This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

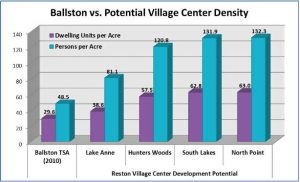

The County, via its proposed zoning density increases, and developers are already planning for Reston’s Village Centers to become nearly two to three times as densely populated as Arlington County’s major Ballston Transit Station Area (TSA).

The result is astounding given that Ballston is rightly a high-density mixed-use transit-oriented development area served by two Metro lines while Reston’s Village Centers are nowhere near Metro. Moreover, the recent year-long Reston transportation development effort (RNAG) revealed that Fairfax County explicitly doesn’t plan to enhance local bus transit to serve the Village Centers or our TSAs.

Fairfax County data and US Census 2010 data for Ballston show that, with the exception of Lake Anne Village Center, where a redevelopment plan is already in place, the number of dwelling units (homes) per acre will potentially be at least twice as dense as in Ballston. Moreover, because Fairfax County anticipates a fraction more people in each household, the potential number of residents per acre runs better than two and one-half times that experienced in Ballston.

Fairfax County data and US Census 2010 data for Ballston show that, with the exception of Lake Anne Village Center, where a redevelopment plan is already in place, the number of dwelling units (homes) per acre will potentially be at least twice as dense as in Ballston. Moreover, because Fairfax County anticipates a fraction more people in each household, the potential number of residents per acre runs better than two and one-half times that experienced in Ballston.

At the risk of repeating ourselves, Reston’s Village Centers are intended to be neighborhood-serving gathering places. They are not meant to be transit station areas without the “transit.” According to US Census data, Ballston is the most populous area in Arlington County and the fourth most densely populated (people per acre). The notion that TSA residential densities should be applied in Reston’s Village Centers is preposterous and contradicts everything that the Reston Master Plan says about their development.

The current Reston Master Plan calls for the following in any Village Center redevelopment: “Enhance Village Centers as vibrant neighborhood gathering places; advance excellence in site design and architecture; strengthen connectivity and mobility; [and] protect and respect the surrounding residential neighborhoods.”

Any notion that residential density in excess of 100 people per acre is consistent with these objectives is ludicrous.

If you don’t want your neighborhood Village Center to be blown up and replaced with one or more 12- to 14-story high-rise apartments or condos, please come to the community meeting on the Reston PRC zoning ordinance on Monday at South Lakes High School. Bring your friends and your children for a major civics lesson on local government. Learn, question, and challenge what you hear. It is our Reston and we must act to protect it by showing our revulsion with this absurd zoning ordinance proposal.

Terry Maynard, Co-Chair

Reston 20/20 Committee

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Restonians turned out in droves two weeks ago for a County-organized community meeting on its proposed Reston PRC zoning ordinance amendment. The essence of the proposed language change is to increase the cap on Reston’s population from 13 to 16 people per acre, but that ignores several other factors including station area development, affordable housing and “bonus” market rate housing for developers. The crowd was so large that Supervisor Hudgins was forced to cancel the meeting. Those hundreds of people were there because, contrary to what the County keeps telling the community, the proposed zoning change opens the door for an overall tripling of Reston’s population.

But that is only part of the story.

An important element of the zoning amendment proposal is the residential development it would not only allow, but is already planned, in our Village Centers. The Village Centers–North Point, Lake Anne, South Lakes, and Hunters Woods–are currently our neighborhood shopping centers and intended to be “neighborhood gathering places” in Bob Simon’s vision. They are where we buy our groceries, purchase our prescriptions, dine out in locally-owned restaurants, and meet many of our other family needs.

Here is what the Reston Master Plan has to say about the role of our Village Centers:

The general vision for Reston’s Village Centers addresses the fundamental elements necessary for any Village Center to achieve the desired goal of becoming a vibrant community gathering space. The Village Center general vision is an elaboration of the Reston Vision and Planning Principles. Recognizing that each Village Center faces unique circumstances, redevelopment proposals should take advantage of this to creatively interpret the general vision to provide a unique, vibrant community gathering space:

• Enhance Village Centers as vibrant neighborhood gathering places.

• Advance excellence in site design and architecture.

• Strengthen connectivity and mobility.

• Protect and respect the surrounding residential neighborhoods. . . .(The) Central Public Plaza should (h)ighlight the Village Centers as neighborhood scale gathering places, in contrast to the regional scale gathering places in the Town Center or the community scale gathering places in the other TSAs.

In short, our Village Centers are meant to be our hyper-local “gathering places” to live, work, and play with our families, friends, and neighbors. Nothing in the whole section of the Comprehensive Plan on Reston’s Village Centers suggests they should be anything other than neighborhood serving and, indeed, the plan suggests the opposite.

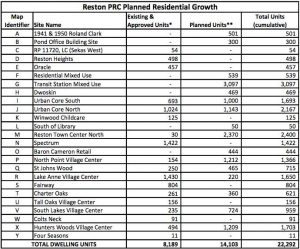

But that is not what the proposed Reston PRC zoning ordinance would allow and, indeed, what is already being planned according to the County’s data. The county’s table of proposed redevelopment sites, which provides the county’s justification for raising the population cap, projects huge increases in dwelling units and population that are totally out of character and will overwhelm North and South Reston.

But that is not what the proposed Reston PRC zoning ordinance would allow and, indeed, what is already being planned according to the County’s data. The county’s table of proposed redevelopment sites, which provides the county’s justification for raising the population cap, projects huge increases in dwelling units and population that are totally out of character and will overwhelm North and South Reston.

