendum be put to Fairfax County voters in the general election this fall.

The Fairfax County Board of Supervisors Budget Committee has recommended that a meals tax referendum be put to Fairfax County voters in the general election this fall.

The idea will now go to the entire Board of Supervisors for a vote.

The meals tax, which supervisors last discussed — but decided not to go to referendum — in 2014, was brought up this spring by Hunter Mill Supervisor Cathy Hudgins.

For the second time in two years, Fairfax County Supervisors are considering a meals tax referendum.

For the second time in two years, Fairfax County Supervisors are considering a meals tax referendum.

Adding a 4-percent meals tax could give the county (and its services and public schools) an additional $90 million annually.

The idea, which the supervisors will discuss at their April 26 meeting, was last discussed in 2014, when county officials were looking at a strained budget. Ultimately, a task force examined the idea, but the supervisors decided not to hold a referendum. County residents last voted on the idea in 1992. It failed.

But times have changed. Aftereffects of the recession that began in 2008 have left home values flat as the county population and need for services has grown, putting the county budget in an annual battle, supervisors say.

The supervisors are likely to approve next week the $3.99 billion budget for Fiscal Year 2017. That budget will include a tax rate rise of 4 cents per $100 of home value, or about $303 for the average Fairfax County homeowner. The county will give about $2 billion to Fairfax County Public Schools.

Most surrounding jurisdictions, including Arlington, Alexandria and the towns of Herndon and Vienna, and the District of Columbia have a meals tax. Does that prevent you from eating in restaurants in those locations?

Meanwhile, grassroots efforts have popped up on both sides of the issue. Several local restaurant groups are against the idea, while many school board members and school advocates say diversifying the tax base is the only way to stave off cuts to services.

What do you say?

Ted’s Bulletin at Reston Town Center/file photo

Fairfax County Supervisors are taking another look at a county meals tax, so advocates on both sides of the issue are gearing up for a fight.

Fairfax County Supervisors are taking another look at a county meals tax, so advocates on both sides of the issue are gearing up for a fight.

Several restaurant companies that have outposts in Reston have joined together to oppose the proposed 4-percent tax. At Clyde’s at Reston Town Center, for instance, there is a large sign in the restaurant’s lobby voicing Clyde’s Restaurant Group’s disapproval of the proposal.

Joining Clyde’s in the fight are Glory Days Grill Restaurants (North Point, Fox Mill and Great American Restaurants (Jackson’s).

“In a recent meeting, Fairfax County Supervisors went back to the well of bad ideas to bring back a rerun that almost nobody in Fairfax County wants to watch,” reps from the three companies wrote in a recent letter to the editor of The Fairfax Times.

“The ‘meals tax’ would levy up to a 4-percent tax for consumers to pay on all food and drinks purchased at restaurants, hotels, grocery stores, doughnut and coffee shops, and convenience stores across the county. It is taxation without justification at its worst.”

The restauranteurs say the meals tax is an unfair burden on residents who are also likely to see a 4-cent rise in real estate taxes next year.

In Reston, visitors to Reston Town Center resturants will also be paying to park starting in August.

Hunter Mill Supervisor Cathy Hudgins suggested last month that the supervisors look again at a meals tax. With the county feeling strain on its $3.99 billion Fiscal Year 2017 budget and the Fairfax County Public Schools facing a multimillion dollar shortfall, the supervisors are discussing putting a meals tax on the ballot this fall.

Hudgins said a 4-percent meals tax, similar to rates in nearby jurisdictions such as Vienna, Fairfax City, Arlington County and Alexandria, would provide close to $90 million for Fairfax County in annual revenue.

Hudgins said a 4-percent meals tax, similar to rates in nearby jurisdictions such as Vienna, Fairfax City, Arlington County and Alexandria, would provide close to $90 million for Fairfax County in annual revenue.

“You can’t keep services up if you are always trying to juggle this one revenue source [real estate taxes] up and down,” said Hudgins. “You can’t rely on one revenue source and be sure it gets to where you want to be.”

The supervisors discussed a meals tax in 2014 but did not move forward. It was last on the ballot in 1992. It failed.

The supervisors will discuss on April 26 whether to move forward.

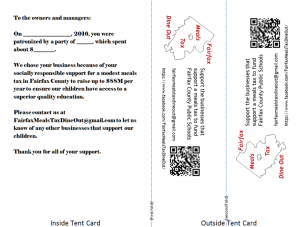

A grassroots group has recently launched to support the meals tax. “Fairfax Meals Tax Dine Out” has a Facebook page, and is encouraging residents to patronize restaurants that support a meals tax and leave a flyer outlining what a meals tax can do for residents.

Photos: Jackson’s at Reston Town Center, top; Flyer for Fairfax Meals Tax Dine Out, bottom

At the suggestion of Supervisor Cathy Hudgins (D-Hunter Mill), the Fairfax County Board of Supervisors will be taking another look at instituting a meals tax.

At the suggestion of Supervisor Cathy Hudgins (D-Hunter Mill), the Fairfax County Board of Supervisors will be taking another look at instituting a meals tax.

Hudgins made the motion after a sometimes emotional supervisors meeting on Tuesday, where the board passed an advertised 2017 tax rate rise of 4 cents. Some supervisors advocated for a higher maximum tax rate of 5 or 6 cents per $100 of real estate value. Read More

Hunter Mill Supervisor Cathy Hudgins says she is disappointed that the Fairfax County Board of Supervisors has decided to accept the Meals Tax Task Force report but not take action yet.

Hunter Mill Supervisor Cathy Hudgins says she is disappointed that the Fairfax County Board of Supervisors has decided to accept the Meals Tax Task Force report but not take action yet.

The task force report was given to the supervisors earlier this week. The task force is comprised of former Board of Supervisors chairs Tom Davis and Kate Hanley, as well as members of two dozen county organizations, including Republican and Democratic parties, the county Chamber of Commerce, the Restaurant Association of Metropolitan Washington, Visit Fairfax, the Fairfax County Taxpayers Alliance and the Fairfax Education Association.

The group was assembled in April by Supervisor Chair Sharon Bulova with this mission: whether or not to proceed with a referendum for a meals tax; if it is the recommendation of the group to do so, the task force should recommend the timing (what year?) for the question to be put to voters; and the task force should return with a recommendation for how revenue from a meals tax should be used.

It is estimated that a county meals tax similar to the ones in Fairfax City and Vienna (4 percent) could result in $88 million annually for Fairfax County.

While the task force weighed the pros and cons of a meals tax, it did not recommend whether there should be a referendum or how the money should be spent. Instead, that decision will be up to the Supervisors, who deferred action until the report could be read more thoroughly.

“I am disappointed that the Board of Supervisors has chosen only to accept the report, and is not moving forward at this time,” Hudgins said in an email to Hunter Mill residents. “Hopefully, after a thorough reading by each member, the Board of Supervisors will decide to further explore this option of diversifying our revenue, as have 47 counties and 104 towns in Virginia levied in tax year 2013.

Pros included: The county needs the revenue; 28 percent of the taxes would come from non-county residents; and diversifying the tax base could have a positive effect on commercial land owners, among others.

Among the cons: The county populace is already overtaxed and the county should manage its money more effectively; the food tax unfairly targets the food service industry; Fairfax restaurants could actually lose business to Loudoun and Prince William counties, where there is no food tax; and the referendum itself will cost money, even if it ultimately fails.

The report also looked at when in the next three election years to hold the referendum and some of the possible areas in which the money could help the county. See the full report on the Fairfax County website.

A meals tax proposal went to a Fairfax County voter referendum in 1992, where it failed.

Photo courtesy of PassionFish