Approval of the PRC zoning amendment to raise the population cap to accommodate such growth will allow developers to add nearly 13,000 residents to our Village Centers, including new affordable and bonus market rate housing that could be added under the county’s rules but is not included in the county’s table. In the worst case example, North Point Village Center, the PRC re-zoning proposal shows a potential twelve-fold increase in dwelling units (DUs), an increase of nearly 1,700 DUs and 3,600 residents. At the low end of the spectrum is Lake Anne Village Center whose redevelopment plan has already been approved with a near tripling of the number of residents to more than 2,600. Across Reston’s four Village Centers, population would be allowed to nearly quintuple.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Restonians once again face the threat of a massive change in one of its key zoning ordinances — the Reston PRC (Planned Residential Community) — on the basis of knowingly faulty arithmetic. You need to understand what that is.

The key change in the Reston PRC zoning ordinance calls for lifting the population “cap” on the number of persons per acre living in the zoning district from 13 to 16. With 6,245.8 acres in the Reston PRC (which excludes most of the station areas), that means lifting the PRC population “cap” from 81,195 to 99,933 people.

That seems to be just 18,738 added people. What could be wrong with that? Certainly we can manage the impact of about 9,000 more homes (“dwelling units” — DUs — in planning parlance), all in multi-family “elevator” apartments and condos with households averaging 2.1 people.

Let’s count the ways.

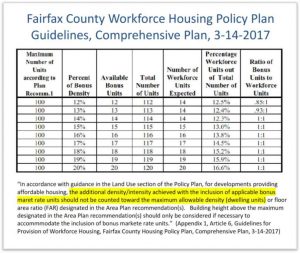

First, the County provided a clue to its funny counting in a footnote in its several presentations to the community (p. 14) on the proposed Reston PRC zoning change. With a small asterisk after the column on Reston’s current and approved DUs, it states that this total “(e)xcludes affordable housing bonus units per Z.O.” What? Bonus dwelling units for providing affordable housing may be as high as 20 percent for meeting the one-for-one bonus arrangement ranging from 12 percent to 20 percent. So add up to 20 percent to Reston’s population potential.

Second, an obscure passage in the PRC zoning ordinance discloses that the affordable housing itself does not count toward the population “cap” according to the PRC zoning ordinance (Article 6-308) and the County’s housing policy plan. The last paragraph on “maximum density” in the PRC ordinance ends with this: “(The preceding restrictions on density) shall not apply to affordable and market rate dwelling units which comprise the increased density pursuant to Part 8 of Article 2 (which sets standards for the Affordable Dwelling Unit Program) …” We welcome the housing diversity, but we think the people living in that 12.5 percent to 20 percent workforce housing should count and the infrastructure and amenities required for them should be in the County’s plans. That’s another potential 20 percent added to our total population.

Second, an obscure passage in the PRC zoning ordinance discloses that the affordable housing itself does not count toward the population “cap” according to the PRC zoning ordinance (Article 6-308) and the County’s housing policy plan. The last paragraph on “maximum density” in the PRC ordinance ends with this: “(The preceding restrictions on density) shall not apply to affordable and market rate dwelling units which comprise the increased density pursuant to Part 8 of Article 2 (which sets standards for the Affordable Dwelling Unit Program) …” We welcome the housing diversity, but we think the people living in that 12.5 percent to 20 percent workforce housing should count and the infrastructure and amenities required for them should be in the County’s plans. That’s another potential 20 percent added to our total population.

Between not counting workforce dwelling units and the bonus density they allow, the nominal 99,933 population cap under the County’s proposed 16 persons per acre in the Reston PRC potentially becomes 139,906 souls in the Reston PRC district, a nearly 40,000-person increase over the nominal cap and nearly 80,000 more people than live in all Reston now.

And then, third, there is the elephant in the room: The County’s current discussion about the Reston PRC change has excluded any reference to the Reston Master Plan’s potential development of 44,000 DUs in Reston’s transit station areas (Figure 35, p. 103), most of which is outside the PRC-zoned area. Based on a County count of existing, approved and planned PRC development in RTC (13,772 DUs — not counting affordable and bonus units?) detailed in Reston Now two weeks ago, we can assume as many as 20,000 DUs may be built in the PRC portion of Town Center over the next 40 years. That leaves 24,000 DUs — about 50,000 people — to be added elsewhere in Reston’s station areas. So add another 50,000 people to Reston’s population — not counting the workforce housing and bonus development that goes with it.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Fairfax County’s development strategy of pursuing high-density residential development around Metro stations and other commercial centers (e.g. — Seven Corners, Lake Anne Village Center) will fail in its fundamental goal of generating large new tax revenues. This is due to the demonstrated fact that the cost of community services for residential services substantially exceeds the revenue it generates.

The need for massive new County tax revenues is driven primarily by the deteriorating fiduciary position of its four pension funds (civilian, police, uniformed, and education). At the beginning of the century, all four funds were essentially fully funded (97 percent to 102 percent), but they have deteriorated almost continuously since then. The FY2016 County annual financial report shows a $4.7 billion funding shortfall despite the quadrupling of County (and additional employee) contributions since 2000. That represents about a one-quarter shortfall in required funding across the four funds. This growing shortfall is why Moody’s issued a warning on the County’s AAA bond rating several years ago and the County made a commitment then to reach 90 percent funding by 2025. One obvious approach to addressing such a shortfall is to dramatically increase development that creates new taxable value. From Reston’s perspective, this has taken the form of two County zoning initiatives linked to the revised Reston Master Plan:

- The passage last year of an amendment to the PDC/PRM (Planned Development Commercial/Planned Residential Mixed-Use) zoning ordinances to increase the allowable density from FAR 3.5 to FAR 5.0. From a Reston perspective, this primarily affects the Herndon-Monroe and Wiehle station areas as well as the southern half of Reston Town Center. The zoning ordinance also covers Commercial Revitalization Areas (CRAs), including Lake Anne Village Center. The two ordinances focus on commercial and residential mixed-use development respectively, and the residential-focused PRM would allow up to as many as 200 dwelling units per acre (DU/AC) at FAR 5.0. No place in the Washington metropolitan area has that much density.

- The recently proposed amendment to the Reston PRC (Planned Residential Community) which would increase the community-wide population density from 13 to 16 people per acre, about 21,000 people. More importantly, it places no limits (except Board discretion) on the number of DU/AC in “high density” development areas. This includes the Town Center north of the toll road and Ridge Heights to the south. Making the matter worse, the Reston plan was amended behind closed doors (not by the Reston planning task force) to eliminate any limits on high density multi-family development. Currently, the limit is 50 DU/AC.

Aside from the many reasons Restonians do not want the intensity of residential development allowed in Reston, there is one vital reason for the County not to want to pursue this ultra high-density residential development strategy: The cost of community services (COCS) for residential development — especially high-density development — exceeds the tax revenues it generates. Residents require schools, streets and other transportation, parks and recreation, libraries, and much more. This is especially important in the ongoing dialogue about increasing residential density in Reston’s PRC zoned area.

Research on this issue by the US Government, private sector, and academia is extensive and it virtually all comes to this same conclusion. All these studies highlight the importance of methodology, assumptions, other values than tax revenue in development decisions, etc., but none we have discovered suggest that residential development will ever generate a net gain in tax revenues for the County.

Probably the benchmark study on COCS is an overview by the Farmland Information Center (FIC) of the American Farmland Trust in a public private partnership with the US Department of Agriculture last September. The overview records the results of analysis of the COCS by type of development in more than 150 communities, counties, etc., across dozens of states over more than two decades. The results of FIC’s studies show that, on average, for every dollar in tax revenues generated by tax revenues, the median residential development is a cost $1.16 in community services, a 16 percent loss. By contrast, commercial and industrial development costs $.30 in community services for every $1 generated in tax revenues, a better than three-fold tax revenue return for the County.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Reston’s population is a key factor in the County’s high-speed drive to raise the density limits in our Planned Residential Community (PRC) zoning ordinance from 13 to 16 persons per acre across Reston to accommodate growth laid out in the new Reston Master Plan. It argues that Reston is at 12 persons per acre right now, including existing and approved development and we need to create more headroom for growth. Specifically, its “calculated estimate” of Reston PRC population, including approved plans but excluding affordable dwelling units, is 74,192 people.

Not even close on Reston’s current population — including the non-PRC areas of Reston.

The Past

The County was even badly wrong back in 2006 when it adjusted the zoning ordinance household factors — the average number of people living in each type of housing (single-family, townhomes, multi-family — garden and elevator). At that time it put Reston’s “calculated” PRC population at 64,227, roughly 10,000 fewer people than it calculates today.

Then reality set in.

In 2010, the US Census put Reston’s population at 58,404 in 25,304 occupied dwelling units, including such non-PRC areas as Deepwood and much of the Reston station area corridor. That’s a population density of 9.4 persons per acre of Reston PRC, nearly 40 percent below the current density limit of 13 persons per acre –hardly a driver for raising the overall population density ceiling.

The Present

The American Community Survey, the US Census’ official mid-decade estimate of population and other data, then put Reston’s population at 60,112 in 2015. Other unofficial sources tend to have even lower estimates of Reston’s population.

So why is the County claiming the much larger “population calculation” of 74,192 people in the PRC, which is most, but not all, of Reston?

The key reason is that the County includes the population of developments that have been approved, but not yet built. In fact, many approved proposals have been on the books for a decade or more, including Colts Neck independent living (former Hunters Woods United Christian Parish now under construction), Reston Excelsior Oracle and Boston Properties Property #16 (under construction).

Spectrum Center is a major example. The Board gave final approval to this redevelopment in January 2013, but the developer — Lerner Enterprises — said then that redevelopment may not take place for many years, even decades. Indeed, the strip mall from Staples to Not Your Average Joe’s is still operating at capacity. Among other features, the redeveloped Spectrum Center is approved to include more than 1,400 dwelling units (almost 3,000 people).

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Last Wednesday evening may have seen a watershed moment in Reston’s development, as about 150 residents confronted the County’s planning staff and Supervisor Cathy Hudgins at a community meeting on the Board of Supervisors plan that, in addition to other changes, would eliminate any limit on the density of residential redevelopment in Reston Town Center under the Reston Planned Residential Community (PRC) zoning ordinance’s “high” density area category, as long as those plans were consistent with the Reston Master Plan.

Power unchecked is power abused. That is what Reston is looking at with the Board’s Reston PRC zoning proposal.

Moreover, increasing the zoned density of any property in Virginia creates a “by right” authority for developers to build at that density. It cannot be revoked by the Board, even if experience shows the density is excessive.

High density is a gift to developers that often costs residents increased taxes (such as the new station area Transportation Service District tax), traffic congestion, school crowding, environmental deterioration; reduced livability from overtaxed open space, park facilities and libraries; and greater demands on police, fire and emergency services.

A more specific look at the implications for Reston Planned Residential Community (PRC) areas of Reston Town Center as shown in the enclosed map highlights where those changes would occur. The PRC zoning area subject to this zoning amendment proposal includes virtually all of Reston Town Center north of the toll road, and the Reston Heights — Westin Hotel — area of the Town Center station area south of the toll road.

A more specific look at the implications for Reston Planned Residential Community (PRC) areas of Reston Town Center as shown in the enclosed map highlights where those changes would occur. The PRC zoning area subject to this zoning amendment proposal includes virtually all of Reston Town Center north of the toll road, and the Reston Heights — Westin Hotel — area of the Town Center station area south of the toll road.

The Reston Town Center area of the zoning code does not explicitly use the high/medium/low residential designation used in the suburban areas. Instead, the PRC land use map calls for them to be related to transit station area mixed-use. Nonetheless, the “high” density limit of 50 DU/A has been used as the upper limit in RTC. Moreover, the Reston plan that theoretically limits development generally identifies “target” residential goals for each of the districts and subdistricts within the Town Center.

Only one of these districts with an explicit “target” number of DUs proposes an overall density greater than the existing “high” density limit the Reston PRC. That’s the area immediately next to the Metro station on the north side, where the plan’s “target” residential density would lead to 88 DU/A, with 2,600 units as laid out as a target in the plan.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Our County Board of Supervisors, led by Chairman Sharon Bulova, is in the process of overbuilding and underserving residents in Reston and across the county. The result will be the eroding livability of Reston and other county areas facing urbanization.

And this is being accomplished by a simple arithmetical trick: Overstating the amount of space new housing and office space require to accommodate residents and workers. Very simply, county planners continue to overstate the space needed for office workers as 300 gross square feet (GSF) per worker when studies globally over nearly a decade show it is now under 200 GSF/worker and could be headed to 150 GSF/worker.

At the same time, as it started to plan for Tysons’ redevelopment nearly a decade ago, the County raised its planning assumption for the size of station area dwelling units (DUs) from 1,000 GSF/DU to 1,200 GSF/DU. Nonetheless, a County planning study for Tysons showed then (2007) that the average size of Tysons residents was 1,100 GSF, mostly in garden apartments before the recent advent of massive high-rise residential development there. Now, the average high-rise DU size is shrinking well below 1,000 GSF/DU, more than offsetting the few mid-rise and single-family attached DUs in station areas, as some recent Reston development proposals show:

- JBG/Wiehle and partners plan for 1,300-1,500 residential units in 1.2 million GSF of development in two 5-story buildings, or 800-925 GSF/DU;

- Golf Course Plaza proposes 413 DUs in a 392,600 GSF multi-family building or 950 GSF/DU, also in 5-story structures;

- Faraday’s proposes redeveloping the area just south of Wiehle Station with up to 500 apartments in two buildings with about 487,000 GSF of residential space that will reach about 975 GSF/DU according to its plan submission.

- Lerner Enterprises is planning a 457-“luxury apartment” complex called Excelsior Park with average unit size at about 1,050 GSF in 423,587 rentable square feet (RBA), which equates to 481,350 GSF.

That’s nearly 3,000 DUs, including luxury apartments, whose average GSF is about 925 GSF/DU — nowhere near the County’s assumed size of 1,200 GSF/DU — and suggesting the number of future residents and DUs in Reston’s station areas will be nearly one-third greater than planned under existing allowable densities. This is consistent with national data: A study of apartment sizes over the last decade shows that their average size has shrunk — not expanded — from 1,015 square feet to 934 square feet.

The impact is straightforward: The resulting planned densities (total GSF of development divided by the square footage of the lot on which it sits) will allow half-again as many office workers and 28 percent more residential units than the County plan officially intends. Yet developers and the County are only planning to provide services — improved roads, schools and parks, and more — based on the lower count envisioned in the plan. The result will be reduced services and higher taxes.

So what does that mean for “real people?” Based on GSF information provided by FCDOT to the Supervisors serving as the Board Transportation Committee, the current Reston station area plan offers the potential for 76,280 added residents (at 2.0 residents/DU) and 29,059 added office worker jobs (at 300GSF/worker) in the next four decades.

If instead of using the County’s faulty planning assumptions, we use real world experience, we can anticipate that the allowable development could result in an addition of 101,492 total residents in 50,746 DUs and 78,559 office workers, including retrofitted office buildings, market conditions permitting. More specifically, it suggests an order of magnitude explosion in residents (11,720 in 2010 vs. 113,212 then) and more than twice as many office employees (69,941 in 2010 vs. 148,500 then) in Reston’s station areas. Overall, Reston can expect twice as many people living and working in the station areas as is anticipated by the Reston plan.

Community group Reston 20/20 is calling for an independent committee of RA members to be formed to delve deeper into the circumstances surround Reston Association’s controversial Tetra/Lake House deal.

The group made the recommendation Monday as part of a 10-page analysis of StoneTurn Group’s review of the transaction and subsequent cost overrun, which was completed in February.

According to Reston 20/20’s recommendation, the committee should be formed after the board’s elections have completed in April. At that time, four new members will join the nine-person board.

“In light of the fact that the current Board majority was immersed in all the events described here and in StoneTurn’s report, it has no credibility in conducting any further actions on Tetra,” said Terry Maynard, co-chair of Reston 20/20. “The new RA Board, installed next month with a majority not involved in Tetra, should tackle the issues we raise here and any others it finds in a deep dive effort by a committee of Restonians.”

The majority of which Maynard speaks will be made up of the four new members plus director Sherri Hebert (Lake Anne/Tall Oaks District) who was elected in 2016, following the conclusion of the transaction and renovations. Hebert has also recently called for more community involvement in the analysis of the report. (Two other continuing board members, Julie Bitzer and Ray Wedell, were elected in April 2015 — after the purchase proposal had been drawn up and scheduled for referendum, which passed with 53 percent of the vote in May 2015.)

In its analysis, Reston 20/20 says StoneTurn’s report provides “important new information on the timeline of actions leading to the excessive price paid for the property and its huge repair costs,” which it says is “a vital first step in understanding fully what transpired in this unfortunate venture for RA and its members.” The analysis goes on to ask numerous followup questions, many related to personal responsibility for decisions made during the process, including:

- “Did RA agree on the price prior to Board approval in January 2015? If so, why? Who made that decision and why?”

- “Who altered the appraisal instructions to assume Tetra was in good repair and the hypothetical restaurant use was large and extended into the lake?”

- “Why wasn’t conflict of interest specifically discussed in the StoneTurn report?”

Reston 20/20 says it wants the citizens’ committee to have “unlimited access to all RA records relating to Tetra; the authority to interview RA employees, contractors and others with possible knowledge about Tetra; and the authority to request records from contractors who worked [with] RA on the Tetra purchase and renovation.”

A group of Reston Association members, working under the name Mediaworld Ventures LLC, had been selected in September 2016 by the Board of Directors to complete a review of the purchase and cost overrun at a cost of $1. The parties could not agree on the terms of a contract, however, and negotiations were terminated in January. The board agreed later that month to have StoneTurn complete the review at a cost of $45,000.

StoneTurn’s review provided 15 recommendations to the RA board for how to avoid a similar situation from happening in the future. Reston 20/20 members say without rooting out more specifics of the transaction, changes to procedure may have minimal effect.

“We believe it is vital to understand the full details of what transpired, including identifying any violations of policy, procedure or the law and the persons involved in those activities. If we do not dig out these details, RA runs a serious risk of repeating many of the same errors in the future no matter what process changes are added.”

The RA Board of Directors has a special meeting scheduled for Tuesday at 6:30 p.m. (weather-permitting) to discuss the results of StoneTurn’s report and the recommendations for the board that were provided within.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op/ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Hunter Mill District Supervisor Cathy Hudgins led off her newsletter this month with a two-page article on “misinformation” concerning the proposed Reston Tax Service District (TSD) for homeowners and businesses along the Dulles Corridor, the so-called Reston transit station areas. So far as we know, no one has provided misinformation on the road tax, including Reston 20/20.

What Reston 20/20 has done — and will continue to do — is highlight the vast quantity of vital information about the proposed Reston road tax that neither Supervisor Hudgins nor FCDOT have been willing to acknowledge because, of course, it undermines the validity of having such a tax. Let’s take a quick look.

First, the foundation argument for a Reston road tax is that there is a $350 million gap over the 40-year period of planned station area expansion — less than $9 million per year — in road funding that can absolutely only be filled by another singular tax on Restonians. Supervisor Hudgins doesn’t even mention the “funding gap” in her missive, almost certainly because she knows there isn’t one. The “funding gap” was created by FCDOT to justify creating an added County tax revenue stream (at the Board of Supervisors’ direction) solely on Restonians.

The so-called “funding gap” is the result of a series of FCDOT assumptions about transportation funding that are a fantasy, plain and simple. [This was addressed in an earlier op/ed.]

That’s all not mentioned, much less explained, in Supervisor Hudgins’ letter. And some things mentioned there are less than “the truth, the whole truth, and nothing but the truth.” Some example, her letter states, “To accommodate traffic pattern changes, reduce congestion, move traffic efficiently, and provide convenient connections to transit stations, multi-modal transportation improvements were proposed.” That statement alone is loaded with fallacies.

- Well, yes, multi-modal improvements were proposed in the revised Reston master plan, but the ongoing County transportation proposal addresses only street improvements. Nary a word about more buses, better bike access, improved pedestrian movements, etc. In fact, to the contrary, FCDOT Chief Biesiadny has stated on multiple occasions that no added bus service is required, just a re-jiggering of current routes. Yet, the plan calls for 76,000 new residents and 41,000 new jobs; a total potential of 211,000 people living and working in Reston’s station areas. But no new bus service is needed? Preposterous! And you know that the proposed Reston station area tax will be increased to finance that obviously needed new bus service.

- And, no, the planned street improvements will neither “reduce congestion” nor “move traffic efficiently.” To the contrary, by County policy intent, the goal is to increase congestion by lowering the acceptable level of service for traffic under the County’s new “urban standard.” Yes, you can expect to wait at least an extra half-minute or more at every already gridlocked intersection in Reston’s station areas as this “urban standard” is implemented.

In fact, proceeds from the County’s Reston road tax proposal will be primarily used (87 percent) to finance the construction of the so-called “grid of streets.” This grid is not being built to “reduce congestion” or “move traffic efficiently”; it being built to improve the profitability of the development of the adjoining properties. In fact, the specific grid streets to be financed by Restonians road tax are primarily those streets at the east and west periphery of the station areas, areas that could not be profitably developed without a public tax subsidy. From your pocket to developer profits.

Moreover, the fact that these streets will be built and the areas developed will mean more, not less congestion, in the station areas. For what it’s worth, not even the developers in Tysons are having the “grid of streets” subsidized by taxes on residents; they will be building all of them there out of their own pockets. Yet somehow Supervisor Hudgins and FCDOT don’t mention any of this. No need to fully inform Restonians, they must think.

And two bits of seeming relative good news in Supervisor Hudgins’ commentary are less than they appear.

- First, there is the seemingly low impact of the $.021/$100 valuation impact of the proposed TSD tax on station area homeowners’ tax bill, for example, $105 per year on a half-million dollar property. Sounds OK, but it fails to acknowledge: The tax is based on 2016 dollars and will triple over 40 years at three percent inflation, totally ignores any property appreciation above inflation, fails to mention that the Board can raise the tax rate at any time — as it has already done on a similar tax in Tysons, and assumes construction costs will not exceed inflation. So, no, it will cost much more than Supervisor Hudgins’ letter says.

- Second, Supervisor Hudgins states that there is a new “sunset” provision in the proposed tax without specifying the details. The implication is that the road tax would be used only for construction, not the indefinite maintenance of the streets and intersections. That’s a positive change, but — like the tax rate and adding needed bus service — can be undone by the Board with a simple vote anytime in the future.

So “cui bono?” Who benefits? By our estimate based on an analysis of Boston Properties’ annual report, developers in Reston’s station areas stand to earn $45 billion over the next four decades in 2016 dollars, roughly double that in future dollars, from fulfilling the Reston master plan. And, as stated above, the County stands to receive $11 billion in property tax revenues at current tax rates in 2016 dollars over the same period.

And station area residents? They get a larger property tax bill every year and increased congestion.

What could be wrong with that?

As the late radio commentator Paul Harvey (for those of you old enough to recall) would say, “And now you know the rest of the story.” So you can accept Supervisor Hudgins’ Tetra-esque one-sided sales promotion or you can consider the proposed Reston road tax in the context of this more complete picture. If you believe, as we do, that the TSD road tax is little more than a fraud, please do any or all of the following:

- Join the more than 200 others who have signed Reston 20/20’s petition to stop the Reston TSD tax which we will submit to Chairman Bulova and the Board of Supervisors before the upcoming public hearing on the Reston road tax proposal.

- Share with Supervisor Hudgins your concerns about the proposed Reston road tax by any means you choose — email, telephone, letter, social media, whatever.

- Take the time to attend and even testify at the public hearing at the Government Center on Feb. 28.

There is no good reason that Reston station area homeowners, current or future, should subsidize developer profits or bolster County coffers for basic public infrastructure requirements. Next they will be taxed for schools, parks and more. Tell Supervisor Hudgins and the Board of Supervisors you oppose this misguided and ill-conceived Reston TSD road tax proposal.

Terry Maynard, Co-Chair

Reston 20/20 Committee

This is an op-ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op-ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

By this time, most Restonians are aware of the County transportation department’s (FCDOT’s) efforts to add an additional property tax on Metro station area residents to pay an estimated $350 million for improvements in their streets to accommodate developer growth. The entire 16-month-long process to get Restonians, particularly the Restonians selected by Supervisor Cathy Hudgins to serve on the so-called Reston Network Analysis Group (RNAG), to nod “yes” to yet another Reston tax has been filled with lies and deception well worthy of our new President’s world of “alternative facts.”

We have already detailed a key Reston road tax assumption that is obviously false (p. 5): That the County cannot divert tax revenues from existing or future uses to improve Reston’s urban intersections. The County won’t even address the fact that the diversion of less than $9 million of the more than $4 billion in annual General Fund tax revenues will pay for all the roads it proposes to improve under its cost assumptions. That’s just two-tenths of one percent from current tax revenues, well less than its mid-year budget adjustment. Instead, FCDOT simply refuses to acknowledge this reality.

But there are so many other intentional, incessantly repeated mis-statements, failures to recognize certain obvious truths, and just plain poor County analysis that comprise the entire “big lie” of the need for a Reston road tax. An obvious place to start is the other side of the road improvement cost equation: The grotesquely huge profits of developers and massively increased property tax revenues of the County because of the major development that will occur in Reston’s station areas over the next four decades. Not once has FCDOT acknowledged that reality, much less used it in any analysis of how street improvements could be paid for.

Based on Boston Properties per square foot 2015 profits from continuing operations nationwide, we estimate that filling out the Reston Master Plan over the next 40 years will generate more than $45 billion in profits in 2016 dollars for Reston’s station area developers. That’s more than one billion dollars per year on average — about double that with modest inflation — most of it from the operation of existing office and residential structures. Why can’t $9 million of that more than one billion per year — less than 1 percent — be devoted to improving Reston’s urban area streets?

At the same time, the value of property in the station areas will increase at least ten-fold from $6 billion to $60 billion, and possibly as much as $90 billion, with the growth in square footage and appreciation over the next four decades if the Reston Master Plan is fulfilled. That property value will generate over $11 billion in property taxes for the County without increasing the property tax rate or adding a new Reston road tax. Certainly the County can divert three percent of that massive Reston tax revenue flow to the improvement of Reston’s streets, but you haven’t heard a word about that possibility from the County. Not once.

The County clearly does not want to tie any of this huge increase in Reston tax revenues to expenditures in Reston. Reston is just a County tax “cash cow” — as it has been for decades — to be milked for County expenditures elsewhere.

In fact, FCDOT has gone so far as to create a roadway “funding gap” out of whole cloth that it values at $350 million. The gap is merely a foil based on faulty assumptions about the availability of road funds to generate a reason for an added Reston road tax. It has no basis in the reality of available of County, regional, state, or federal tax revenues for road improvement purposes. But if you don’t have a “gap,” no matter how phony, you can’t justify a new tax. So the County made one up.

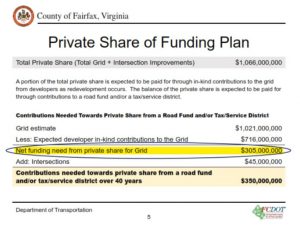

Worse is the planned use of the Reston road tax funds. About 12 percent of it ($45 million) will be used to actually improve intersections on Reston’s through streets, the streets that are already clogged with rush hour traffic.

The other 87 percent ($305 million) or so will be used to flesh out the “grid of streets.” The purpose of the “grid of streets” is to create street fronts for commercial development. They have no purpose in improving traffic flow; in fact, to the contrary, the development that will accompany them will actually add to the traffic flow burden on nearby through streets such as Reston Parkway and Wiehle Avenue, Sunrise Valley Drive and Sunset Hills Drive, used to access the rest of Reston, the Dulles Toll Road, and beyond.

Worse, almost all the streets that Reston’s road tax will be used to build are streets that would not be built in the absence of a Reston corporate welfare tax because of a lack of commercial demand. The streets financed by Restonians’ taxes will be at the extreme west and east ends of the station areas, near Centerville Road in Herndon and in the vicinity of the Reston Post office to the east. These locations are too far from any Metro station to be walkable and would not be developed at all unless paid for by the public, specifically Restonians’ tax dollars. In contrast, Tysons’ developers are paying for the entirety of the “grid of streets” there, even those well beyond walking distance to a Metro station. In short, developers will use Restonians’ corporate welfare to increase their profits with no traffic or other benefit to the community.

The entire County assertion of a need for a special Reston road tax, a so-called Tax Service District (TSD), on residents in Reston station areas is nothing more than a massive con built on fraudulent assumptions, half-baked analysis, ignored realities, and the gullibility of Restonians serving on RNAG (none of whom live in the areas to be taxed except an employee of Boston Properties), and even the Reston Association Board of Directors. In fact, the RA Board will be considering a resolution at its meeting this week to support the imposition of the Reston road tax on non-member areas of Reston so long as the rate remains constant at $.021/$100 valuation and the tax has a 40-year sundown provision. The Board of Supervisors will eliminate those proposed constraints with a dismissive wave of its hand if not at the outset, at the first sign that it might crimp its tax collection from Reston’s station areas.

It is time for Restonians, and the RA Board in particular, to quit being the sucker for County taxes imposed on Reston. We already pay an extra $.047/$100 valuation for the Reston Community Center (RCC) which is stealthily moving forward with a plan to build a large regional performing arts center in Town Center North, a mile from the nearest Metro station, and raising our RCC (STD#5) tax rate to pay for its construction and ensuing perpetual operating losses.

It is time for Reston to say not just “No,” but “Hell No” to more property taxes that go to subsidize commercial for profit ventures and county-wide spending initiatives. If a developer can’t pay a few extra dollars per year to cover the cost of the road in front of his property, they simply should not be in the development business in the highly lucrative Reston market. And if the County’s leaders can’t figure out how to do that, then they should be replaced by representatives who can. We, the people of Reston, should not be putting our money in developers’ pockets through added County taxes so they can make even more billions of dollars with no benefits for our community.

Terry Maynard, Co-Chair

Reston 20/20 Committee

This is an op-ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

This is an op-ed submitted by Terry Maynard, co-chair of the Reston 20/20 committee. It does not reflect the opinions of Reston Now.

Two years ago this month, under the leadership of former RA Board President Ken Kneuven, Reston’s homeowner association announced its deal with a local developer to purchase his property, the Tetra office building, for over twice its county-appraised value of $1.2 million. Thus began a long slide of Reston Association into bad governance and mismanagement.

How did this happen? We don’t know for sure, but we understand Kneuven and another former RA Board President, Rick Beyer, who lives on the shore of Lake Newport opposite the Tetra property, have been friends for some time. Beyer, who was active in supporting the RA Tetra purchase, and other Lake Newport homeowners were no doubt concerned that something untoward would happen to their view and, as a result, also their property values. It is not clear whether Beyer asked a favor from Kneuven in eliminating this risk by having RA pursue the purchase of the Tetra property, but what is clear is that after Kneuven left his RA post, he ended up working as a senior consultant in the company managed by Beyer.

As for the rest of us, RA and its Board justified paying $2.65 million in part by pointing out that a proposal had been drawn up to build a costly restaurant there twice the size of the Tetra building. RA didn’t bother to note, however, that the restaurant was never approved, nor would it have been given environmental restrictions and 14 easements on the property. Moreover, RA’s appraiser put the property’s “as is” value at just $1.1 million using the Income Approach, even lower than the county’s valuation. In fact, the Tetra property had been on and off the market with little interest for most of a decade.

Nonetheless, to sell the deal in a community referendum, RA “projected” that renovations, inside and out, would cost RA members just $259,000. To date, interior repairs alone have cost Restonians $692,000 — not counting $925,000 in seller contributions and a Comstock proffer to RA which could have been used for much better purposes — and an RA consultant projects proposed exterior improvements will cost $1.2 million.

On the other side of the ledger, RA projected rental income from a rent back agreement with the Tetra owners of more than $140,000 through 2016. Unfortunately, the sloppily written agreement allowed Tetra’s former owners to walk away at the end of 2015, resulting in an immediate $100,000 loss in RA revenues. RA scrambled to make up the shortfall, but — as of November — expected year-end cash flow losses reached $902,000, some $515,000 more than RA projected for 2016 during the Tetra referendum.

If publicly known at the time, these massive misstatements, mistakes, expenses and overruns would have doomed the purchase’s narrow community approval.

Indeed, the massive renovation cost overruns were not revealed until May 2016, although RA financial data indicated RA and presumably some Board members knew there would be huge overruns as early as February. Thus, RA members were denied that important information as they cast their ballots for RA Board members in February, including the re-election runs of two Board members who strongly supported the Tetra initiative, Eve Thompson and Danielle LaRosa. Of course, they won re-election in the absence of public knowledge of the huge cost overrun.

When the cost overruns were disclosed, even the complicit RA Board found this revealed reality a bit much. Under significant community pressure, it agreed last summer to contract for an independent review of the purchase and renovation.

After choosing to sign a pro bono $1 review contract with Mediaworld LLC, using a team of Reston volunteers expert in financial matters, a few members of the Board sabotaged its own by insisting on excessive RA control and contractor liability in multiple, lengthy contract drafts. A special Board meeting with the Mediaworld volunteers in December couldn’t salvage the negotiations — another obstructionist draft resulted — and the volunteers withdrew last week, explaining the multitude of reasons why.

The increasingly urgent question is: What are some members of RA’s Board and senior staff trying to conceal about the Tetra acquisition and renovation — and why? Did they engage in illegal, unethical or just plain stupid behavior? Unless there is a criminal investigation, the chances are dwindling Restonians will ever know who, how, why and when all this financial mischief occurred as the Board and staff continue to hide the truth any way they can. The future of honest, open, prudent governance in Reston has never looked more uncertain.

The RA Board 2017 election a month away is an opportunity to reverse the Board’s recent gross misbehavior. There are four openings and, if filled with candidates who seek to reform the RA Board and the way it does business, the Board could actually represent the interests of the community rather than the guilty. Pay attention to what candidates file and what they say about the handling of Tetra, including the need for an audit, the development of an RA ethics policy with teeth and openness in RA decision making. It could be your last chance in years for meaningful change in how our community is governed.

Terry Maynard, Co-Chair

Reston 20/20 Committee

This is an op-ed submitted by Terry Maynard, co-chair of the Reston 2020 committee. It does not reflect the opinions of Reston Now.

The Transportation Service District (TSD) proposed for Reston’s station areas calls for homeowners there to subsidize developers as they build private roads on their property. With a projected balance in residential and non-residential development in the station areas, that means residents there would be paying between $55-$88 million in 2016 TSD tax dollars to developers to build roads on their properties over the next forty years depending on the initial TSD tax rate and if it remains constant (which it won’t).

In an incomprehensible move, the Fairfax County Department of Transportation (FCDOT) has identified a phony $350 million “funding gap” for Reston road improvements requiring the creation of a TSD. As laid out in its September 30, 2016, presentation to station area developers, the so-called RNAG “stakeholders,” $305 million of the funding shortfall is to pay for the construction of their “grid of streets.” That’s 87% of the total TSD funds and some 30 percent of the grid’s $1 billion total cost.

In an incomprehensible move, the Fairfax County Department of Transportation (FCDOT) has identified a phony $350 million “funding gap” for Reston road improvements requiring the creation of a TSD. As laid out in its September 30, 2016, presentation to station area developers, the so-called RNAG “stakeholders,” $305 million of the funding shortfall is to pay for the construction of their “grid of streets.” That’s 87% of the total TSD funds and some 30 percent of the grid’s $1 billion total cost.

This “grid of streets” is the network of privately built roads on developer-owned property. They may be turned over to the state upon completion, but that is not at all clear. Station area residents–present and future–just get to pay developers to build them if this TSD proposal is approved. In contrast, the Tysons “grid of streets” is being paid for in its entirety by developers through financial contributions ($304 million) or in-kind contributions ($561 million); not a penny of Tysons TSD tax revenues.

This subsidy to the for-profit endeavors of developers of scores of millions of residential tax dollars suggests that the developers’ effort really won’t be that successful. However, our analysis of scope of profits for developers across the station areas over the next forty years, based on Boston Properties 2015 annual report, indicates they will have a net operating income averaging in excess of $1.1 billion per year in 2015 dollars. That’s $45 billion in profits over the next four decades. And yet the proposed tax suggests developers’ need residents’ financial help for some reason to build their roads themselves. We don’t think so.

The economic question above only accentuates the unfairness, even immorality, of forcing residents to to pay taxes to support commercial for-profit development. We don’t think the idea comes remotely close to passing a decency test, especially in light of developers’ anticipated profits. We recognize we are dealing with politics here, but it still leaves a strong stench.

As we have said here and elsewhere, there is no need for a new Reston road tax of any kind. This is especially so when a large chunk of it is intended to go into the pockets of developers. Moreover, the so-called “funding gap” is a mirage, even a fraud, created by the County to justify creating a new tax gimmick to afflict Restonians.

You can help stop this dangerous Reston road tax idea. First, Reston 20/20 has posted a petition on Change.org calling for a stop to passing this new tax that you can sign. Second, attend and participate in the RNAG community meeting on Nov. 7 at 7 p.m. in the South Lakes High School lecture hall. Third, let Supervisor Cathy Hudgins know about your concerns over the Reston TSD proposal.

Finally, attend and testify at the Board of Supervisor’s hearing on the matter, which has yet to be scheduled.

If we all work together, we have a chance to stop this unfair, unneeded County tax boondoggle.

Terry Maynard, Co-Chair

Reston 20/20 Committee